The overhaul is notable as it sets the scene for the first Myer annual meeting in more than six years where there has been a relatively smooth transition of power inside the boardroom, and everyone – including Lew – are on the same page. Indeed the moment now marks Lew’s transition from Myer outside agitator to insider.

The key players – including outgoing chair JoAnne Stephenson – recognise it is now a make-or-break moment for Myer’s rehabilitation.

What the retailer needs more than anything is stability in the boardroom as it navigates a slowing economy and looming management overhaul with a search underway for a new chief executive.

Shares in Myer have fallen more than 43 per cent in the past six months even as sales have held up better than expected. Still, the retailer has clearly entered a tougher period as top-line sales were largely flat in the quarter to the end of July.

Myer’s relatively small board had been heading into the November 9 annual meeting facing the second leg of a shareholder strike. Stephenson rightly calculated that Lew had full control over the outcome of the vote with the numbers now on his side, and this meant a board spill would be coming.

In the background Lew has been quietly increasing his stake in Myer under the creep provisions, allowing him to top up his stake by 3 per cent over six months without the requirement to launch a full takeover offer. This has resulted in his holding growing to 28.8 per cent and far eclipsing anyone else on the register.

Stephenson has worked hard to keep the peace through the year, including “constructive” talks in recent months with the Lew camp about board renewal.

And after last year’s bruising battle where Lew managed to secure support to finally get his own director – the former senior Myer executive Terry McCartney – on to the board, Stephenson has also offered herself up for an early exit, even with several years to run on her term.

She has managed to control the process on the way out, naming former SABMiller top exec and existing director Ari Mervis as her new chairman. She too has recruited well with the appointment of business journeyman Gary Weiss, who has previous links to Lew, while extending a board role to Qantas loyalty executive Olivia Wirth. This marks the first board appointment for the well-connected Qantas executive, who had also been among the internal contenders to take over from Alan Joyce.

The new board appointments were made independently of Lew, although the Lew camp met with the prospective directors in recent weeks.

While Wirth’s airline faces its own turmoil – mostly self-inflicted – the Qantas Frequent Flyer scheme is as one of the best loyalty programs in Australia alongside the MyerOne program that has more than 7.3 million members.

MyerOne now sits at the heart of Myer and the program is aggressively used to keep customers spending and coming back into the stores, even when interest rates have been making retailing a tougher place to be.

MyerOne had more than 720,000 people join in the past year and, significantly, it is skewing to a high-spending younger demographic and more than half of the new members are under the age of 35.

Meanwhile, Weiss stands to bring a sharper focus on Myer’s turnaround – especially through property where it has more than $1.6bn in lease liabilities sitting on the balance sheet.

Weiss has exposure to property through his operating vehicle, Ariadne Australia (which holds the stake in Dreamworld owner Ardent Leisure). He also chairs the Cromwell office and funds empire and is steering through the $838m takeover of Regis in his role as chair of the aged-care provider.

Weiss is his own man with his own projects under way, but the links with Lew run deep. Weiss was on the board of Lew’s Premier Investments for 24 years, including when Lew’s campaign against the Myer board started seriously heating up from late 2017. Weiss also spent some time on the Westfield board last decade, and the shopping mall owner is still the biggest landlord for Myer.

Lew has responded to the changes by signalling that for the first time in years he intends to vote with the board, rather than against it.

“As Myer’s largest shareholder we are supportive of Myer’s efforts to refresh the board by adding to the skills and experience of the group,” a spokeswoman for Lew’s Premier Investments said.

It was notable that the proposed directors “had strong, property, commercial, consumer and loyalty credentials,” the spokeswoman said.

The changes will mean the majority of Myer’s six non-executive directors will have joined the retailer within the past three-and-a-half years. The longest serving director is former M&C Saatchi boss Dave Whittle who joined in 2015.

The big challenge for incoming chairman Mervis will be to sign off on a new chief executive as current boss John King is due to retire in the second half of next year.

