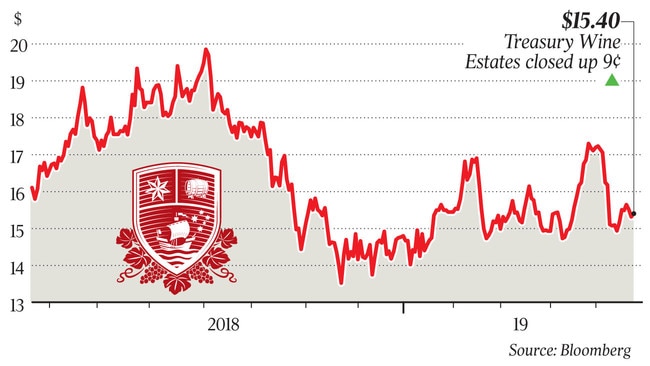

Channel-stuffing claims clouding investor outlook on Treasury Wine Estates

The channel stuffing allegations facing winemaker Treasury are fuelling a bearish investor outlook.

A UBS survey of winemaker Treasury Wine Estates’ biggest institutional investors has shown widespread concern about the “channel stuffing” allegations it faces in the US and a generally bearish sentiment.

According to UBS’ research, 58 per cent of these shareholders believe the allegations of channel stuffing in the US and China is the key issue facing Treasury.

It seems the growing negativity swirling around the company, which produces wine labels including Penfolds, Wolf Blass and Lindemans, has been fed by the accusations from the US, where a hedge fund manager alleged Treasury was engaging in channel stuffing in its key markets.

That poor sentiment has been exacerbated by chief executive Michael Clarke’s recent sell down of his shares in the group.

But UBS executive director of retail and consumer products Ben Gilbert argues concerns around channel stuffing and general negative sentiment are “overplayed” with Treasury Wine set to meet its earnings guidance.

The company has been feeling the heat for some time.

Shares in Treasury Wine tumbled more than 7 per cent in one day earlier this month after it was revealed CEO Mr Clarke had sold $6.88 million worth of shares; almost 50 per cent of his available stock.

Soft export data already had Treasury shares under pressure when at the Sohn Investment Conference in New York, Bayberry Capital’s Angela Aldrich listed a litany of issues she believed were threatening the company’s profitability.

In a series of slides and talking points at the conference, Ms Aldrich attacked the Melbourne-based winemaker and called out what she saw as major operational problems for the business in the US, as well as in its big growth and earnings market of China.

She accused Treasury Wine of channel-stuffing — where sales figures are inflated by forcing more products through a distribution channel than the channel is capable of selling.

In a report to clients, Mr Gilbert said his own survey had revealed that channel stuffing was the biggest issue facing Treasury Wine.

Overall sentiment was negative, Mr Gilbert said, with 30 per cent of respondents regarded as “bearish”, compared to 23 per cent that were “bullish” about Treasury.

The channel stuffing allegation was the issue foremost in investors minds, Mr Gilbert reported.

“US route-to-market changes and cash conversion were perceived as the next most important, while M&A is a distant fifth.

“We were not surprised by the negativity given recent CEO selling and softer industry data,” he said.

Mr Gilbert said channel stuffing, or ‘product bundling’ has always been prevalent but his feedback is that the intensity has eased.

UBS has retained its “buy” recommendation on Treasury Wine and with an opportunity for the company to re-rate its perception among investors and the market.

“What the results highlight to us is a significant opportunity for Treasury Wine to re-rate if management can appease concerns around channel stuffing, meet fiscal 2019 cash-conversion guidance and provide tangible evidence US route-to-market changes are working.

“We believe they can do this, but more tangible evidence is needed.”