AdBri hit by Alcoa lime deal decision

AdBri has been savaged by investors, shedding a quarter of its value after Alcoa cancelled a 50-year-old contract.

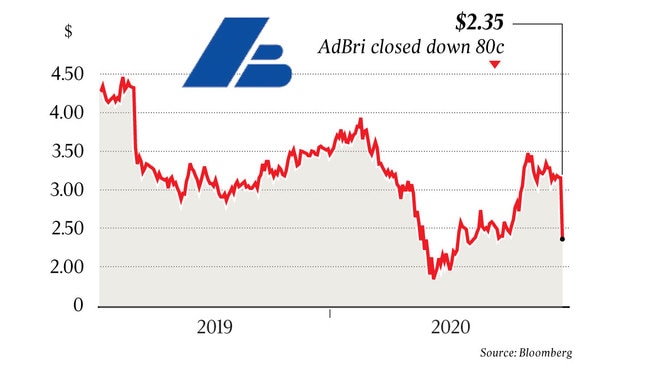

Construction materials supplier AdBri has been savaged by investors, shedding a quarter of its value in a single session, after Alcoa cancelled a 50-year-old lime contract following a decision to import supplies from overseas.

Alcoa told AdBri subsidiary Cockburn Cement it would not renew the supply deal for its three Western Australian alumina refineries when it expires on June 30, 2021 after a two-year review of suppliers in the market.

“In order to efficiently supply our three Western Australia refineries, Alcoa of Australia conducted a comprehensive process to evaluate potential suppliers for lime, a strategic material needed for alumina refining,” Alcoa said in a statement on Friday.

“This process lasted for around two years and considered numerous factors including product cost and quality.”

AdBri, formerly known as Adelaide Brighton, said the non-renewal would have a material hit on revenue after June 2021 but said it was too early to quantify the impact. Its shares tumbled 25.4 per cent to $2.35, leaving it with a market capitalisation of $1.5bn.

“The company will promptly evaluate and take necessary mitigating actions. Consequently, it is not possible to quantify the full financial impact of the non-renewal at this stage,” AdBri said.

While the $70m yearly income from the contract represents about 5 per cent of AdBri’s group revenue, the loss of a deal tied to WA’s booming industrial and resources sector comes at a delicate time, given pressures on housing and infrastructure earnings in its east coast markets from COVID-19 and the declining economy.

AdBri still holds lime supply deals with other resources players, but acknowledged losing the contract was a blow to its WA business.

“We are disappointed with Alcoa’s decision to displace locally manufactured product with imports from multiple sources, particularly considering our almost 50-year uninterrupted supply relationship,” AdBri chief executive Nick Miller said.

“We will work quickly to mitigate the impact on local jobs supporting our lime business and we remain committed to supplying our WA resources sector customers.”

The AWU criticised Alcoa’s decision given the emphasis on rebooting manufacturing amid a COVID-sparked economic slump.

“The Morrison government should be demanding an explanation from Alcoa as well. Neither the state or federal government should allow Alcoa to get away with such a destructive move without a very clear and detailed explanation. It’s too destructive to simply wave through,” AWU WA branch secretary Brad Gandy said.

AdBri said in May the immediate focus was to get through an uncertain time for the Australian economy.

Trading in March and April was in line with expectations, but it conceded there was little visibility on the size of housing approval declines.

It dumped its annual earnings guidance in April due to uncertainty from the pandemic, in line with a host of major Australian corporates, withdrawing its February expectation of a 10 per cent fall in 2020 profit.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout