Coalition reprieve on SMSF property

The Morrison government has snubbed regulators by not banning property investment through SMSFs.

The Morrison government has snubbed the nation’s powerful financial regulators by opting against their “preferred option” of banning property investment through self-managed superannuation funds, amid concerns about the threat it presents to the savings of retirees and the financial system.

Josh Frydenberg yesterday said he would not be making any changes to so-called limited recourse borrowing arrangements (LRBAs) enjoyed by a rising share of self-managed super funds to buy investment property following a three-year review of the practice by the Council of Financial Regulators and the ATO, which was released late yesterday.

Instead, the Treasurer will task the Council of Financial Regulators, whose membership includes the Reserve Bank, Treasury and the prudential and corporate regulators, to monitor the LRBAs in the super system with the Australian Taxation Office and report back in three years.

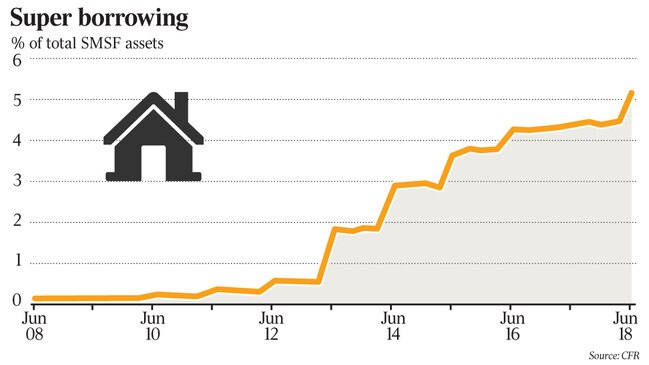

The Treasurer said the borrowing arrangements were “unlikely to pose systemic risk to the financial system at this time” as they made up just 5 per cent of self-managed super fund assets, or a little over $40 billion.

The move came despite the Council of Financial Regulators raising concerns that many low-balance SMSF owners had the majority of their savings tied up in a single property and that its “preferred option” was to ban the borrowing arrangements. This follows the government’s own Financial System Inquiry recommending a ban in 2014.

The decision comes just days after Macquarie Bank became the last mainstream lender in Australia to offer the LRBAs, after the major banks ended the sale of the products that were found to have been sold alongside questionable financial advice, and as property prices in the nation’s capital cities suffer double-digit percentage falls.

The Australian Securities & Investments Commission has found financial advice recommending LRBAs was unlawful 91 per cent of the time. The banking royal commission exposed a number of one-stop-shop advisories hawking SMSFs and the borrowing arrangements for high fees even when it would not be in the best interests of members to enter the schemes.

David Murray’s Financial System Inquiry recommended banning limited recourse borrowing arrangements to “prevent the unnecessary build-up of risk” and ensure super remained a vehicle for retirement income “rather than a broader wealth management vehicle”.

It was the only recommendation the government did not adopt. Labor has proposed banning the products if it wins government.

Mr Frydenberg said the government had tightened regulation of LRBAs, lending standards, financial adviser accreditation and the powers of regulators to intervene in the market.

“These reforms, together with our response to the royal commission, will ensure consumers are better protected without limiting the investment choices available to SMSFs,” he said.

Opposition treasury spokesman Chris Bowen hit out at the release of the Council of Financial Regulators report late yesterday

He said the Treasurer “significantly plays down financial regulator concerns” and that his response was “extremely misleading and plays down the level of concern evident in” the report.

Mr Frydenberg’s decision follows a backflip on implementing Kenneth Hayne’s royal commission recommendation on banning mortgage broker commissions following a sustained campaign by the sector against ending the kickbacks, which it argued would damage competition in the financial sector.

Loans for property investment through SMSFs are considered “limited recourse” because if the loan defaults, the bank can claw back only the specific asset bought with the loan, not the rest of the assets in a fund.

The total value of property investment loans held by SMSFs has raced to $40 billion, a 10-fold increase from the $400m figure a decade ago.

As loans can account for a large share of a particular SMSF’s assets, this can leave the borrower vulnerable to changes in property prices, risking pushing a retiree on to the age pension, which would increase the burden on the taxpayer.

In its report to government, the Council of Financial Regulators and the Australian Taxation Office said banning the products would “address a number of significant risks which could be detrimental to individuals’ retirement incomes, in the event of adverse movements in the property market or a severe economic decline, particularly for those with high levels of leverage and low diversification of assets”.

The Council of Financial Regulators noted real estate made up a significant proportion of the assets held by SMSFs with limited recourse borrowing arrangements. Of concern was that SMSFs with small balances of up to $500,000 were most likely to have LRBAs, and in 2017 the average loan was $380,000.

“If you are essentially encouraging people to put all of their super into a single asset, which is then highly leveraged, it is very hard to believe that is good financial advice,” Grattan Institute CEO John Daley said.

Sydney home values have fallen more than 11 per cent from their July 2017 peak.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout