A string of delays in regulatory approvals as well as problems in getting greening projects in place has forced the quarries, concrete and asphalt major to water down expectations for carbon reduction efforts out to the end of the decade.

It comes after miner Rio Tinto recently waved the white flag and acknowledged it was unlikely to hit its own 2025 targets without the use of carbon credits given the lack of progress around green power for its energy-hungry aluminium smelters in NSW and Queensland. Rio is still looking for a solution to hit its goals by the end of the decade, but it will require a monumental shift in thinking for the plants to make it beyond that time frame.

With all the will in the world, it shows the complexity corporate Australia faces on efforts to transition to a greener outlook but confirmation that for some the journey may not be linear.

There’s an intensity on everyone trying to get carbon reduction work done all at once that is crowding out the market, while the engineering challenges of the process are still immense. Planning has been a major headache for many.

With two years to go, more bosses are expected to start reviewing their own 2025 targets given many were put in place in more predictable pre-pandemic times.

For his part, Boral’s chief executive Vik Bansal says he is not backing away from hitting net zero by 2050. But he sits at the sharper end of efforts to reduce carbon. The process of making concrete, particularly in clinker production, is one of the most carbon-intensive industries and it comes as demand from an infrastructure boom means many of his plants are already running at full capacity.

Boral was previously tipping an 18 per cent cull in Scope 1 and 2 emissions by 2025. It now expects this to come in between 12 per cent and 14 per cent. It has essentially paused its 2030 targets and these should be known in the coming year.

Boral is captured under the Albanese government’s Safeguard Mechanism requiring progressive reduction until 2030. Bansal still expects to hit these hurdles with investment. He has also urged movement on a carbon border adjustment mechanism – essentially a form of carbon tariffs, that Canberra is considering. This is necessary to protect his manufacturing base against carbon leakage from imports.

Price and cost

The former Cleanaway boss and most recently was running Sanjeev Gupta’s InfraBuild, Bansal has been running Boral for less than a year. And from day one he has used two levers to steer his quarries, cement and asphalt plants through an economy running hot with inflation: price and cost.

He has been ruthless in pushing through a round of price rises to offset higher energy and other raw material costs to his building and infrastructure customers. Cost control is no longer an “event” it is now being added into the daily operating rhythm of the business.

His concrete and quarries and recycling operations have pushed through double-digit price rises over the past year and asphalt prices are up, albeit at a slower pace.

However, Bansal is only just running ahead of just as intensive cost increases including energy (21 per cent), input material prices (16 per cent) and labour is up 7 per cent.

Using these two levers, Bansal has issued a goal of getting earnings margins to double-digit levels in the next few years. In the past 12 months it jumped from less than 4 per cent to 6.7 per cent.

This helped the Kerry Stokes-controlled Boral rocket to a financial 2023 profit of $142.7m with the long underperforming company now generating its best revenue and earnings numbers for at least five years.

There needs to be acknowledgment of a massive restructure under former boss Zlatko Todorcevski, including billions of dollars in asset sales here and around the world. The program, which also included heavy cost cutting, was spurred on in response to the Stokes family tightening their grip on the share register. This program distracted management but has been necessary to make Boral a more simple organisation. Stokes’ Seven Group now controls more than 70 per cent of Boral and has so far enjoyed a windfall from its recovery.

Bansal expects the pace of inflation to start moderating from the past 12 to 18 months, but tells The Australian: “Inflation is not going back either.

“We not going in a deflationary environment, which basically means that all the costs increases that we have in place they are going to stay,” he says.

Boral is yet to pay dividends, but Bansal says that is a factor of not having enough franking credits following several years of heavy losses.

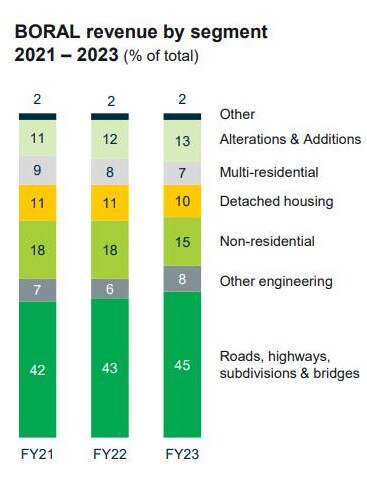

After riding Australia’s infrastructure boom for the past decade, Boral too is facing a different medium-to-long term environment. Governments are starting to switch spending from big infrastructure like roads and tunnels to more social infrastructure such as schools and public housing.

That’s less intensive in terms of demand for volume-based products such as asphalt and concrete, but Bansal says there is still a full pipeline of works on the horizon. Nor is he seeing any cancellation of major infrastructure projects and expects additional medium-term demand from a pick-up in housing investment.

