Christine Holgate’s secret plans to grow AusPost

Christine Holgate had big and sometimes radical plans for Australia Post. But not everyone was on board.

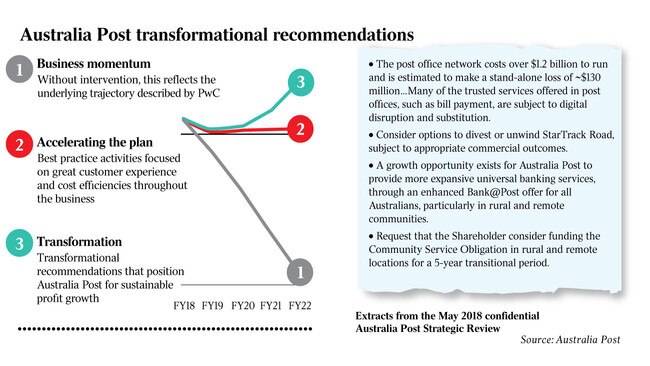

If Christine Holgate had her way at Australia Post, part of StarTrack would have been sold, it would effectively become a bank and offer cold chain distribution, with taxpayers funding mail deliveries in the bush.

Ms Holgate’s plan to transform Australia Post, which she drafted in May 2018, about six months into her three-year tenure, also recommended slowing down letter deliveries to once a week and posties carrying more parcels.

But that review was quickly usurped when Communications Minister Paul Fletcher announced the appointment of Lucio Di Bartolomeo as Australia Post’s chairman in November 2019, and with his arrival another review.

Boston Consulting Group completed its review, at a cost of $1.3m, on behalf of the government and dismissed Ms Holgate’s plan as too ambitious and risky.

It was this review that began sowing seeds of division between Ms Holgate and the federal government, which culminated when Scott Morrison demanded she stand aside or “go” last October over the Cartier watch affair.

In a Senate inquiry into her controversial departure from Australia Post, Ms Holgate revealed her opposition to the BCG review was one of the reasons for her ousting. “It would be fair to say I wasn’t popular,” she said.

To Ms Holgate, her review and BCG’s plan were at polar ends: her strategy aimed to grow the business by investing in new services, while BCG wanted to cut those services — a move that would have cost up to 8000 jobs and 190 post office closures.

“(The BCG review) would have ravaged jobs and the services that Australia Post offers. I objected rigorously to the BCG recommendations, and I still do. It is completely the wrong strategy for Australia Post to its customers, to the teams and to the communities,” Ms Holgate said.

“The BCG review did not support management’s view of having a strategy to grow the business or remaining sustainable by leveraging our infrastructure to carry parcels and letters while building new services, including extending financial services.

“BCG essentially argued it was too optimistic and risky, even though the business was ahead of its targets for the year when the review commenced and the organisation had only lost money once in its history.”

While there were some differences in Ms Holgate’s plan and the BCG review, there were also some similarities. Ms Holgate’s review states it would “not look at the privatisation of Australia Post, but will consider the organisation structure of Australia Post including ownership of subsidiaries and joint ventures to ensure that it continues to fulfil its core mandate”.

To avoid confusion, it expressly states this means considering “options to divest or unwind” its StarTrack Road business, but keep StarTrack’s premium business.

Australia Post acquired StarTrack in a joint venture with Qantas in 2003 to provide businesses with a “full suite of domestic parcel solutions, including road express and premium services”. It later bought out Qantas’s stake in October 2012.

“Australia Post has sought unsuccessfully to divest this business, and continues to look for partnerships that will enable it to focus on and grow its profitable B2C (business to consumer) activity,” Ms Holgate’s review states.

“The road express business has been characterised by intense competition driven by the addition of significant extra capacity in express processing, driving down prices.

“Additionally, some freight profiles are less suited to Australia Post’s assets and as a result not financially attractive to its business. Australia Post loses money in its road express business.”

