Bain Capital wins over Estia’s board in $838m takeover after a five-month pursuit and aged care sector faces ‘critical threat’

Bain Capital is poised to take over Estia for $838m, with more consolidation expected in the age care sector where seven out of 10 providers are operating at a loss.

Estia chief executive Sean Bilton says Bain Capital is an “appropriate custodian” of the aged care provider as its directors finally back a $838m takeover from the private equity titan as the sector faces widespread upheaval and consolidation.

After a five-month month pursuit – including an exclusive due diligence period expiring last week – Bain and Estia signed a scheme of implementation agreement on Monday morning.

The takeover is priced at $3.20 a share – a 50 per cent premium on Estia’s closing price on March 21 before Bain lobbed its first offer.

Estia shares rocketed more than 8.6 per cent to $3.08 – a five year high.

It is the latest in a flurry of dealmaking in the troubled aged care sector following a royal commission – which revealed stories of abuse and neglect – before the pandemic hit, sparking Covid-19 outbreaks across nursing homes and deaths among elderly residents.

Catholic healthcare provider Calvary took over Japara – an aged-care provider formerly listed on the ASX – for $380m in late 2021. When Estia’s takeover is completed, this will leave Regis Healthcare as the last major aged care provider listed on the ASX.

Mr Bilton is predicting further consolidation within the sector as providers implement a raft of recommendations, including delivering at least 200 minutes of care per resident a day – 40 minutes of which must be from a registered nurse (RN).

Aged care providers must also have a registered nurse employed 24/7 – a tough task given Australia, and the world, is facing a chronic nursing shortage, and the aged care sector historically is considered a lower payer than big acute hospitals.

“We’ve had 24/7 RNs for five years within Estia but there are providers, smaller providers, particularly in a number of more difficult regional locations where that is not easy as it is in other places,” Mr Bilton said.

“The industry structure is still 60-70 per cent of providers have one or two homes and the broader regulator piece is driving a number of (consolidation) proposals. That’s not a bad thing.

“A few years ago, there were close to 1000 providers. Now it’s closer to 800 and you will continue to see that trend down. I don’t see it as being a big step change. But it will continue to trend down.”

Mr Bilton said Bain Capital’s interest in Estia Health was a strong endorsement of the company’s strategy to build a market-leading aged care provider.

“We look forward to a partnership that will continue to deliver our core purpose to ‘enrich and celebrate life together’.”

Crucially, he said Bain – which has $US14bn ($21.3bn) capital deployed and more than 175 platform investments in healthcare – was an appropriate custodian of Estia’s assets as the aged care sector faces widespread upheaval from the royal commission’s recommendations and recovers from the pandemic.

“They’re one of the largest private investors in the world and certainly healthcare is one of their core competencies.

“I’ve worked in the sector for 17 years and I’ve recognised that if you don’t focus on resident outcomes and you don’t get care right, then you can forget everything else. In my dealings with Bain through the due diligence process, I get a sense that they understand that, given their background and history of investing in healthcare.

“I’m comfortable that they will be an appropriate custodian if the shareholders elect to proceed and accept the offer.”

Bain initially approached Estia with a $3 a share bid, which was rebuffed, with directors telling the private equity group to improve its offer.

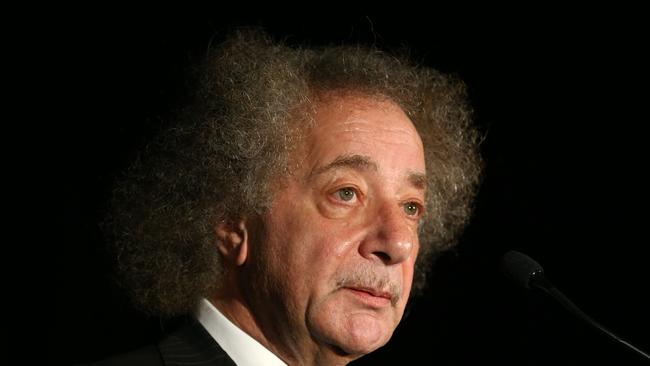

On Monday, after Bain sweetened its bid, Estia chairman Gary Weiss said: “We are pleased that Bain Capital has recognised Estia Health’s value as a leading Australian aged care operator with a strong reputation for person-centred care.

“The Estia Health Board is confident as to the outlook for the business, however, recognises that the Scheme allows shareholders to realise certain cash value now at an attractive premium.”

Estia intends to pay a fully franked ordinary dividend on or before the scheme implementation date, and is permitted under the agreement to pay ordinary dividends of up to 12 cents cash per share.

Its directors unanimously recommended that shareholders vote in favour of

the scheme, in the absence of a superior proposal and subject to an independent expert concluding.

“The board considered a range of matters in coming to its unanimous recommendation, including the intrinsic value of Estia Health under a range of scenarios and the price at which its shares may trade over the medium term in the absence of the scheme,” Dr Weiss.

“We believe the proposed transaction is a good outcome for shareholders and our stakeholders more broadly.”

Mike Murphy, a Sydney-based partner of Bain, said the takeover would extend its strategy of “investing in Australian businesses to drive positive and lasting impact for companies, employees, and communities”.

“We are delighted to invest in Australian aged care and expect a long-term presence in the sector,” Mr Murphy said.

“We appreciate the trust families have placed in Estia Health to care for their loved ones. Bain Capital will support management to continue to build on their track record of delivering highly compliant, high quality, and compassionate residential aged care to thousands of Australians.

“We will build on and invest in Estia Health’s robust corporate governance. We want management to maintain the highest levels of care and keep the needs of residents central to everything Estia does.”

Earlier this year, it was revealed that seven in 10 nursing homes are operating at a financial loss, while rapidly declining occupancy levels and severe staff shortages are jeopardising the care of hundreds of thousands of vulnerable older residents.

Underlining the financial woes of the sector, nursing homes lost an average $21.29 a bed a day in the September quarter compared to $7.30 in the same quarter of 2021, according to StewartBrown’s latest aged-care financial performance survey.

Estia shareholders are expected to vote on the takeover in November.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout