Wesfarmers held off from providing a specific outlook but said: “The Australian economy is starting from a strong base with low unemployment and high levels of household savings, but the effects of inflation and higher living costs are placing pressure on parts of the economy, including household budgets”.

These are the five key take-outs from the Wesfarmers result.

Bunnings powers on

Hardware giant Bunnings is the Wesfarmers engine room, representing more than 60 per cent of group earnings and the bulk of sales. Despite store closures during the first half of the financial year Bunnings sales rose 5 per cent, including a better-than-expected 9 per cent in the second half. Full-year profit was up 1 per cent to $2.2bn.

Bunnings has shown it has remained resilient through lockdowns and has kept shoppers returning even as inflation pushes up some raw material prices including timber. Bunnings has been able to perform through the cycle and Wesfarmers chief executive Rob Scott says there is a backlog of at least a year’s work ahead for tradies and builders, while the consumer side is still seeing solid DIY demand and maintenance spend. Bunnings profit margins were slightly softer at 12 per cent but far ahead of other parts of the group. Its return on capital represents a massive 77 per cent meaning it delivers the cash for entire group.

Inflation cooling?

This week Woolworths boss Brad Banducci said it was too early to call the peak of inflation but hopeful of seeing some easing of the pressure on rising prices easing in next few months, possibly before Christmas. Early on Friday Scott said he expects inflation to remain elevated over the next six months but notes there have been recent signs of input costs decreasing — particularly around timber, cotton, plastics and aluminium. “These decreases in some of the raw material prices will ultimately start to flow through to consumers over the next six to nine months — there’s some positive signs in that. But overall, I suspect for the next few months, inflation will still be a challenge,” Scott said.

Kmart boost

With cost of living front of mind for households, Wesfarmers is positioning its massive Kmart and Target discount department store chain to capitalise on this. Scott says there has been a “flight to value” as shoppers focus on the impact of inflation and further expected rises in interest rates. Retail trading conditions have been robust in the first seven weeks of the financial year, he says.

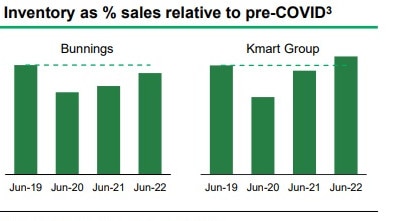

Kmart earnings were hit by store closures and lockdowns in the first half, with the full-year result down 36 per cent at $506m. Revenue was off 3.5 per cent to $9.65bn but earnings momentum picked up quickly in the second half. One to watch is the run up in inventory levels across Kmart and Target. Significant work is going on behind the scenes with Target store closures (11 in the past year) and conversions of some stores to Kmart. Interestingly Target that has a skew to clothing and apparel, has a higher digital sales ratio (22 per cent) to its bigger sibling Kmart (11 per cent). More broadly Scott says the Australian economy is starting from a strong base with low unemployment and high levels of household savings.

Catch a wave?

The federated structure of Wesfarmers with each business running as its own independent unit has meant that digital initiatives have sometimes been patchy across the group. At the same time Wesfarmers’ online marketplace Catch continues to generate losses amid heavy investment.

Catch is going up against global giants Amazon and eBay, but worrying earnings went negative despite the digital sales surge during lockdowns. Catch posted a loss of $88m in the year to end-June and follows a $24m loss a year earlier. Sales held stubbornly flat at $989m even after the lockdowns should have given it a boost in the December half. A new CEO Brendan Sweeny will oversee Catch in coming months and the platform will underpin Wesfarmers New Cross-business digital unit OneDigital which in itself is tipping an operating loss of $100m this coming year.

Lithium bet

Wesfarmers is jumping on the electric car battery revolution with plans to develop the Mt Holland mine in Western Australia. It’s a big bet for Wesfarmers which is more aligned with downstream positions, or that is segments that are closer to end users. Scott says he is conscious of some inflation creep coming into the lithium development as they continue in the planning and construction stage.

There was $304m in development costs last year on the project which includes a concentrator and Kwinana refinery, and this represents a ramp-up in Wesfarmers overall capital spending which is dampening operational cash flows. “Those risks and challenges around skill shortages, cost increases and so forth, have certainly come to light and they are putting pressure on costs,” Scott said. “The challenge I see at the moment is there are risks going forward.” One to watch will be Wesfarmers’ overall capex spend this coming year which is forecast between $1bn and $1.25bn.

Wesfarmers is one of the big 10 companies, but as a conglomerate spanning retail such as Bunnings, Kmart and Officeworks, healthcare, industrial and mining it delivers a window into the economy like no other. It also ranks as one the nation’s biggest private sector employers with more than 120,000. Being headquartered in Perth also means its executives often have a different perspective from the east coast majors. On Friday Wesfarmers reported a 2.9 per cent drop in net profit to $2.35bn and declared a dividend of $1.80 a share, up 2 cents.