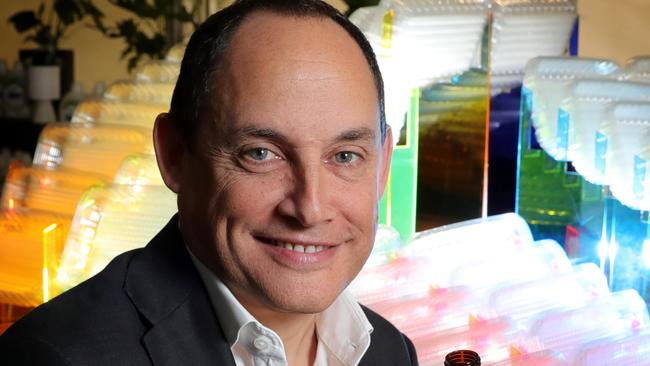

Billionaire packaging boss Raphael Geminder turns up the pressure on takeover target McPherson’s

Raphael Geminder wants McPherson’s to release a trading update to the market, for transparency on current conditions.

Packaging billionaire Raphael Geminder has sustained his pressure on the board of takeover target and diversified industrial McPherson’s to release a trading update to the market, provide transparency on current conditions and has also attacked the experience of its new chief executive Grant Peck.

In its supplementary bidders’ statement Gallin, a company controlled by Mr Geminder’s Kin Group, has upped the pressure on McPherson’s to accept its $1.34 all-cash offer for the company that was launched in late March.

The statement from Gallin has also savaged McPherson’s on a number of fronts, from its failure to issue a trading update to the appointment of its new CEO Mr Peck and what it claims is his lack of experience in the key health, wellness and beauty sector that McPherson’s has pinned its profits on.

In the statement, Gallin said the McPherson’s CEO and board are unwilling or unable to provide shareholders with a trading update prior to the expiry of the current offer period and therefore failing to provide any transparency or any clarity on current trading or current financial performance.

“This is notwithstanding that only 10 weeks remain in fiscal 2021,” Gallin added.

It also said McPherson’s have announced a so-called “Operational Review” without previously disclosing to shareholders that it’s been underway for many months.

“This seems to recreate history. Conveniently the results of the review are proposed to be released at an unspecified date in May presumably after the scheduled close of the Gallin offer.”

In terms of the appointment of Mr Peck, Gallin said his most recent CEO role was at Sunny Ridge Farms (a strawberry farm located in Victoria).

“Mr Peck has no executive experience in running a health, wellness and beauty company and no experience in running a public company. As a non-executive director since December 2017, Mr Peck has had direct involvement in many of the decisions and missteps McPherson’s has made in recent years.

“Now as CEO, Mr Peck is expected to develop the strategy and grow a multi-branded, complex $200 million revenue health, wellness and beauty company.”

Gallin said McPherson’s target statement is highly uninformative and underwhelming.

“The lack of transparency raises a number of material red flags which is deeply concerning for Gallin as well as all other McPherson’s shareholders.

“Gallin calls on McPherson’s to be transparent with its shareholders and provide a complete update in relation to its year to date operational and financial performance, as well as an update on its operational review. This information may be material to the McPherson’s share price. Therefore it is critical that it be provided before the end of the Offer so shareholders can form a view on value.

Gallin considers that its Offer of $1.34 cash per share provides an attractive price for shareholders, it said.

McPherson’s has tried it hand at almost everything, from book publishing and producing the telephone directory to selling cutlery. More recently it has focused on beauty and wellness through a string of acquisitions.

Mr Geminder, whose private investment empire spans food, packaging and retail, is setting himself up as a company turnaround specialist following the unconditional all-cash takeover for underperforming diversified industrial play McPherson’s. It follows a recent takeover bid for The Reject Shop which saw him take board seats and help turnaround the once sickly retailer.