It is a big appointment. Under King, the retailer has finally found financial certainty. He also set about making Myer’s massive store portfolio work harder by shrinking the retail footprint while closing the underperformers where he could. For the first time in years Myer is sitting on a net cash position while sales have grown at double digit rates.

However, as the search gets under way the message of peace in the boardroom will make a smoother ride to secure a new chief executive.

To his credit King signed on in 2018 while Myer’s outlook had been made less certain and Lew had been ramping up the pressure on the board.

King, who was last year paid $2.45m, will see an overhaul of his remuneration mix for the coming financial year given his pending exit. This will see his short term bonus increase to 116 per cent of his fixed salary, up from 90 per cent.

King has no long-term bonus payments on offer. However, Myer insists it has put in place protections around encouraging management to focus on short-term profits at the expense of longer-term returns. King currently ranks as the 13th biggest shareholder in Myer with more than 3.5 million shares.

Lithium pain

There will be more pain on lithium before any gain, according to Citi’s latest global commodities outlook. The US banking major has cut its forecasts for lithium pricing for the near term to $US18,000 a tonne for carbonate sold into China, from around $US22,000 currently. It tips there is a one in three chance prices could fall to $US15,000, depending on the strength of Chinese demand for EVs.

Rising inventories among battery manufacturers and a flurry of projects coming on-stream could see the lithium market remain in moderate surplus Citi analysts have said. However this could set the market up for a strong rebound over the longer term. Growth in EVs are likely to put lithium on track as a $US80bn market by the end of the decade from around $US30bn currently. Longer-term Citi is tipping lithium carbonate to range in the $US20,000-25,000 a tonne range.

The near-term strains are likely to increase pressure on lithium players to consolidate with Allkem and US listed Livent leading the way with their recent $15bn-plus scrip merger. Share losses among locally listed lithium players have been significant over the past year, with names like Pilbara Minerals down 30 per cent, MinRes is off 17 per cent and even Allkem has seen the best of the near term boom with shares off 27 per cent.

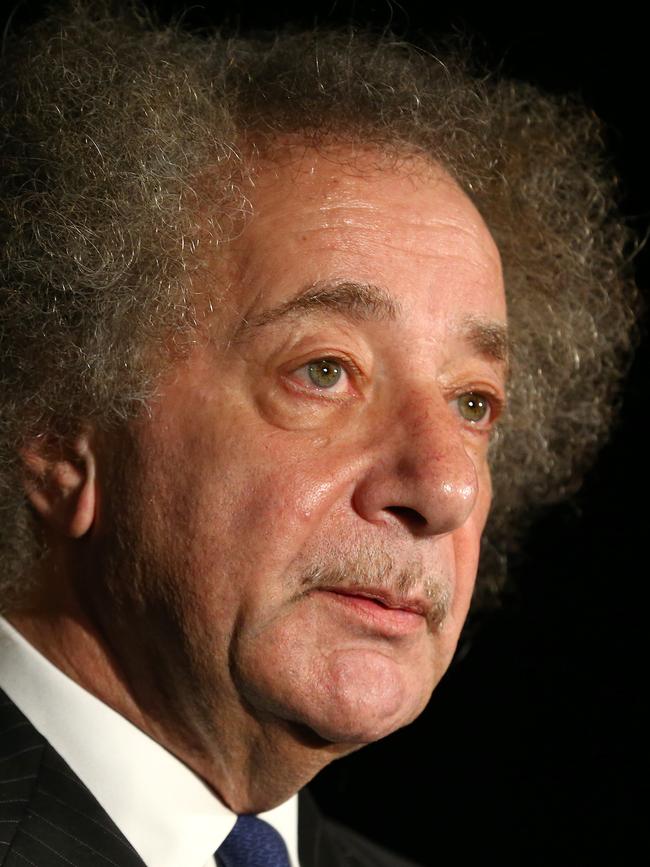

Solomon Lew’s long game stalking Myer is starting to pay off, with a boardroom shake-up including a new chair and addition of Gary Weiss as a director, sealing the multibillionaire’s power over the department store beyond his nearly one third stake.