These include the demerger of Coles, closure of the Bunnings UK experiment and the sale of coal, while his acquisitions have tended to be relatively small for a $66bn company – like Monday’s low-ball proposed $687m bid for API.

Acquisition of the health and pharmaceutical retail group, which includes the Priceline and Soul Pattinson pharmacies, would be a good addition to the Catch online sales group with growth prospects, but it’s early days yet.

This year’s API underlying earnings before interest and tax of $68m compared with Wesfarmers’ EBIT of $4bn and $200m-plus for Officeworks.

That puts some context into the deal.

Twenty per cent holder WSP agreed to support the deal as long as there is no higher bid.

No stock has changed hands. Wesfarmers approached WSP last week to test its interest and to ensure it would not play a spoiling role. WSP has no interest in buying the rest of API and, like Wesfarmers, has an open position on all of its portfolio, being a seller at the right price.

API and Sigma have long looked at merging, the last time formally in December 2018, when API acquired 13 per cent of Sigma, which rejected the deal and API sold.

The ACCC has also rejected past deals.

Scott has ridden the market well in his term as boss when you consider predecessor Richard Goyder’s 12-year term saw 193 per cent total shareholder return with an outperformance of 8 per cent.

Stock price moves don’t tell the full story, with Goyder managing through the global financial crisis early in his term, the switch into retail and also backing former Bunnings boss John Gillam’s successful defence of the network from Woolworths’ Masters attack.

API acquired Soul Pattinson in 2000 and, through that deal, what is now known as Washington Soul Pattinson took a 20 per cent stake in the business.

It has agreed to sell that stake to Scott unless a higher bid emerges and the reality is Scott’s bid is just an opening gambit.

API’s stock price jumped 20 per cent on Monday at just below the bid at $1.37 a share and a higher price will be demanded from API chair Ken Gunderson-Briggs, assuming no rival bid emerges.

API is being advised by Macquarie with Gresham advising its parent company, Wesfarmers.

The roughly 20 per cent premium in the bid is seen as another sign of being a low-ball first-up offer, but it was enough to get the prized agreement of WSP to vote its stake in favour of a deal.

WSP is moving more into unlisted investments in aged care and renewables, but the recent Milton acquisition maintained the listed company exposure.

Ever the diplomat, Scott was effusive in his praise of the community pharmacy model, which is basically a protection racket for chemists.

Chemist Warehouse is breaking the mould but historically there have been anti-competitive rules restricting how many pharmacies exist in a suburb and how many can be owned by one person. The rules are held dearly by the chemists even though the move by big companies into the space is breaking the model.

Still, Scott obviously sees merit in talking friendly prior to the deal.

Chemist Warehouse is the Bunnings of the pharmacy market and is long trumpeted as being a potential IPO candidate.

Online sales now account for just 8 per cent of Australian pharmaceuticals sales, roughly a quarter of offshore trends, which is where Wesfarmers can use its Catch expertise.

This deal won’t shift the dial at Wesfarmers, but it is another tentacle to potentially build a new earnings line.

–

Funds’ power takes off

The IFM bid for Sydney Airport has raised the issue of the increasing power of industry funds and their ownership of Australian assets.

It’s a long bow but ACCC boss Rod Sims has in the past mused on the topic given the $225bn AustralianSuper has plans to hit $500bn in funds under management in five years and, owning just 25 listed companies, that could include say two banks. What chance a couple of industry funds quietly suggesting a strategic deal to, say, Westpac and CBA?

UniSuper is not an industry fund but its investment boss John Pearce rejects such talk, noting: “Governments and regulators underestimate the degree of accountability the funds have to their own boards and members.”

Pearce is a key player in the airport battle because he owns 15 per cent and IFM, GIP and QSuper want his support for the bid.

IFM has 25.2 per cent of Melbourne Airport and 20 per cent of Sydney, but these assets are held in its Australian fund and the bid is being made through its international fund which has different members. Airports regulation says you can’t own more than 15 per cent of Sydney, Melbourne, Brisbane or Perth airports but this is not an ACCC issue.

On competition grounds there is zero cause for action on the IFM bid.

Sims will use his August 27 talk to the annual Law Council meeting to unveil his planned merger reforms.

His proposals are not yet known, but may include more limited rights of review of ACCC mergers, more specific guidance under section 50 detailing what matters must be considered, a change to say a deal is blocked if it “may” have the effect of limiting competition, strict rules on whether a deal can proceed if the ACCC has blocked it or is still considering it, and pre-merger notification.

Sims’s call for tighter merger laws received significant external backing from President Joe Biden, who last week used stronger US action. Such high-profile concerns about concentrated industry would not go unnoticed in Canberra, where Sims is pressing for help.

Many of Biden’s words could have come from Sims’ own mouth.

“Capitalism without competition isn’t capitalism. It’s exploitation,” Biden said.

“Without healthy competition, big players can change and charge whatever they want, and treat you however they want. And for too many Americans that means accepting a bad deal for things that you can’t go without,” he added.

Among the White House’s targets are agriculture, healthcare, shipping, transportation and technology, as well as labour practices that the administration says limit wages and mobility. All of these are on the ACCC hit list.

Sims’s concerns about industry concentration are in part of his own doing because he has waved through mergers giving Transurban a stranglehold on toll roads and let Woolworths increase its control over food services.

At the risk of stretching the point, the acquisitive asset managers could increase their powers by bidding for control of Transurban.

The super funds point to international giants like BlackRock and Vanguard and note they also tend to be passive investors.

The federal government has ideological issues with the industry funds claiming, albeit falsely, trade union influence.

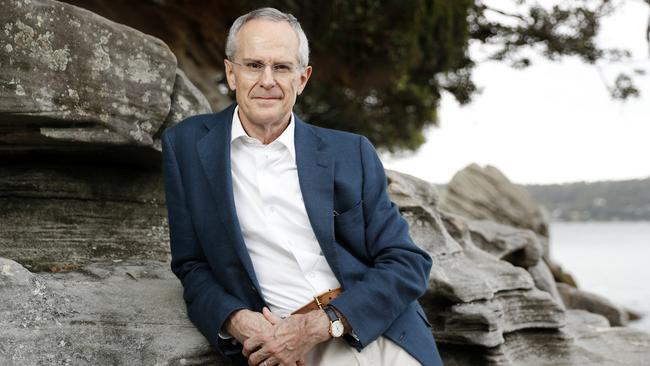

In his almost four years as Wesfarmers boss, Rob Scott has posted total shareholder returns of 147 per cent, outperforming the market by 100 per cent in part by undoing investments made by his predecessors.