Cocoa, sugar prices hit Nestle Australia profits, but demand rises

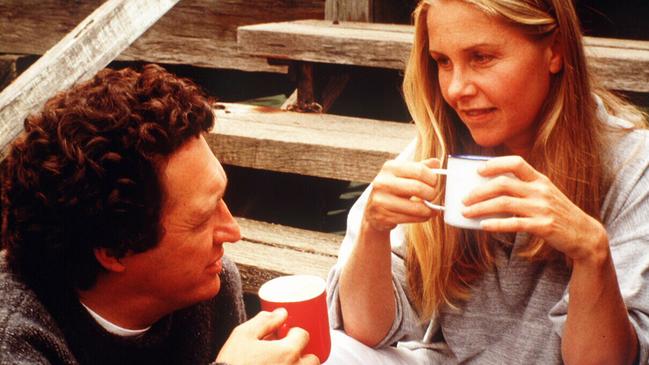

Sales of instant cappuccino sachets and the classic Nescafe range are up as offices and homes facing cost of living pressures ditch barista brews.

Instant coffee is making a comeback as consumers struggling under the weight of rising bills, steeper rent and higher mortgage repayments avoid their local barista and instead turn to brewing their own cuppa at home.

This has delivered a local kick in demand for the world’s leading instant coffee company, Swiss giant Nestle, which has seen its range of pre-mixed cappuccino sachets record an almost 9 per cent spike in sales in Australia through 2023.

Its classic Nescafe range is also trading strongly.

The world’s largest packaged food company, which also owns the Nespresso, KitKat, Allen’s lollies, Smarties, Milo and Uncle Tobys brands, still suffered a one-third slide in its profitability last year.

This was due to inflationary pressures as well as higher prices for its key ingredients cocoa and sugar, which took a bite out of earnings from its stable of chocolates, sweets, coffee and snacks brands.

Nestle Australia did hike up its prices over 2023 to counter inflationary pressures within its business, as well as push through a number of efficiency initiatives.

Nestle chief executive Mark Schneider in February highlighted the dilemma, labelling the spike in food inflation over 2023 as a “50- year event” given the sheer size, steepness and unexpectedness of skyrocketing food prices.

“Unprecedented inflation over the last two years has increased pressure on many consumers and impacted demand for food and beverage products,” Mr Schneider said in the global giant’s full-year results presentation.

This pricing pressure has come from a near tripling of the cocoa price, and international sugar prices trading at 13-year highs.

When combined with softer demand from cash-strapped consumers, it doesn’t leave a lot of room to substantially lift shelf prices to claw back margins.

On the flip side, however, squeezed household budgets are pushing many consumers to forgo their favourite freshly brewed coffee sold by their local barista or cafe to instead reach for an instant coffee at home to also help bolster Nestle’s coffee business.

In 2023, the number of Nescafe Cappuccino sachets grew by 8.9 per cent, making it the group’s fastest growing coffee format in Australia in the last three years.

The slow but sustained retreat of the ‘work from home’ trend is also seeing office towers and other corporate buildings restocking instant coffee options in communal kitchenettes.

Globally Nestle is believed to have hiked prices by around 10 per cent last year and that in Australia, average prices rose by as much as 8 per cent, although this was at different levels across its key categories.

Nestle Australia’s 2023 earnings show profitability slumped 30 per cent to $88.9m as sales – boosted partly by price hikes – rose to $2.7bn from $2.5bn in 2022.

Inflation and higher commodity prices were blamed for the earnings retreat.

Cost of sales in 2023 rose almost 10 per cent to $1.6bn, while marketing and selling costs were up 4.4 per cent.

“Profitability declined … impacted by significant cost inflation (increased commodity prices and supply chain costs), increased financing costs and higher transfer prices,” Nestle Australia’s financial report states.

“Results were in line to management’s expectations on growth and profitability. However, cost optimisation continues to be a focus for the company and its consolidated entities including leveraging operational efficiencies, structural cost reductions and delivering sustained growth.”

Martin Brown, general manager of coffee and dairy for Nestle Australia, told The Australian that rising prices for key food ingredients have been problematic for the food company and shaved profit margins.

“We have worked really hard to reduce the impact of commodity costs and we haven’t been able to fully recover the impact of these important commodities and that’s why you’ve seen our reported profitability after tax drop by 30 per cent.

“And so the ingredients most essential in our coffee and confectionery businesses have climbed sharply. So to give some perspective, London cocoa futures are up 297 per cent year on year. Sugar is slightly down year on year, but it is at historically high levels … over a five-year time frame, it is still at very high levels.”

Mr Brown said the price of robusta coffee beans were up 85 per cent year on year.

But there is greater demand for Nestle’s brands.

“If you look at the difference between a $5 barista-made cappuccino versus being able to make something for on average 50c at home, then that’s a pretty smart choice and we’re definitely seeing a lot of people make that move.”

For many shoppers, its range of snacks, chocolates and confectionary remained an “affordable treat”.

Australia had proved a difficult trading environment for Nestle of late.

In 2021 and through the Covid-19 pandemic, it recorded flat sales and profits as disruptions to key supermarket, convenience store and shopping centre channels affected performance.

Empty office towers watered down demand for its instant coffees, Nespresso coffee pods and large tins of Milo that are typically stocked in office kitchenettes.

Mr Brown said that business-to-business coffee demand had started to return as people left their home offices and returned to work from offices.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout