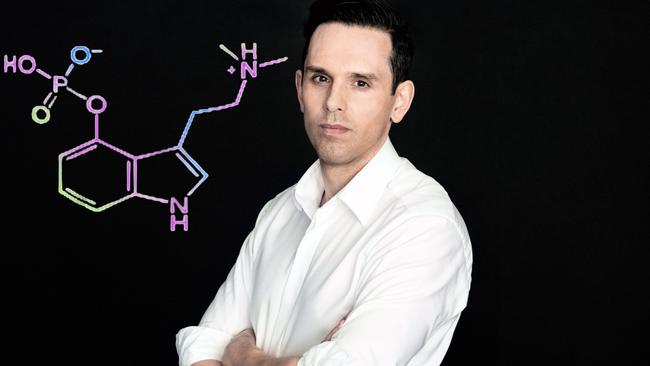

Christian Angermayer’s Bionomics play and his obsession with magic mushrooms and MDMA

Christian Angermayer is among a growing breed of new-age billionaires around the world investing in ‘moonshot’ ideas and he has now turned his attention to Australia.

At 42, Christian Angermayer is among a growing breed of new-age billionaires around the world putting their money into the seemingly possible or impossible ideas, depending on everything from your financial nous to where you sit on the scepticism radar.

Think longevity or anti-ageing research, use of drugs or hallucinogens for mental health treatment, fintech, spacetech and cryptocurrencies and entertainment, too.

Earlier this week, he unveiled plans to make ASX-listed Bionomics Australia’s first psychedelics company.

Surrounded by powerful and well-connected friends, including PayPal co-founder Peter Thiel and cryptocurrency and fintech enthusiast Mike Novogratz, he has invested close to $US1.2bn of his money and another $US700m in 70 different companies through his asset management business Apeiron Investment Group.

Half of those bets are placed in two areas of biotech research that keep him awake at night.

One is the use of psychedelics, especially magic mushroom (psilocybin) and MDMA (ecstasy) to treat depression, anxiety, post traumatic stress disorders and other mental health issues.

The second is joining the commercial effort – through Rejuveron Life Sciences in Switzerland and Cambrian Biopharma in the US – to defy ageing with the firm belief that dying is really a “disease” and science can find a cure for it.

Through his platform company ATAI Life Sciences – gearing up to list on the NASDAQ for at least a billion dollars this year – he first helped magic mushroom researcher Compass Pathways to its US public listing last year.

When he first punted on Compass, his stake was valued at $US16m. Today, that investment has grown to more than $US300m, with the market value of Compass at more than $US1.4bn.

Now he is partnering with Australian biotech, Adelaide-based Bionomics, which is gearing up for clinical trials for own BNC210 drug candidate for PTSD.

He thinks ATAI’s work on MDMA and Bionomics’ BNC210 can work together in the treatment/management of PTSD.

Mr Angermayer last year joined Bionomics’ registry – along with his friends – and this month underwrote its $15.9m to fund the clinical trials.

“I have a nose for them. Possibly a talent to recognise good ideas,” Mr Angermayer told The Weekend Australian from his penthouse which doubles as an office in the UK.

“I first invested in a business idea when I was 20 in partnership with my then tutors.

“That company was Ribopharma, now part of Alnylam Pharma, which is valued at more than $US15bn.

“I sold out early so it was the source of my early wealth.”

The tryst with magic mushrooms and psychedelics started on the Carribean island of Canouan in 2014.

“Up until that point, I had never smoked or had alcohol. A lot of people trusted me in those early days because I was known for being clean.

“Then I tried mushroom for the first time and it was the single-most meaningful thing I did in my life.

“It’s very hard to put it in a language, but it was like meeting my soul and it gave me long-lasting deep happiness.”

In Australia, the Therapeutic Goods Administration earlier this month handed down its interim decision to not recognise MDMA and psilocybin (magic mushroom) as medicines.

Mr Angermayer said research into the use of psychedelics is dogged in “misconception” but fast-tracked studies in the US offer strong hope.

“There is solid science out for the use of these substances to treat depression and other problems.

“Drinking alcohol is worse, like pouring poison into yourself.

“Importantly, our effort is not to legalise psychedelics, like cannabis, we simply want to make them available medically.

“It will still need the expertise of a doctor and be a journey in management of mental health issues.”

His partners in most investments, Mr Thiel and Mr Novogratz, were early backers of his ideas.

“I met them through mutual friends in 2010 and they were the first to back ATAI, which seemed like a crazy idea to some.

“We are good friends and that trust is now mutual.”

Mr Novogratz is on the record for describing Angermayer’s “extraordinary ability to elevate companies with promising science that need investor and social backing”.

Trust is also at the heart of the Bionomics investment.

Mr Angermayer has a longstanding relationship with Bionomics’ executive chairman Dr Errol De Souza, based in the US.

“I have known Errol for a number of years. He is one of the best and sits on the boards of a few companies overseas.

“His word counts for a lot.”

Dr De Souza said it has taken him two years to “right the ship” since he stepped in as Bionomics’ executive chair in late 2018.

The ASX-listed business, valued at $172m, reported disappointing trial results in a different formulation of BNC210 in September 2018.

“I think given the registry Bionomics now has – major overseas investors – and the expectations with BNC210, we could get a ‘b’ in front of Bionomics to reflect its true valuation,” Dr De Souza said.

“There could potentially be a NASDAQ listing for Bionomics too but we are going to do this right and use the next few years to take it to the next level.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout