Analysts scrutinise A2 Milk after CEO’s shock departure

Investment analysts have looked beyond the shock exit of A2 Milk CEO to look more closely at the dairy company itself.

Investment analysts have looked beyond the shock departure of high-profile A2 Milk chief executive Jayne Hrdlicka on Monday for a sudden “unforeseen” personal issue to look more closely at the dairy company itself and what it means for its crucial expansion in China and its profit margins.

The surprise resignation of the former Qantas executive after only 18 months in the role usually points to a major disagreement with the board or investors, or both, but as yet no chasm between Ms Hrdlicka and other directors has been highlighted.

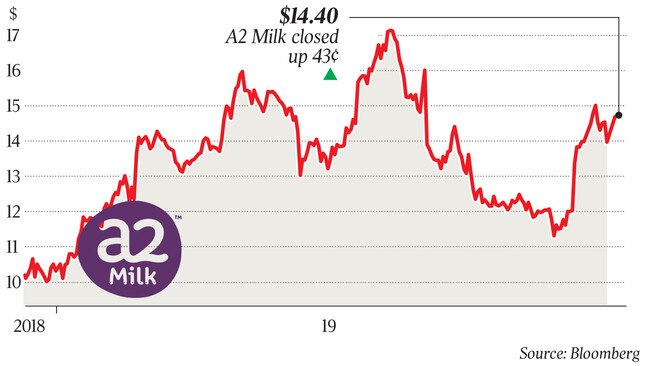

Shares in A2 Milk fell sharply on Monday, down almost 4 per cent, on news of her departure, although some investors found comfort in the return of former chief executive Geoff Babidge as interim CEO.

However, the stock clawed back most of its lost ground on Tuesday, ending up 43c, or 3.1 per cent, at $14.40 each.

UBS analyst Ben Gilbert said key takeaways from an investor call with A2 Milk in the wake of the CEO leaving included no change in strategy, with the new CEO to focus on operational execution rather than a new strategy, internal and external candidates to be considered and that A2 Milk will target ongoing EBITDA margins of at least 30 per cent in the medium term.

“Overall, while the departure was a surprise, a low risk of strategy change (hence re-base), higher EBITDA margin targets, and reputable interim CEO gives us comfort,’’ Mr Gilbert said in a report to clients.

He said that in his view there were three key questions facing A2 Milk: What is a realistic long-term share of the China infant milk formula market? What level of profitability can A2 Milk achieve? And does CEO turnover suggest risk to the strategy?

“While today’s update has increased uncertainty from a management stability perspective, further clarity around profitability targets and no change to the strategy is positive.

“The above is coupled with strong cash generation and a long growth runway.”

Ord Minnett said in a note to its clients guidance for first-half and fiscal 2020 revenue and operating earnings (EBITDA) margin was reiterated, while the A2 Milk board introduced a medium-term EBITDA margin target of at least 30 per cent.

It did, however, raise questions over the company’s excuse that the excessive travel burden was to blame for the chief executive’s surprise resignation.

“This news was surprising to us as, considering the international nature of A2 Milk, and the focus on two of the largest consumer markets globally (China and US), we expected Hrdlicka would have been well aware of the requirement for travel and it would have been reinforced during the detailed strategy development work,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout