AACo H1 profit grows on premium beef sales away from Asia into North America

The nation’s largest pastoral company continued to shift premium beef away from Asia and into North America in the wake of China import bans.

The nation’s largest pastoral company continued to shift premium beef away from Asia in the wake of China import bans and into North America to take advantage of better prices, improving first-half operating profit to $30m.

Australian Agricultural Company (AACo) said the result was driven by stronger operating margins compared to the prior period and was particularly positive in context of the reduced meat volumes sold due to the historical impacts of drought and the Gulf flood event.

Net statutory profit after tax rose to $83.2m versus a $1.7m loss in the prior corresponding period.

Statutory earnings before interest taxes deductions and amortisation was a profit of $137m, compared to $15m previously, driven by changes in market pricing.

US meat sales for the half year ended September 30 nearly doubled to $22.1m while South Korea fell 17 per cent to $29.8m. China sales fell 44 per cent to $4.4m.

Shares in ASX-listed AACo, valued at $950m, fell by more than 7.1 per cent to $1.58 as the market digested the numbers.

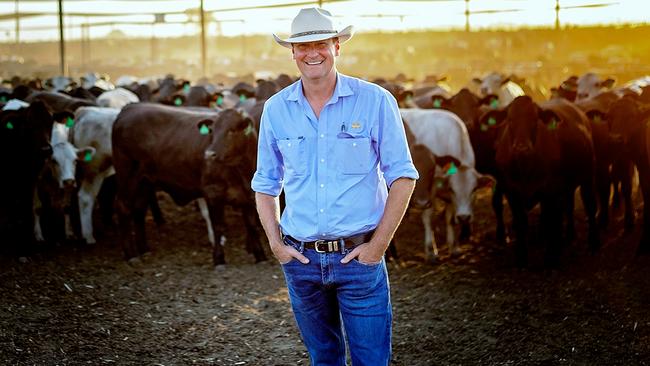

Managing director and CEO Hugh Killen said the results demonstrated the strength of AACo’s business in what is still an uncertain operating environment.

“What’s especially pleasing is how we achieved the result, with higher margins in-market and growing brand awareness,” he said.

Strategic market allocation was a key factor in the result, underpinned by its strong brand portfolio and distribution partnerships.

“AACo has continued to adapt to fluctuating market dynamics. Those adjustments have helped drive 55 per cent branded sales growth in North America vs pcp.

“There is strong demand for high value loin and rump cuts in North America, supporting an average branded meat sales price per kilo increase in the region of 33 per cent vs pcp.

“We’ve reallocated some product away from Asia to realise these premiums, though the region still represents more than 50 per cent of total meat sales.”

Mr Killen has previously said a “healthy” trade relationship with China is good for Australian agriculture but diversity is also important.

Its Westholme and Darling Downs branded products now represent 83 per cent of total branded meat sales.

Overall, the business delivered a 9 per cent increase in average Wagyu meat sales price per kilogram compared to the previous period.

The result was also supported by higher cattle sales margins on the back of record high market prices.

But lower calving rates from prolonged drought and Gulf flood continue, with meat sales volume down 8 per cent consistent with broader industry decreases in slaughter rates.

AACo is 48 per cent owned by billionaire Joe Lewis’ Tavistock with the Holmes à Court family-controlled WA cattle business Heytesbury emerging as a 6.04 per cent shareholder earlier this month.

Its Livingstone Beef facility in the Northern Territory continues to be mothballed following suspension of operations in July 2018 and the “board and management continue to monitor various strategic options” for its future.

On the outlook, cattle prices are expected to remain strong driven by global demand for beef supported by continued shortages of protein supply in Asia and resurgent demand seen in developed markets.

China pork production is estimated to contract further in 2022 and beef imports to grow for the eighth consecutive year in a row, but export supply has been restricted from key players including Australia, Argentina and Brazil.

Australian exporters were also likely to benefit from the peaking of the US herd rebuild.

The US drought was fuelling a current liquidation of the cow herd, mitigating some of the shortfall of imported lean beef supplies from Australia and New Zealand.

In Australia, positive conditions are encouraging producers to retain stock for breeding purposes, supporting the start of a national herd rebuild from the 25-year lows experienced in 2020.

The group will release its sustainability framework on Friday, which it says will “underpin the company’s future as a food producer and landowner”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout