ASIC doubles down on climate disclosure, warns of ‘perfect storm’ of global threats

ASIC is cracking down on climate disclosures, while warning of a ‘perfect storm’ of new global threats in the wake of the pandemic.

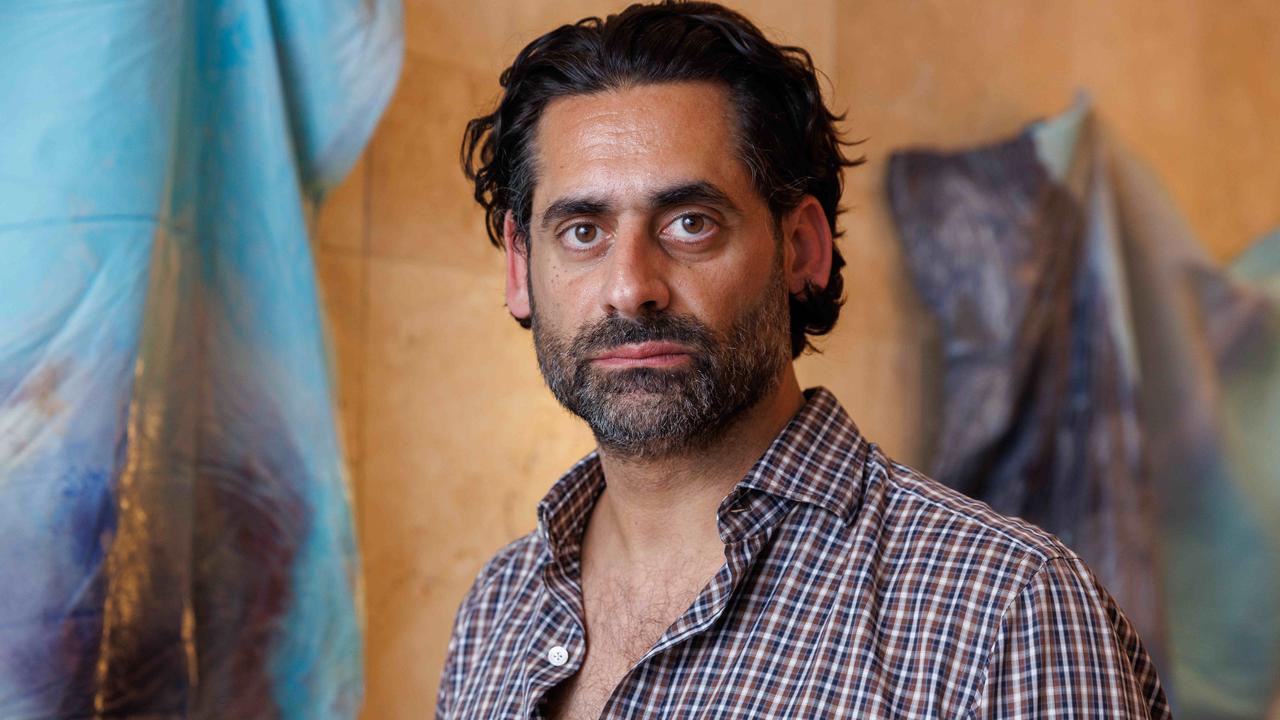

The chairman of the Australian Securities and Investments Commission, Joe Longo, has warned companies to take their climate change disclosures seriously.

In opening remarks to the first day of the ASIC annual conference in Sydney on Thursday, Mr Longo said climate-related disclosure now played an important role in “ensuring fair and efficient markets, and confident and informed investors”.

“There is strong investor demand for climate-related disclosure to help investors make capital allocation decisions,” he said.

“ASIC’s task is to ensure that there is integrity, trust and confidence in sustainable finance-related products, services, and disclosure practices.”

At the same time, Mr Longo cautioned a “new set of threats” destabilising global economies and markets in the wake of the pandemic, and challenging regulators everywhere.

Economic and societal fallout from the pandemic, the transition of the economy to confront climate change, engagement with new technologies and cyber risks, and the ongoing war in the Ukraine created a “near perfect storm of geopolitical and economic complexity”, he said.

Mr Longo warned that ASIC would be keeping a close eye greenwashing, using its existing powers to take action against companies making false claims about their environmental credentials.

His comments follow ASIC’s first action on greenwashing taken last week: fining listed energy company Tlou Energy a total of $53,000 for false or misleading statements on sustainability made to the ASX in October 2021.

Mr Longo warned that the regulator was currently investigating the climate change disclosures of a number of listed companies, super funds and managed funds.

He said it was “encouraging” to see many Australian firms taking concrete steps to voluntarily align with international climate change disclosure standards.

“ASIC is currently contributing to this work,” he said. “Good work is being done but there is more work to do.”

He said investment in companies committed to reducing their emissions and committing to climate change could “only be supported where there is confidence an offering is true to label” and companies had a reasonable basis for making public statements on this topic.

He warned that the regulator was currently investigating the climate change disclosures of a number of listed companies, super funds and managed funds.

Eighty per cent of the global GDP is now covered by net zero carbon targets, including the Australian government’s recent legislation for a target of 43 per cent reduction in emissions by 2030.

“Meeting these targets will demand enormous investment, which will be channelled through the markets and entities regulated by ASIC,” Mr Longo said, adding that the physical impacts of climate change were expected to continue to accelerate.

“Analysis by global insurance underwriters indicates that the world may lose up to 18 per cent of GDP by 2050 through physical damage alone if emissions are not curtailed.”

Central bankers were now suggesting that climate policy sat alongside fiscal and monetary policy as the “third pillar” of macro economic policy, he said.

ASIC is currently contributing to the proposed law on corporate climate change disclosures, while “further developing (its) medium to long-term strategic approach in this space.”

“These issues will be with us for generations to come,” Mr Longo said.

Meanwhile, ASIC was also closely watching the cryptocurrency sector.

“The inherent risks associated with investing in cryptocurrencies are often opaque, and the risk equation is never static.

“They are highly volatile, inherently risky, and complex. Crypto and the crypto ecosystem continue to pose challenges and opportunities for regulators and policymakers alike.”

Mr Longo noted the federal government was working on legislation to regulate the sector.

“In the meantime, ASIC continues to utilise the current laws and its expanded regulatory toolkit – including the design and distribution obligations regime, or DDO – to protect investors from harms arising from risky, volatile, and complex products.”