Coles boss vows to revive glory days of growth

Coles boss Steven Cain has set himself a target to return the supermarket group to the market-beating growth of a decade ago.

Coles boss Steven Cain has set himself a target to return the supermarket group to its glory days of market-beating growth of a decade ago.

In the face of rapidly changing consumer tastes, Mr Cain has pledged to investors a crackdown on bloated costs, a tightening of the supply chain, and a ramping-up of its digital credentials.

Mr Cain, reflecting on the Australian economy, called it a tale of at least two cities: there are pockets of wealth where some Coles stores deliver boxes of four-pack Magnum ice creams, and other stores where shoppers reject milk selling for an extra 30c to support dairy farmers.

Mr Cain told The Australian: “That shows you some people are doing it really tough because of things like utility prices perhaps, concerns about mortgages and everything else, and equally there are a lot of people who are spending more money on food, particularly convenience food.

“We have to cater for a broad church.’’

Unveiling yesterday its earnings as an independent company following last year’s $20 billion demerger from Wesfarmers, Mr Cain delivered a December-half result that was weaker than expected and included headwinds lashing the business as well as its liquor stores and convenience shops.

Coles’ reported profit for the half dipped 29.4 per cent to $381 million as $146m in restructuring charges linked to new investments in its supply chain punctured its bottom line.

Flat earnings at its flagship supermarkets and a near 40 per cent slump in retail convenience pre-tax earnings kept overall profits in check.

Strong same-store sales leading into Christmas also showed signs of slowing and limped into the new year. Sales are expected to remain flat heading into the third quarter.

Mr Cain yesterday paraded these challenges, inherited from Perth-based conglomerate Wesfarmers, before analysts and investors. Staff wages, energy and supply bills outpaced sales.

Mr Cain, however, remained upbeat on Coles’ ability to overcome these challenges and declared he would reset the company’s strategy to deliver to shareholders the type of growth previously experienced under Wesfarmers’ ownership.

“What we have is a fast-changing consumer and competitor set,” Mr Cain said yesterday.

“Obviously we want to go from being a cash-generative business into one that delivers shareholders with long-term growth.

“And to get there we are going to have to address our cost base because we need additional funds to invest in technology, digital and all the opportunities that are out there.

“So really, what we are saying today is that it is going to take some time to get Coles back on a growth trajectory more like the one we saw from 2009 onwards.

“It is time to reset the Coles business to achieve sustainable long-term growth for our shareholders, a strategic refresh to ensure we appropriately address the headwinds facing the company.’’

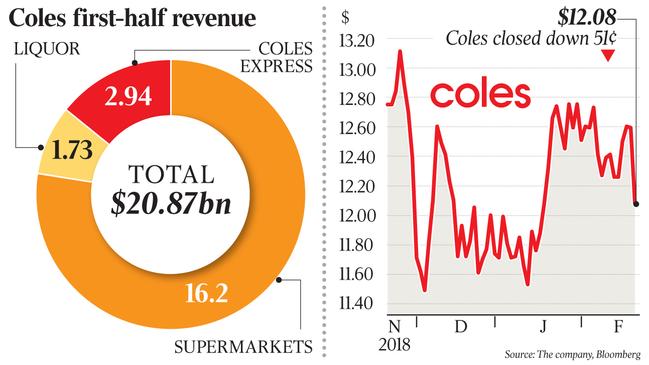

Sales for the half rose 2.6 per cent to $20.867bn.

Sales from supermarkets were up by 3.6 per cent to $16.195bn.

Liquor sales were up 0.6 per cent and convenience sales were down 1.8 per cent. The supermarkets arm continued its run of consecutive-quarter same-store sales growth.

Earnings before significant items, relating to the Wesfarmers demerger and supply chain restructure, fell 5.8 per cent to $733m, slightly undershooting analyst forecasts.

No interim dividend was declared. Shares in Coles fell 4 per cent to $12.08.

Alphinity Investment Management portfolio manager Bruce Smith said it was still early days in the evolution of Coles as an independently listed company and its demerger from Wesfarmers last year was still flowing through the accounts, making it difficult for investors to get a lock on the company’s performance.

“It is a very messy result reflecting the demerger from Wesfarmers, and Coles’ effective disposal of Officeworks and the discount department stores, which stayed with Wesfarmers,’’ Mr Smith said.

“It is difficult to take the numbers too seriously other than the sales line, which looked OK rather than stellar.

“The third quarter so far is fairly tepid.

“We really need to see a couple more results in order to get a clean read on whether it is a great investment opportunity or a hospital pass from Wesfarmers.’’

CLSA analyst Richard Barwick said the December-half result for Coles was “broadly in-line” but that sales momentum looked soft.