Coalition can afford only snack-sized tax cuts

Weak wage growth means ‘half a sandwich and a milkshake’ tax cuts are all the government can afford, say economists.

The strongest tax revenue growth in almost 20 years has underpinned a $14 billion boost to the budget bottom line, but weak wage growth means “half a sandwich and a milkshake” tax cuts are all the government can afford if it wants a budget surplus on time, say leading economists.

Amid speculation Scott Morrison will announce income-tax cuts over 10 years in next week’s budget, after last week dumping a plan to increase the Medicare levy, Deloitte Access Economics has forecast an even smaller budget surplus in 2021 of $3.8bn, equivalent to 0.2 per cent of gross domestic product, down from the Coalition’s expectation of $11bn.

“The rivers of gold are running again, with the global and Australian economies doing the budget plenty of favours,” said Deloitte in its latest budget preview. Deloitte forecasts tax revenues will rise 10 per cent this financial year, the strongest annual growth since 2001, and a further 6 per cent next year.

“But they may turn back to a trickle by 2019,” it added, cautioning against further cuts in tax until surpluses were achieved.

“It makes sense to see the whites of the eyes of a surplus or two before rewarding ourselves with a pack of Tim Tams,” the report said.

“The budget is determined more by China than it is by Canberra, so if China turns out weaker than we forecast, a return to surplus would drop off the radar pretty fast”.

The Treasurer again flagged tax cuts yesterday but gave no details. “This will be another responsible Coalition budget that sticks to our plan of keeping within our means, keeping expenditure under control, and staying steadfastly on track,” he said, adding “lower taxes will further strengthen our economy to create more jobs and guarantee essential services.”

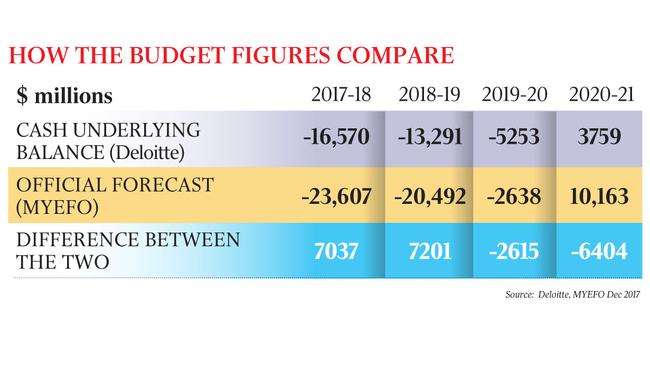

Higher than expected commodity prices and strong global growth have boosted company tax collections that, even before next week’s update, were budgeted to rise from $81bn this financial year to $96bn by 2021. Deloitte expects this and next year’s bottom line to improve by about $7bn each, but subsequent years to fall short by $3bn and $6bn.

The opposition, which has proposed tax increases worth about $200bn over 10 years, has fuelled expectation it will propose tax cuts in its response to the budget.

“The looming election is a threat to prudent policymaking … the cost of any promises shouldn’t hurt budget repair by more than some $4bn a year — if solely spent on a personal tax cut, that’d buy a half a sandwich and a half a milkshake a week,” the report said.

“We see wage gains continuing to fall short of the Treasury view,” it added, estimating growth in average earnings would rise from 1.3 per cent this year to 2 per cent next.

Deloitte said ditching the Medicare levy had dashed any chance of reaching a surplus a year earlier than 2021.

Deloitte said tax increases, mostly through bracket creep, were doing most of the work of returning the budget to surplus.

“Remarkably, the marginal tax rate for the nation as a whole this year will be a truly boggling 56c in the dollar,” the analysis said. “Not only are there more dollars in the economy than Treasury forecast, but companies and super funds have also increasingly run out of the losses they racked up during the GFC, meaning that good news on the economy is being turbocharged in its effects on tax take.”