CKI’s bid for APA abandoned after Treasurer blocks takeover on national interest grounds

APA has confirmed CKI’s $13bn bid has been abandoned after the deal was blocked on national interest grounds.

Gas operator APA Group has confirmed a $13 billion takeover by Hong Kong’s CK Infrastructure has been abandoned after Treasurer Josh Frydenberg blocked the bid on national interest grounds.

In a move likely to inflame tensions with Beijing, Treasurer Josh Frydenberg last night confirmed a preliminary view taken two weeks ago that CKI’s proposal would not be in the national interest because it would establish a dominant foreign player in the gas and electricity

sectors.

APA and CKI “agreed to terminate the implementation agreement and the bidder’s proposal will not proceed further”, the company said in a statement today.

The pipeline giant has reconfirmed its 2019 earnings guidance of $1.55bn to $1.575bn and said it remains a resilient business despite the distraction of a six-month bid process.

“We believe that APA’s business is robust and resilient and despite being subject to a takeover offer for almost six months, APA has been able to continue to run the business smoothly and today reconfirms the FY2019 guidance metrics as announced in August 2018,” APA chairman

Michael Fraser said.

The APA chair thanked CKI “for their compelling offer and valuation of the business” and pointed to $4bn of growth opportunities for APA as outlined in August with capital spending of $425 million this year.

It expects total distributions for 2019 of 46.5c per security plus a franking credits allocation if available.

Hong Kong billionaire Li Ka-Shing’s CKI has previously rejected claims from security experts that the company would be answerable to Beijing given China’s more frequent interventions in Hong Kong’s affairs and attempts to suppress political freedom.

The APA decision closely follows Canberra’s move to block Chinese companies Huawei and ZTE from participating in the rollout of the 5G telecommunications network.

The Treasurer said Australia remains open to foreign investment. “My decision is not an adverse reflection on CK Group or the individual companies,” Mr Frydenberg said in a statement on Tuesday night. “We continue to welcome any foreign investment that is not considered contrary to our national interest. As Treasurer I consider each foreign investment proposal on its merits.”

Rare Infrastructure said the initial knock-back to the deal showed a hardened line on foreign ownership of infrastructure assets. Rare had previously tipped CKI to win regulatory approval for the deal when deposed leader Malcolm Turnbull was still in power.

“The political environment has taken a more hawkish turn and I think that was a factor in the final decision,” Rare’s co-chief executive Nick Langley said. “Our sense is there was a change in tone of politics. You’ve had a change in seats and different personnel within government.”

The government signalled on November 7 it would block CK’s bid for pipeline operator APA but left the door ajar for the Hong Kong company to alter its bid or walk away ahead of the final decision.

Sources close to the process said CKI held further talks with the government over its initial adverse view as it sought to understand whether a revised offer could appease the national interest concerns.

CKI had been set to become Australia’s largest gas pipeline operator if the deal proceeded, swallowing APA’s 15,000km of gas pipelines marking 74 per cent of the nation’s gas infrastructure.

While APA is clearly in play as a takeover target for the broader market, CKI faced a stiff challenge to rebadge a bid according to the Sydney-based fund manager, which holds more than $6bn of assets under management and is a top ten shareholder in APA.

“I think clearly the announcements that were made we read as a signal to CKI that there were some major revisions required to the structure of the bid which may or may not be possible,” Mr Langley said.

A rival bid from an investor giant like Canada’s Brookfield Asset Management could not be ruled out, Mr Langley reiterated, along with potential interest from Australian investors.

CKI’s bid for APA was pitched at a sensitive time for the nation’s energy industry with Australian Competition & Consumer Commission chairman Rod Sims voicing his concerns over gas supply shortfalls and spiralling prices threatening the viability of heavy industry and large manufacturers.

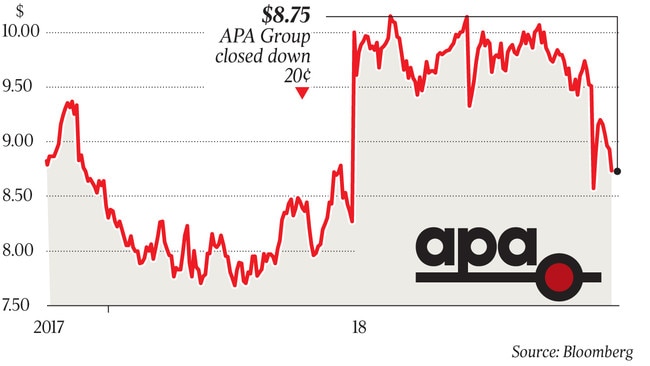

At 10.18am (AEDT), shares in APA were 2 cents, or 0.23 per cent, higher at $8.75.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout