Caltex to open books to UK’s EG Group, stoking bid battle

Caltex is set to grant due diligence to Britain’s EG Group which could spark a bidding war with Canada’s Couche-Tard.

Caltex is preparing to grant due diligence to Britain’s EG Group early next week in a move that could spark a bidding war with Canada’s Couche-Tard for control of the Australian fuels retailer.

Chairman Steven Gregg convened a Caltex board meeting in Sydney on Thursday to discuss the merits of EG’s bid.

While its cash and share takeover offer is more complex and difficult to value than Couche-Tard’s $8.8bn straight cash bid, it is expected Caltex will open its books to EG in a move stoking competitive tension and potentially triggering a higher bid from the Canadians.

Caltex is expected to update the market as early as Monday ahead of the release of its annual results on Tuesday.

Zuber Issa, one of the billionaire brothers behind EG, will likely return to Sydney to take part in several days of management briefings with Caltex, should it get the nod for due diligence.

EG made a big entry into Australia’s petrol convenience sector after scooping up Woolworths’ 540 retail sites in a $1.7bn deal just over a year ago.

US oil giant Chevron has also emerged as a potential third bidder for the company, possibly in a consortium given its focus lies as a fuel supplier rather than store owner.

The Issa brothers that run EG from the British industrial town of Blackburn first met Mr Gregg and chief executive Julian Segal just prior to Christmas to indicate their interest.

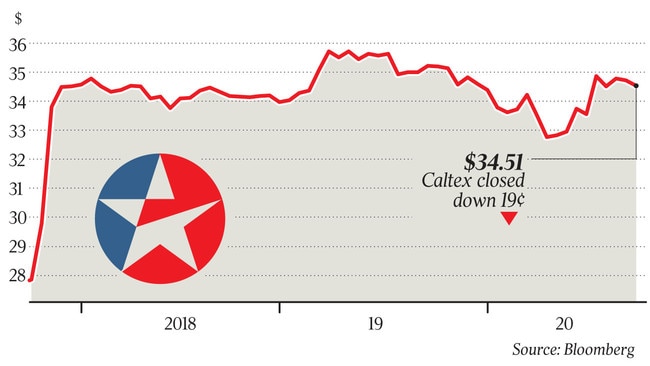

At that stage Caltex had rejected two bids from Couche-Tard, comprising an initial proposal of $32 a share in October and a bump to $34.50 in late November.

The Canadian convenience store giant then lobbed a “best and final price” of $35.25 a share on February 13 in a deal worth $8.8bn, but left the door open to a higher offer if rivals emerged.

EG had initially considered teaming up with financial powerhouse Macquarie, framed around the idea EG would buy Caltex’s 2000 convenience sites with the bank scooping up the fuel and infrastructure assets.

The two were close to agreeing consortium terms, but Caltex’s decision to grant full due diligence to Couche-Tard effectively fired the starting gun for any rival parties considering a bid.

Just under a week later EG joined the battle on its own, proposing $3.9bn in cash for Caltex’s convenience retail business and giving shareholders a stake in a ASX-listed Ampol fuel business. The move could now spark a higher offer from Couche-Tard.

Despite bidding solo, Macquarie could still join the British company dividing up Caltex’s assets should it win the bid.

Chevron may also emerge as a third bidder with the firepower to outflank both Couche-Tard and EG. The US oil major signalled its intent a week before Christmas after paying $425m to scoop up Puma Energy, surprising some industry watchers after it sold its 50 per cent stake in Caltex just four years ago for $4.7bn.

Chevron’s purchase of Puma gave it a new market supplying products from its stakes in three major Asian refineries in Singapore, Thailand and a giant facility in South Korea.

Comparing the EG and Couche-Tard offers depends on a range of assumptions, with RBC saying EG’s bid for the retail business implies an eight times multiple between enterprise value and EBITDA, compared with Couche-Tard’s 10 times for the consolidated business. Others think EG represents a close bid to Couche-Tard’s offer, based on lower projected consensus earnings for Caltex’s retail and fuel units.

Under EG’s offer Caltex shareholders would receive $15.62 in cash and a security in Ampol for each Caltex share they own. EG will consider buying up to 10 per cent of Ampol for an extra cash payment.

A fully-franked special dividend would also be paid by Caltex to pay out its franking credits under EG’s proposal.

Caltex shares fell 0.55 per cent or 19c to $34.51 on Friday.