Boral has a rich history of surprising on the downside and a big part of Bansal’s job is to make the materials company more predictable. Bansal reinstated guidance for earnings of between $270m-$300m and this is slightly ahead of where the market was forecasting at the midpoint.

Bansal knows what’s at stake if delivery falls short of guidance. So far the market is backing the story with Boral rocketing 60 per cent higher in the past 12 months, including more than 6 per cent on Wednesday.

AGL powers up

Newly appointed AGL boss Damien Nicks is set to see more of his bonus payments tied directly to how the coal-fired power generator is tracking on ambitious plans to go fully green by 2036.

In particular a bigger slice of long-term bonus payments will be linked to how up to 12 gigawatts of renewable generation is actually being delivered into the grid rather than being talked about. It puts real skin in the game for the chief executive to get moving on a multibillion-dollar transformation, which in more normal business planning cycles would take decades.

Following intense pressure from cornerstone shareholder and tech billionaire Mike Cannon-Brookes, AGL is racing to go green. It plans to shut its massive coal-fired plants in Victoria and NSW by the end of 2035 and replaced them with 12 gigawatts of renewable and firming capacity. AGL also has an interim target of 5 gigawatts by 2030. Last year it finally switched off the five-decade old Liddell coal-fired plant and began installing a new big battery.

“What’s important is for us is about actually seeing the reality of that (renewables) pipeline being delivered into the marketplace,” Nicks says.

Nicks was talking as he handed down AGL’s eye-watering loss of $1.26bn for the year to end-June. The loss was flagged in recent months and is largely as a result of writedowns on the earlier closure of power plants and being on the wrong side of electricity hedging.

Stripping that away, earnings were up 25 per cent to $281m helped by having his plants online for longer. Profit is set to jump in the coming year helped by rising prices in the wholesale market. Cannon-Brookes has done well from his activist bet with full year dividend of 31 cents increasing 19 per cent. AGL shares are up 32 per cent over the year.

For now though Nicks has one eye on keeping the lights on in the near term and if a mild winter so far is any indication, this summer is going to be a big test.

Nicks plans to spend $400m to $500m annually in coming years to keep his remaining ageing coal-fired power plants running more reliably. As well as preventing grid outages, a reliable plant is good for AGL’s bottom line.

One area he is spending up big on is putting a little “flexibility” into AGL’s usually rigid plants. Big coal-fired plants can’t be powered up or down easily but increasingly they are competing with renewables such as wind and solar flooding the grid through the middle of the day. That means they lose money on generation and the plants are under unnecessary pressure. Now AGL has started to drop thermal generation by 70 per cent at Bayswater in NSW and 45 per cent at Victoria’s Loy Yang.

This coming year AGL will trial taking another 50 megawatts offline when renewables are pouring into the market. It’s a significant step and stands to take pressure off plants to improve the reliability curve for when the power is needed.

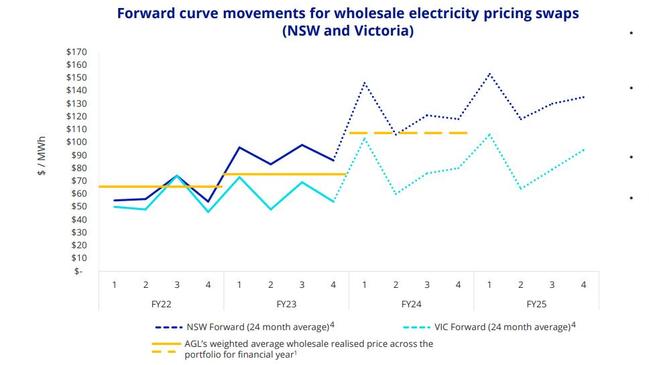

There’s little near-term relief for consumers and business with forward wholesale electricity prices remaining high for at least the next two years. And that’s in a perfect world that assumes no major plant outages, unusual weather and global factors like war escalating already fragile prices.

“What’s really important is we continue to invest in renewables and firming and build that out. Because that will ultimately go to lowering prices over time,” Nicks says.

AGL’s accounts show Nicks was offered a $400,000 retention bonus in shares and cash when he was chief financial officer amid the turmoil of last year at AGL when former chief Graeme Hunt’s efforts at splitting the nearly two century-old company were derailed.

After Nicks was named chief executive in January, he opted to leave the bonus on the table.

johnstone@theaustralian.com.au

Boral has become the second big polluter in recent weeks to pull back on near-term targets to slash emissions. It won’t be the last.