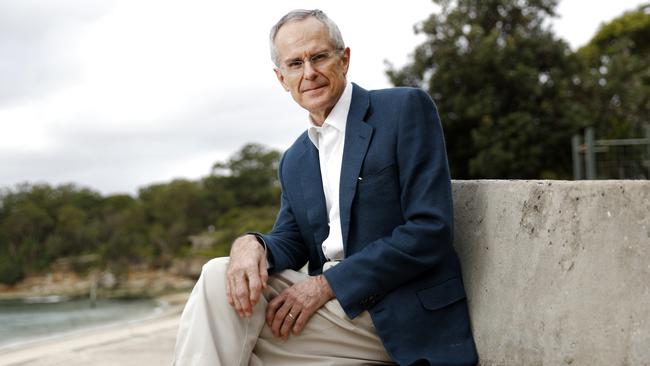

ACCC chief Rod Sims has gone from battling the $US600bn behemoths in Facebook and Google to Zimmer frame supplier Country Care in a case which starts in court next week.

The latter has annual turnover in the tens of millions rather than billions but the issues are no less important, as will be unveiled in the Federal Court next week before Justice Robert Bronwich.

The central character, Robert Hogan, is a Mildura-based small business person who had a good idea to adapt to Department of Veterans Affairs administrative changes which effectively locked small business out of bidding for its hospital equipment contracts.

The case, first lodged in 2018, is the first criminal case launched by the ACCC against an Australian company and individual.

Previously the department had dealt with local suppliers of the equipment, but it changed and sought out statewide or national suppliers like Allianz or Aidacare.

Hogan’s idea was to group small players together and bid jointly so the consortium could take on the big guys.

He used to hold national conferences so everyone knew what was coming up, showcase new products, and provide advice about aspects of their business.

At one of the conferences it was alleged that Hogan sought to persuade members of the group not to advertise products to the public below the price that his company had negotiated to supply these items.

In a proposed member agreement it was suggested that “The member must ensure that efforts to promote the products under the contract do not lessen the market value of those items by advertising the products at a price less than the price agreed to by the department.

“This includes all online marketing.”

Hogan and Country Care reject the allegations outright, and say there was no attempt to fix prices or manipulate bids.

The small companies involved had not sought authorisation from the ACCC.

The issues are not quite as clear cut as two big business bosses meeting in a pub to agree to fix prices, as in the Amcor and Visy matter 13 years ago, and the small businesses involved had no idea or concept that attending the meetings was seen as a breach of the law.

In a note, lawyers Ashurst said that after the full Federal Court rejected the ACCC’s appeal in the 2017 egg industry case, “industry bodies may provide information to members, and suggest that members independently examine and consider changing their business practices without this conduct contravening CCA cartel provisions, but need to tread carefully to ensure there is no suggestion that those changes should be through collective action or pursuant to an arrangement or understanding between members”.

The ACCC had argued the body tried to get producers to limit supply of eggs to offset a perceived oversupply.

Sims’ schedule

As the Zimmer frame case winds its way through the court ACCC boss Rod Sims has his foot on the reform pedal as more market studies are due.

The NSW Minerals Council is considering an appeal to Treasurer Josh Frydenberg’s decision last month not to declare the Port of Newcastle’s charges.

The case has been to the High Court and back and different levels of the Federal Court, but Frydenberg is unwilling to take on the states on port regulation, so he is refusing to declare the port as urged by the ACCC.

The coal producers are protesting the level of port charges from the monopoly asset.

Frydenberg has announced yet another review of the port access regime in the wake of the long-running Newcastle port saga.

The original law was designed to deal with Telstra, which owned monopoly infrastructure used by its retail competitors. The infrastructure is now run by the government through the NBN.

The port doesn’t compete with the coal companies but arguably abuses its market power by charging too much, which is what the law was meant to control through an arbitration process.

Highly regarded Treasury deputy secretary Jenny Wilkinson is tasked with coming up with a workable amendment to the law.

The experiences of Australian consumers, developers and suppliers in using mobile apps is next on the horizon, with an interim report due by month’s end.

Issues to be examined include the use and sharing of data by apps, the extent of competition between app providers on Google and Apple’s app marketplaces, and the app marketplaces’ relationships with consumers.

This will focus on Apple’s charges for app suppliers, which run up to 30 per cent, among other issues.

The problem for Sims’ reform push is lack of focus, with some issues like unfair trading already under the eyes of the federal and state consumer council.

The courts are upholding a strict interpretation of “unconscionable conduct” and there is a clear case for unfair trading to be included in the Act.

His merger push is a different issue, with the prevailing wisdom being the problem is not the law but the cases the ACCC pursues, and/or the way it proceeds in the cases.

Sims has been careful to not be too prescriptive in exactly what changes he wants and is likely to link it with the global push against the digital platforms.

He has suggested things like reversal of the onus of proof so merger parties must show the deal isn’t anti-competitive, to adding provisions to section 50 (3), which details matters the court must consider when considering a merger.

Sims knows the moment he is prescriptive the trade practices mafia will jump on the terms because practitioners oppose a change to the section.

Tense times

Lex Greensill’s financial woes have obvious financial implications for a major creditor in Sanjeev Gupta, who owes a reported $US2bn ($2.6bn).

Greensill is reportedly talking with private equity concern Apollo Capital, which no doubt would be keen to minimise the Gupta exposure.

The Infrabuild float value is mooted at $1.6bn which would offset the $US600m in debt attached to the Whyalla steelworks, which is not part of the float.

There is industrial logic in favour of an independent steel operator to supply infrastructure and provide some competition in the distribution market to BlueScope.

Cleanaway boss Vik Bansal is pencilled in to take over the reins at Infrabuild from Dak Patel, who is keen to minimise his involvement in the business.

Local investment banks are not rushing to the barricades to write a blank cheque for Gupta right at the moment.

Suffice to say the situation is fluid.