Big W could be forced to close a third of its 183 stores: Macquarie

Woolworths could be forced to close down one third of its Big W outlets at a cost of almost $800m, says Macquarie.

Woolworths could be forced to close down one third of its Big W stores at a cost of almost $800 million, according to Macquarie analysts, as the loss-making general merchandise chain continues to rack up losses above Woolworths expectations and is saddled with $2.7 billion in lease commitments.

A report from Macquarie Wealth Management has run the slide rule over Big W in the lead-up to an expected update from Woolworths in the coming weeks.

The report argues that Big W should eventually return to profitability, therefore not justifying a complete closure of the chain, but that a more logical and cost-effective strategy would be of “cutting of the tail” and drastically reducing the 183 stores operating across Australia.

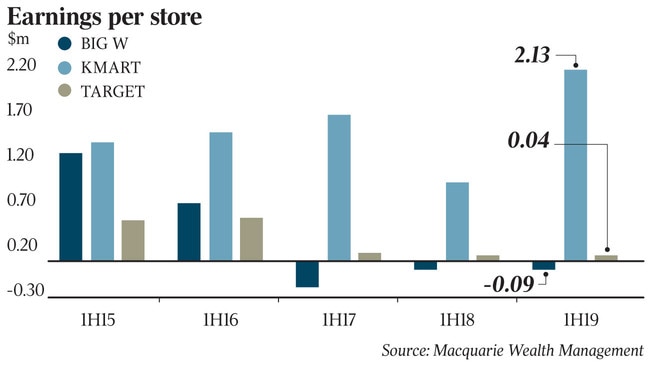

The retail chain has been underperforming and ringing up large losses for several years as it faces intense competition within the discount department store space, especially from Kmart and Target. For the 2018 fiscal year, Big W posted a full-year loss of $110m and a loss of $151m in 2017. For the first half of 2019, Big W recorded a loss of $8m.

“Partial closure of most unprofitable and shorter-lease stores (is) more likely,’’ Macquarie said in a note to clients.

“Given significant closure costs for the portfolio, a more likely scenario is Woolworths to close up to one-third of its stores (60 stores), in our view. This cost could be around $759m. The ultimate cost would come down to the lease term remaining on these problematic sites and whether the landlord would accept a discount given potential for alternate use.

“The market may like the removal of uncertain downside given the challenging industry outlook.”

Macquarie argued that half of the Big W store network was located in challenging centres.

“Big W is highly exposed to regional areas … it is unlikely these locations will enable Big W to regain the momentum required for profitability,” it said.

“In a challenging retail environment, we see a reduction in store count as the most likely outcome from the review.

“Given the format of Big W stores, we believe it would be difficult to reduce space as Myer is doing and that outright store closure is more likely.”

The investment report also argues the skew of profitability in the 183 store Big W network is the swing factor. “Myer previously indicated that flagship and premium stores (about 33 per cent of the network by number) are two to three times more productive and contribute more than 60 per cent of store level EBI,” it said.

“We understand Big W has loss-making stores. However, the skew may not be as significant as Myer, in our view, given Myer has significantly larger CBD and regional mall flagships, etc, compared with the network average.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout