Wesfarmers fears reform push is waning, as profit falls

Rob Scott fears the already weakened economy might need to get even worse before there’s the political will for structural reform.

Wesfarmers chief executive Rob Scott fears the nation’s already severely weakened economy might need to get even worse before there is the political will to engage in deep and structural economic reform that will pull at all the policy levers to restart growth.

Mr Scott said at a time when the Australian economy was floundering in its first recession in 30 years there was plenty of talk about what needed to be done but also a general inertia when it came to translating that into meaningful political action.

“I think that everyone I speak to recognises that we need to use every lever we have to get people in jobs, everyone agrees with that, the only problem is they acknowledge that it is really hard to do politically,’’ Mr Scott told The Australian.

“Unfortunately I think maybe things just get, need to get, a bit tougher before there is the real will to change.’’

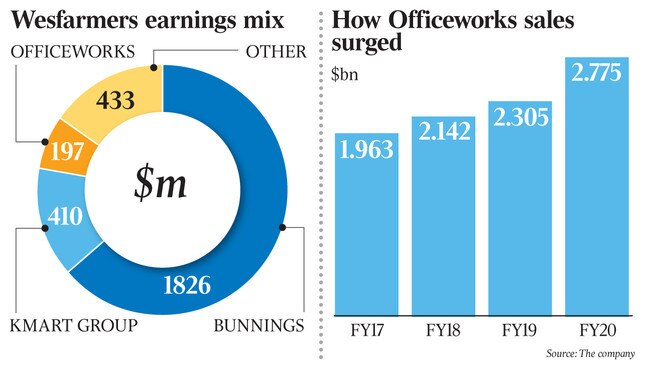

The impact of the prolonged COVID-19 pandemic was evident on the performance of Wesfarmers over fiscal 2020, but in diverse ways. Its retail chains Bunnings, Officeworks and online marketplace Catch experienced boom time conditions as shoppers stripped shelves and digital catalogues to undertake home improvement projects or to set up home offices.

But the flip side of the health crisis was also to be seen in the Perth-based conglomerate’s results where general merchandise struggled, pushing its Kmart group to a $222 million loss, and its industrial and safety business posting a $270m loss as demand dried up from its business customers.

There was more than $800m in impairments and restructuring charges for its lagging divisions.

When combined with the absence of Coles that was demerged in 2018 and the divestment of other assets such as coal mines, Wesfarmers posted a 69.2 per cent fall in full-year profit to $1.697 billion for 2020 as the conglomerate reworked its sprawling operations.

Wesfarmers has emerged from these sales cash rich and shareholders will have one last reward for the 2018 demerger and sell down of Coles shares with the company declaring a special dividend of 18 cents per share, although the ordinary final dividend was kept flat at 77 cents per share. The dividend will be paid on October 1.

While Bunnings can remain open to tradies under Victoria’s stage 4 restrictions Wesfarmers other retail chains in Melbourne have been closed, and Mr Scott said border shutdowns have caused disruptions with some businesses such as a Bunnings store in Mount Gambier which has 30 staff living in Victoria that now cant get to work.

Mr Scott said the prospect of further shutdowns across the economy could have dire consequences.

“Clearly if we continue to have further lockdowns the ramifications of that will be that there will be more job losses, enormous pressure financially on households, many businesses will fail in which case collectively we are going to need to work out how we deal with that.

“That is why it’s just so important at the moment that we find a way of operating in a COVID safe way to reduce the need for this continuing to provide what will be unsustainable levels of financial support.

“The way I look at it is that we are in the first recession for 30 years, now facing a significant health and economic crisis, we should be using every lever that we have to try and create jobs and get through this.’’

Meanwhile, the Wesfarmers result was hit by post-tax significant items from continuing operations of $461m comprising $83m in post-tax restructuring costs and provisions in Kmart Group, post-tax non-cash impairments of $437m in Target and $298m in Industrial and Safety.

Net profit from continuing operations, a better indication of the company’s ongoing profitability, increased 8.2 per cent to $2.09bn as strong performances by its key profit engine Bunnings as well as Officeworks and Catch helped to counter sliding earnings at its general merchandise and industrial safety unit.

Revenue for fiscal 2020 rose 10.5 per cent to $30.85bn, with its recently acquired Catch online marketplace perfectly placed to benefit from the massive shift to online shopping by consumers through the pandemic.

Earnings at Bunnings rose 13.9 per cent to $1.83bn while earnings at Kmart and Target fell 23.5 per cent to $410m. Elsewhere, Officeworks earnings rose 13.8 per cent to $197m and its industrial safety operations saw earnings dive by 53.5 per cent to $39m.

“COVID-19 and the bushfires last summer had a significant impact on our customers, team members and the communities in which we operate during the 2020 financial year,” Mr Scott said.

“Earnings in Bunnings and Officeworks were particularly strong and demonstrated the ability of these businesses to rapidly adapt to the changing needs of their customers.

“The result in chemicals, energy and fertilisers reflected a continued solid performance, while the performance of Industrial and Safety was below expectations and included a $310 million pre-tax impairment as a result of the deterioration in the outlook for customer demand in some segments and uncertainty around future economic conditions.

“The group’s retail businesses delivered total online sales growth of 60 per cent during the year, excluding Catch,” Mr Scott said. “Total online sales across the group, including the Catch marketplace, increased to $2.1bn. This reflects the significant investment in digital capabilities over recent years, as well as the continued change in customer preferences towards online shopping.”

However, some analysts were concerned that the sales booms at Officeworks and Catch didn‘t translate to similarly large leaps in earnings for both retailers.

Mr Scott said Officeworks’ earnings were pinched by a shift to consumers buying lower margin technology products and the business investing in new growth opportunities such as its educational offer to schools. Wesfarmers had decided to invest in the newly acquired Catch for the long term rather than maximising immediate profitability, he said.

Shares in Wesfarmers ended down 10 cents at $48.78.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout