Ardent chief has questions to answer as shares dive

Ardent Leisure has had more than $250m wiped from its value after the Dreamworld theme park tragedy.

Ardent Leisure has had more than $250 million wiped from its market capitalisation since four people were killed at its popular Gold Coast Dreamworld theme park on Tuesday, prompting investors to question the company’s direction.

The leisure group’s shares fell 15.1 per cent yesterday after dropping nearly 8 per cent on Tuesday, which means nearly a quarter of its sharemarket valuation has been lost in less than two trading sessions.

The company’s board is under pressure after outgoing chairman Neil Balnaves and embattled chief executive Deborah Thomas refused to comment yesterday on the tragedy that killed Roozi Araghi, Luke Dorsett and his sister Kate Goodchild, and Sydney mother Cindy Low. The Australian was told Mr Balnaves was “too emotional” to speak while Ms Thomas was in meetings at the Dreamworld park with her mobile phone switched off.

Ardent’s annual meeting will proceed in Sydney today and executives are expected to update shareholders on the police investigation into how the accident on the Thunder River Rapids ride occurred on Tuesday. A statement released by Dreamworld last night said the theme park would reopen tomorrow at 11am.

Mr Balnaves will proceed with his previously flagged plan to retire from the Ardent board on November 6 after 13 years, despite market speculation yesterday that he could remain to steer the company through the crisis.

Former insurance executive and current Ardent director George Venardos is set to take over as chairman.

Ausbil chief executive Paul Xiradis, who is Ardent’s second largest shareholder with 8 per cent of the stock, said the board’s handling of the accident was critical to its future.

“First, this is an absolute tragedy and something that you never want to see happen,” Mr Xiradis said.

“Equally, it’s the responsibility of the company to make sure all of the events and the attractions at its parks are safe.”

Citigroup analysts forecast yesterday that Ardent would take a major financial hit and visitor numbers to Dreamworld could fall by up to 20 per cent in the next few months.

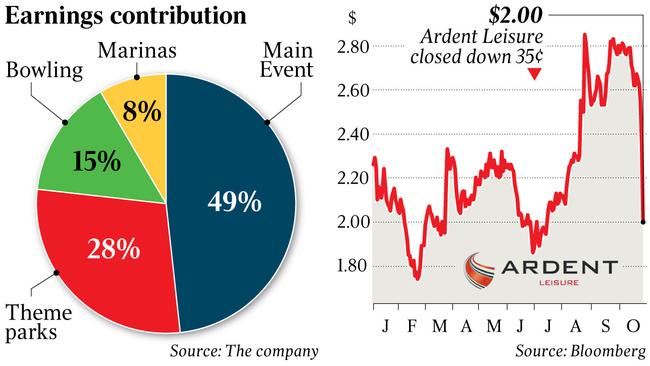

Since the recent sale of its Fitness First gyms offshoot, Dreamworld and Ardent’s second Gold Coast-based theme park, WhiteWater World, generate about 30 per cent of the company’s total earnings. Combined, it is Ardent’s second-largest division behind its US entertainment group, Main Event.

“I think the company will recover from this but there will be a short-term impact,” Mr Xiradis said.

“Eventually there will be demand from people for theme parks ... but there’s a risk that it could take longer to recover from this.

“There could be serious consequences if it is found that someone has not taken responsibility to the degree that (they) should have.”

Ardent shares yesterday lost 35c, or 15.1 per cent, to close at $2 — the lowest point since July.

Mr Xiradis said he retained confidence in Ardent’s board and senior management but was keen for answers as to how the tragedy on the ride — which had been the subject of safety issues previously — unfolded.

“I will be quizzing management to understand, once there are more details, what could (have) been done to prevent this and what measures are being put in place to stop this happening again,” he said.

Mr Xiradis said Ms Thomas’s controversial appointment as Ardent chief executive and the accident were separate issues but she had “ultimate responsibility as CEO”.

Ardent could face large lawsuits and potential fines as a result of the tragedy.

Queensland’s Workplace Health and Safety has launched an investigation into the cause of the accident.

Clyde & Co partner Michael Tooma said a number of charges could emerge once the investigation was finalised, as well as potential civil claims against Ardent and Dreamworld.

Under Queensland’s workplace safety act, liabilities could be as high as $3 million on each offence while the company’s officers could face fines of up to $600,000 or five years prison if found to be negligent.

“A number of offences could arise from this,” Mr Tooma said.

“There could also be civil claims that could be made from the families over and above the potential official charges.

“The public requires a high degree of confidence in the systems that the company has in place to prevent incidents like this.”

Analysts started to downgrade Ardent Leisure shares yesterday with forecasts that attendance at Dreamworld could fall by up to 20 per cent, based on previous similar accidents at theme parks around the world.

Citigroup analysts cut the stock’s outlook from “buy” to “neutral” after the accident.

Citigroup based its forecast of a major fall in attendance after the Alton Towers park rollercoaster accident in Britain in June last year, which seriously injured four people.

In that case two victims had to undergo leg amputations and a further 14 people were hurt.

The accident cost its owners Merlin tens of millions of pounds in lost revenue and fines.

“Based on the Merlin experience, we expect Dreamworld attendance to be adversely impacted over the upcoming peak Christmas trading period, and beyond, as a result of negative press commentary,” Citi said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout