APA Group takeover: Analysts split on CKI’s bid chances

The chances of HK predator CK Infrastructure’s $13bn bid for APA Group clearing regulatory hurdles has divided opinion.

The chances of Hong Kong predator CK Infrastructure’s $13 billion bid for pipelines company APA Group clearing regulatory hurdles has divided opinion, with three analysts that cover the stock boosting target prices to the offer price but others saying political risk should not be underestimated.

Analysts at Macquarie, whose investment banking arm is advising APA, have suggested the bid faces extended approval timelines because it will be the first major bid for infrastructure since the Critical Infrastructure Centre was established by the Turnbull government to consider foreign ownership issues and the Security of Critical Infrastructure Act was legislated.

CKI, controlled by the billionaire Li Ka-shing family, has been granted due diligence from the APA board on the back of a non-binding $11 per share approach.

The price is seen as strong, at a 33 per cent premium to where the stock previously traded. But approval from Scott Morrison and the Australian Competition & Consumer Commission are seen as major risks.

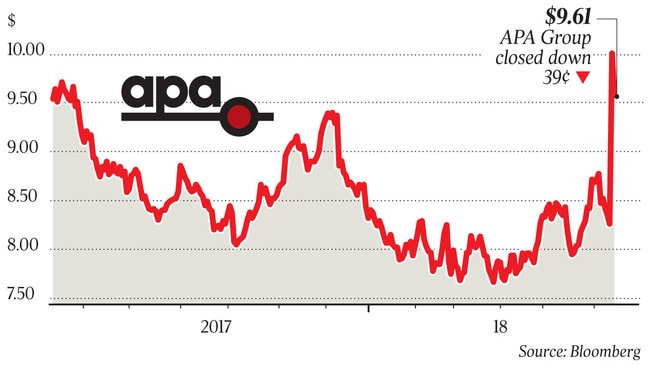

As a result, APA stock has remained well below the bid price, yesterday falling 3.9 per cent to $9.61.

But some analysts are more confident than the market. Credit Suisse, JPMorgan and Morgans have all boosted their APA target price to $11 on the assumption the bid is successful.

“We view the transaction as likely to complete,” Morgans analyst Nathan Lead said. “But we note the risk to our view is high, with regulatory approval replacing fundamental value as the key share price value.”

Credit Suisse analyst Peter Wilson said CKI’s early engagement with ACCC and FIRB and the bidder’s previous experience in buying assets here gave him confidence it would get approval.

But Citi analyst James Byrne said CKI faced more difficulty getting this approval than for its $7.4bn takeover of pipelines Duet Group in 2017.

“We consider the large grid-like assets of APA on the east coast to be significant infrastructure for domestic gas supply, which is a politically sensitive topic, and therefore consider the risks to the deal completion from regulators and politicians to be particularly acute,” Mr Byrne said.

“This time around could be more difficult for CKI, considering changes to the political landscape in the last 12 months.”

The Security of Critical Infrastructure Act covers assets that are, among other things, critical to the social or economic stability of Australia. APA’s east coast assets include the Moomba to Sydney and Southwest Queensland pipelines that can transfer gas between Queensland’s export plants and the domestic demand centres of NSW and Victoria.

They well and truly fit the Act’s definition of a critical gas transmission pipeline as one “critical to ensuring the security and reliability of a gas market”.

Macquarie analysts, who have withdrawn their recommendation because of the bank’s involvement in the bid, noted CKI was likely to be the first company to test the act. “This will create some uncertainty to the process and may even see timelines get extended,” it said.

“We see a low risk of rival bidders emerging, especially when competing against the size and funding clout of CKI,” Citi’s Mr Byrne said.

“We think that the larger pension fund players would be likely candidates.”