BCG agreed. “There appears to be merit in further exploring a partial divestiture of … (the parcels) business to release cash and avoid significant capital investment over time”. It was just a question of how much silverware to sell.

Ms Holgate was adamant that Australia Post retain ownership of the more profitable StarTrack premium business, which was known by a blue Australia Post ‘P’ rather than traditional red livery.

“Australia Post must migrate its profitable StarTrack premium business with its traditional parcels network and product range,” her review said. “The timing of this integration needs to coincide with a pending resolution to its loss-making road express business, to minimise disruption for its people working in both groups.”

The two also agreed on reducing letter deliveries. BCG recommended reducing letter deliveries to three days a week in metro areas — which Ms Holgate said was similar to the controversial temporary COVID-19 relief measures the government granted Australia Post last year. In another option, BCG recommended nationwide alternate-day delivery.

Ms Holgate’s review, meanwhile recommended “slowing down the mail”, delivering regular letters once a week. This would save $60m in processing — “largely from the consolidation of letter sorting into three or four major regional centres” — and a further $124m in labour by reducing the number of delivery rounds.

Priority letter deliveries — a service that was removed during the COVID relief — would be pushed out by one day, saving about $25m a year.

Ms Holgate’s review also requested the government to “consider funding” its community service obligations in rural and remote areas “for a five-year transitional period”. But the government has made it clear it wants Australia Post to remain self-funding, and the BCG review aimed to deliver a plan to achieve that goal.

Ms Holgate then had big plans for expanding into financial services. This was on top of the $66m-a-year deal the four Australia Post executives clinched with three of the big four banks to allow post offices to provide banking services on their behalf, receiving Cartier watches for their efforts.

Ms Holgate’s vision was to introduce “white-labelled banking products, including deposits and home loans”.

“Australia Post will not need to apply for any new regulatory licences, if it can leverage the licences of its partner/s, and act as an Australian Credit Representative. Australian Post will not be required to become an authorised deposit-taking institution,” the review states.

Ms Holgate told the Senate that “disappointingly the BCG review did not significantly explore … extending financial services as many other profitable post offices around the world had, including Swiss Post, La Poste (France), China Post, and Japan Post”.

Rather than advocate Ms Holgate financial services strategy, the BCG report urged the government to consider, among other things, the “financial attractiveness of the opportunity, considering likelihood of profitable growth, extent of capital/funding required, and materiality of risk to AusPost of Gov (sic)”.

Cold chain distribution was one of the big ideas in Ms Holgate’s review. She even dispatched two executives to the US to research temperature-controlled delivery systems.

It made sense. After all, Australia Post missed out on the COVID-19 vaccine distribution because it had no way of ensuring it could maintain the 2C-8C needed to transport the AstraZeneca vaccine, let alone the -70C needed for the Pfizer vaccine. Instead, rival DHL, owned by Germany’s Deutsche Post, and Linfox won the distribution contract.

Ms Holgate believed cold chain distribution would open new markets. “Australia Post is in the process of completing an initial market opportunity assessment for domestic temperature-controlled solutions,” her review states. “Australia Post is investigating a range of packaging and chilled locker solutions and potential partnership opportunities.

“Examples of potentially attractive opportunities emerging in this area are temperature-controlled pharmaceutical solutions, as well as temperature-controlled packaging and delivery solutions for B2C (business to customer) perishable foods.”

But The Weekend Australia understands the plan to implement cold chain distribution at Australia Post was prohibitively expensive, given it would have involved retrofitting delivery centres and its postal fleet.

“During my three years at Australia Post, I went through four reviews with external companies, the first initiated by myself, the following three by the government. The three government reviews all suggested our plans were too ambitious and that there should be more focus on cutting costs,” Ms Holgate said.

“Each year we overachieved our targets, avoided losses, secured our jobs and protected our community post offices, while still remaining viable, delivering modest dividends and covering a cost of approximately $400m to meet our community service obligations (CSO). Australia Post received no funding towards our CSO costs, unlike other organisations; we paid taxes, collected GST and gave dividends.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout