Afterpay, Zip hammered as tech index falls 10pc

Shares in buy now, pay later provider Afterpay plunged by more than 30pc while rival Zip fell 17.8pc on Wednesday.

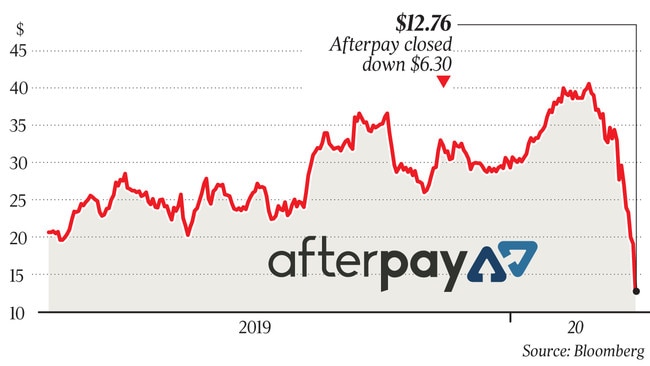

Shares in “buy now, pay later” provider Afterpay collapsed by more than 30 per cent on Wednesday — a mammoth drop for a stock once considered a market darling and the hottest tech stock on the bourse.

As the coronavirus epidemic continues to plague the retail sector buy now, pay later providers are some of the hardest hit, with Afterpay shares falling 33 per cent on Wednesday to $12.76. It weighed on the broader sector, with the ASX’s technology index closing down around 10 per cent.

The fall means Afterpay has plummeted 68 per cent in the last 30 days, with ASX-listed rival Zip down 66 per cent and Sezzle down 61 per cent.

Prior to the COVID-19 threat, Afterpay’s share price was as high as $41.14, which gave the company a valuation of more than $10bn.

At lunchtime on Wednesday, with the company valued around $4bn, Afterpay co-founders Nick Molnar and Anthony Eisen posted a message to social media acknowledging the dire conditions facing its retail partners.

“Now more than ever we stand together with the businesses that are essential to the fabric of our Afterpay community. That’s why it’s important that Afterpay Day, our biannual shopping event, still goes ahead later this week,” the pair said.

“The last few days have been crazy for us all and we know there is still uncertainty ahead. We’re continuing to keep a close eye on development and work through ways we can offer support.”

Shares in Afterpay rival Zip fell 17.8 per cent to $1.32 per share on Wednesday, while fellow listed buy now, pay later outfit Sezzle was down 1.4 per cent to 70c per share.

Afterpay said on Tuesday it would refund more than $1m in late fees paid by customers in California for loans that were deemed “illegal” by the US state’s financial regulator, as part of a settlement. The company will pay $US916,350 ($1.5m), of which $US905,000 will go to about 640,000 consumers in California who paid late fees with the rest on administrative fees.

The settlement is for loans issued without a California financing law licence. It was granted to Afterpay in November last year.

The increasingly popular buy-now pay-later space has been facing growing regulatory scrutiny and Afterpay, considered by many as the sector’s bellwether, has been in the regulatory spotlight in Australia too.

Additional reporting: AAP