Bruce Mathieson backs Cosette’s offer for Mayne Pharma

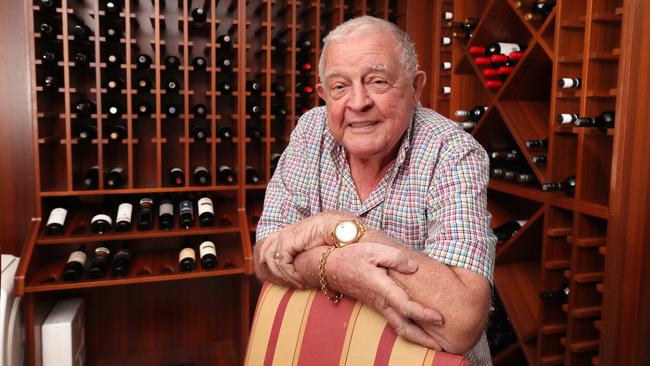

Pubs baron Bruce Mathieson, a major investor in Mayne Pharma, is backing a $672m takeover offer for the drugs maker by US giant Cosette.

Mayne Pharma’s largest individual shareholder, billionaire pub baron Bruce Mathieson, has backed US giant Cosette’s $672m takeover tilt for the ASX-listed drugs maker.

Mayne told shareholders that in the absence of a better offer, the board had unanimously agreed to a scheme of arrangement with Cosette at $7.40 a share cash, 37 per cent higher than Thursday’s closing price.

“The offer provides shareholders with the opportunity to receive cash value at a significant premium,” Mayne Pharma chair Frank Condella said. “We are pleased that Cosette has recognised significant value in Mayne Pharma, particularly in our women’s health and dermatology businesses.”

Cosette, which also has a portfolio of products in women’s health and dermatology, has corporate and manufacturing facilities in New Jersey and North Carolina in the US. It is backed by private equity firm Avista Healthcare Partners and funds managed by Hamilton Lane, a US private markets investment manager.

Mr Mathieson and Viburnum Funds, Mayne’s largest shareholder, together control 14.1 per cent of the company. Both plan to vote in favour of the scheme.

Rubric Capital, the owner of 100 per cent of the Mayne Pharma Convertible Notes issued on December 31, 2022, has also agreed to divest its holding to Cosette.

The ordinary stock rallied 33.1 per cent, or $1.79, to $7.20 on Friday, but remains well shy of its 2016 glory days when it traded closer to $40.

Mr Mathieson, who could not be reached for comment on Friday, is a long-term investor in Mayne, where he was a director from 2007, when the company listed, until his resignation in 2021 as part of a board renewal.

He is also the largest shareholder of pubs and bottle shop owner Endeavour and embattled casino group Star Entertainment.

Mayne’s advisers Jefferies Australia have been actively exploring options for the company in recent months, including a potential sale.

In a recent market update, Mayne said it expected first-half revenue for the six months to December 31 of $210m-$215m, with robust growth particularly in the women’s health segment. Its results, due for release next week, are expected to show underlying earnings before interest, tax, depreciation and amortisation of $30m-$32m, up 275-300 per cent on the previous first half.

Mayne Pharma CEO Shawn Patrick O’Brien said the offer marked a “pivotal moment” in Mayne’s journey. “Attracting an offer from a strategic buyer who is active in the US dermatology and women’s health markets, such as Cosette, reflects the excellent work our teams have been doing to strengthen our company.

“Having broadened our portfolio in dermatology and women’s health, and improved patient access through a refined US channel strategy, we have executed against our corporate strategies with precision. As we enter this new chapter, we do so as a stronger, more agile company.”

The scheme booklet will go out to shareholders in late March.

Mayne said the Cosette offer was fully funded and subject to various regulatory approvals, including shareholder approval and an independent expert’s report.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout