Caltex petrol station spin-off put in doubt by Canadian takeover bid

The bombshell dropped mid-November when Canadian retail giant Couche-Tard — French for “night owl” — emailed an $8.6bn offer

After months of preparation, Caltex had circled the third week of November to deliver some pre-Christmas cheer to shareholders.

Under the watchful eye of new finance chief Matt Halliday, the fuels retailer was putting the final touches to a long awaited $1bn spin-off of its petrol station sites.

The company had long faced calls by its big shareholders to find a way of freeing up value in its portfolio which s ans the Lytton refinery in Sydney, import terminals and 800 retail sites serving fuel and food to three million Australians a week.

The property initial public offering — and the lure of significant capital returns to shareholders — was seen internally as the first step to a rebuild of the company: ticking off an IPO, rebooting its convenience store strategy and finding a replacement for long-serving chief executive Julian Segal.

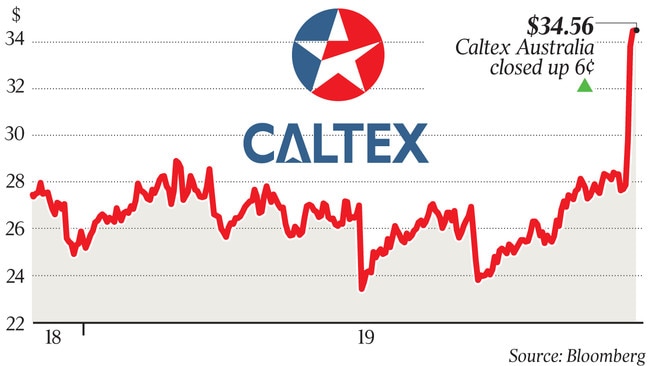

But as it confirmed the final messaging around the property float, a bombshell dropped on November 18. Canadian convenience store giant Couche-Tard — French for “night owl” — emailed an offer letter containing a $8.6 bn, $34.50 a share takeover bid.

Caltex’s board, led by chairman Steven Gregg, had only just rejected a $32 a share tilt from the same suitor a few weeks prior. Now a new takeover deal was back on the table. And with it Caltex’s own long awaited property spin-off was put on ice for another day.

To be sure, the timing of the bid had created an extra headache for an Australian corporate icon.

The earlier $32 price was always seen as a starting bid but the extra $2.50 bump and with it the lure of a special dividend might tempt some long-term shareholders disappointed at its share price performance the last few years.

Despite the vast geographic distance, the two companies had known each other for some time with senior executives crossing paths in Asia.

Certainly, Couche-Tard has made little secret of its desire to land a chunky target in the region as part of an ambitious five-year strategy to double the size of the company through acquisitions and organic growth.

When the Woolworths’ portfolio of 540 petrol stations came up for sale last year, the Canadian player ran the numbers on a deal. While it came to nothing, it set off a much grander idea giving it a even bigger foothold in the Australian market.

With Segal announcing in mid-August his plans to eventually depart the company, Couche-Tard could see an opening ripe to exploit. On the morning of October 11, Couche-Tard chief executive Brian Hannasch put his cards on the table.

After flying in from Vancouver over the weekend, Hannasch and his M&A offsider Alex Miller visited Caltex’s Market Street headquarters in Sydney to pitch their $32 a share bid. On the Caltex side was CEO Segal, chairman Gregg and deals head Alan Stuart-Grant.

While both sides had advisers in place — Goldman Sachs for Couche-Tard and UBS and Grant Samuel for Caltex — it was decided the first meeting should be with the principals of each company.

There was little denying Couche-Tard was a serious player.

With their $54bn market capitalisation, a near $9bn deal for Caltex was big but achievable.

To show its intent it picked up a 2 per cent stake in Caltex after starting to buy shares before its first October bid. Still, it was early days with any deal subject to both financing and due diligence.

After several weeks of careful consideration, Gregg phoned Hannasch to officially reject the offer. And for Caltex the focus was back on implementing the vision for its property IPO.

After taking over as finance chief in April following Simon Hepworth’s 18-year run in the job, Halliday quickly identified that while Caltex had strong assets it needed to work them harder and smarter.

The former Rio Tinto executive worked with UBS who had developed similar property strategies for Telstra and Charter Hall to cash in on high demand for stable property assets among investors hunting for yield.

The structure could give a big lift in value to Caltex’s property sites based on a yield of five per cent or the equivalent of a 20 times earnings multiple compared to eight times for the Caltex group.

Halliday had been given the green light by Gregg and management to pursue the spinoff deal.

The second bid on November 18 may have changed the timing of the property pitch, but only by a week. Caltex went to market on Monday with its float announcement and was met with a positive response from shareholders as they laid out their vision for a listing in the first half of 2020.

But it also spurred one of the parties to leak word of the Couche-Tard deal later that night.

By Tuesday morning Caltex was forced to confirm the details of both bids by the Canadian company, the second of which it is still considering. Crucially, Couche-Tard said it would axe the planned property deal should it prevail, setting up a divide for investors as they weigh the likely machinations still to come. With Caltex due to host its investor day on Thursday in Sydney, a response by Gregg and his board on the $34.50 bid is now just days away.