Ansell half-year profit surges 67pc as it looks to Russia

Ansell continues to spend on share buybacks, acquisitions and capital investment, as the coronavirus means good and bad news.

Protective gloves maker Ansell will open its first factory in Russia this year and is contemplating opening its first in the US amid urgings from Donald Trump and Vladimir Putin to buy locally first in their respective countries.

The comments from Ansell chief executive Magnus Nicolin come as the company increases production across its global factories to help combat the deadly coronavirus, which has killed more than 1700 people and infected tens of thousands more.

But while Mr Nicolin is seeing a trend of manufacturing returning to more mature markets, he has crossed out the possibility of Ansell returning to making gloves and other protective clothing in its original market — Australia — after more than 30 years.

Australia has experienced an exodus of manufacturers in the past decade, including carmakers Holden, Ford and Toyota that stopped making cars locally from 2016 and culminated with US auto giant General Motors axing the Holden brand on Monday.

“We are very proud of our Australian roots but we are fundamentally a super global company,” Mr Nicolin told The Australian.

“It’s probably not the most likely developed country that we would go to. It would be more logical to start in the US or in Germany or in big markets with big volumes before we would do something in Australia.

“It’s a relatively small market in the scheme of things — we only have about 5 per cent of our sales in Australia — and that’s what would hold us back. I don’t see it as a likely outcome in the coming three or four years.”

It is a different story in Russia. President Vladimir Putin is urging companies and consumers to buy Russian first. This compares with Australia in late 2013 when then treasurer Joe Hockey dared Holden to stop making cars locally in the wake of Holden’s then managing director Mike Devereux refusing to say before a Productivity Commission inquiry whether the company had planned to leave after receiving $1.8bn in taxpayer subsidies over a 10-year period.

While Australian politics has little influence on Ansell’s business decisions, given the global nature of the company, Mr Putin’s message has prompted Ansell to open its first factory in Russia to service Russian and eastern European markets.

“It’s not that Russia is an extremely high-cost location nor a very developed or mature market, but it’s also not a traditional low-cost manufacturing location,” Mr Nicolin said.

“The reason why we are doing it is we see the same developments in Russia as we do in the US. Donald Trump is advocating buy American first, and Putin is doing the same thing in Russia. So if we are going to be successful, we better be perceived as a local player and that’s what we are doing.”

Mr Nicolin was speaking as Ansell’s half-year net profit surged more than 66 per cent to $US65.8m ($97.98m) in the six months to December 31. This compares with consensus forecasts of $US71.95m. Revenue increased 3.9 per cent to $US753.3m versus consensus forecasts of $US759.25m.

Ansell’s shares fell 2.9 per cent to $31.42 on Tuesday.

Its industrial GBU division posted 1.3 per cent organic growth, which Mr Nicolin conceded was “a little short of our expectations”.

“We entered this fiscal period facing trade uncertainties, a weaker macroeconomic environment and challenges in some markets,” he said.

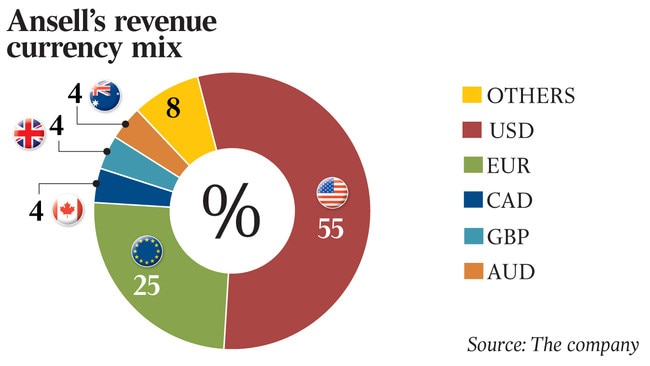

Ord Minnett analyst Athena Kospetas said a key driver of the soft operational result was larger-than-expected currency headwinds, which accounted for about $US9m. “A contraction in the industrial division earnings was attributed to weaker Americas demand, labour-related costs and one-off service disruptions,” Ms Kospetas said in a note.

“As expected, healthcare was stronger, increasing 14 per cent.”

Mr Nicolin said the company had experienced both positive and negative effects from the coronavirus outbreak, namely broader external plant shutdowns in the manufacturing sector, decreased manufacturing production, lower stock levels and potential supply chain disruption.

But he said a positive was that its operations in China were running at “full speed” as the company helps Beijing combat the virus through supplying gloves, masks and other protective clothing.

“All manufacturing facilities in China have struggled after the lunar new year to start up because people can’t move,” he said.

“But the good news is that the Chinese government has prioritised our facility because it’s very important to provide these protective suits. They have actually provided a lot of help to get our employees back, finding additional employees, and have even helped us ship in raw materials.

“It’s been going well and we’re running full speed at this point. There aren’t too many plants in China that are running full speed at this time.”

Mr Nicolin maintained Ansell’s full-year earnings guidance of US112c-US122c a share, compared with an EPS of US111.5c in the 2019 financial year.

Ansell chairman John Bevan said the company would continue its share buyback program in the second half of the year. Ansell bought back $US40m worth of shares in the six months to December 31.

Mr Bevan said since Ansell sold its condoms business, which it sold to Chinese interests for $800m in 2017, Ansell had spent $US312m buying 17.7 million shares to “further shareholder returns”.

Ansell will pay an interim dividend to investors of US21.75c a share on March 12.