Bellamy’s investor Jan Cameron: China has too much power

Entrepreneur Jan Cameron has questioned China’s power over the Australian economy.

Jan Cameron, the entrepreneur who took camping brand Kathmandu to the world and is the biggest shareholder in infant formula group Bellamy’s, has questioned China’s power over the Australian economy and the effectiveness of free trade agreements when Beijing changes regulations “seemingly at random’’.

The outspoken investor, who earlier this year led a shareholder rebellion at Bellamy’s to gain control of the board, raised her concerns about the strings being pulled by China and the impact on Australian businesses.

Dairy groups in Australia are bracing for a new wave of regulations from next year that will tighten procedures and the number of producers that can export dairy foods into the region.

Bellamy’s was caught up in the regulatory shake-up last week when authorities at China’s Certification and Accreditation Administration suspended cannery Camperdown Powder’s infant milk import certificate.

Only a few days earlier Bellamy’s had finalised a deal to buy a controlling 90 per cent stake in the Victorian cannery for $28.5 million, with the help of a $60m capital raising from its shareholders. Ms Cameron owns an 18 per cent stake in Bellamy’s, and said she fully participated in the raising to maintain her holding.

The acquisition was driven by the cannery’s licence, which Bellamy’s desperately wanted, as well as the cannery itself, which it can expand to can its own products. But those plans are now into limbo after China announced the licence held by Camperdown would be suspended.

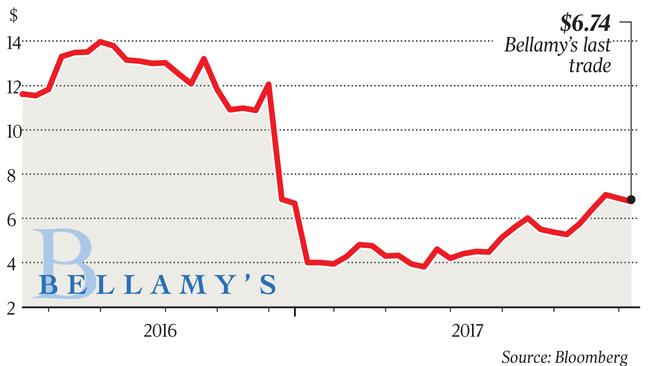

Bellamy’s shares were placed in a trading halt on Friday and are set to resume trading by tomorrow, when the stock could fall sharply as investors fret over the sovereign risks of doing business in China.

Ms Cameron told The Australian she was uneasy about the power China authorities could exert over the Australian economy.

“It is concerning the Chinese can really be in a such a powerful position over our economy that they can turn things on and off seemingly at random,’’ she said.

Tougher regulations on the import of infant milk formula have been partly explained by Chinese officials as a push to improve labelling and standards, but they come in the wake of a scandal about contaminated Chinese-made infant milk powder nearly 10 years ago that left six babies dead.

“I’d love to get inside a Chinese baby formula factory and see what standards of practice they have there,’’ Ms Cameron said. “It’s not tough when you are buying things from them; it is just tough when you try to sell to them, despite our wonderfully free trade agreement produced by (then trade minister) Andrew Robb, who is now a Chinese employee.’’

Since leaving office Mr Robb has been criticised for taking an $880,000 part-time job as a consultant to a Chinese billionaire reportedly aligned to the Chinese Communist Party.

Ms Cameron said she was supportive of the decision to buy Camperdown Powder as Bellamy’s would benefit from expanding the cannery line to produce infant milk formula for other markets. “It is important to stress the China licence is only representing 16 per cent of Bellamy’s sales,” she said.

Late on Friday Bellamy’s said it was working with Australian trade officials and channel partners to understand the reasons for the suspension, and she emphasised it was a not a cancellation.

“Importantly, the suspension does not impact the sale of the company’s organic baby and toddler formula products, which are manufactured by Fonterra and Tatura Milk under their respective CNCA (China) licences.”

Bellamy’s added that it does not intend to can its products at the Camperdown facility until the second half of 2018.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout