China and Russia are they keys to our future

Now of course, I don’t really mean and you couldn’t anyway - ‘forget’ about those things. It’s just that these ‘two others’ are more fundamental, more ultimately determinative, while also being uncertain and unpredictable, and also completely beyond our control or even marginal influence.

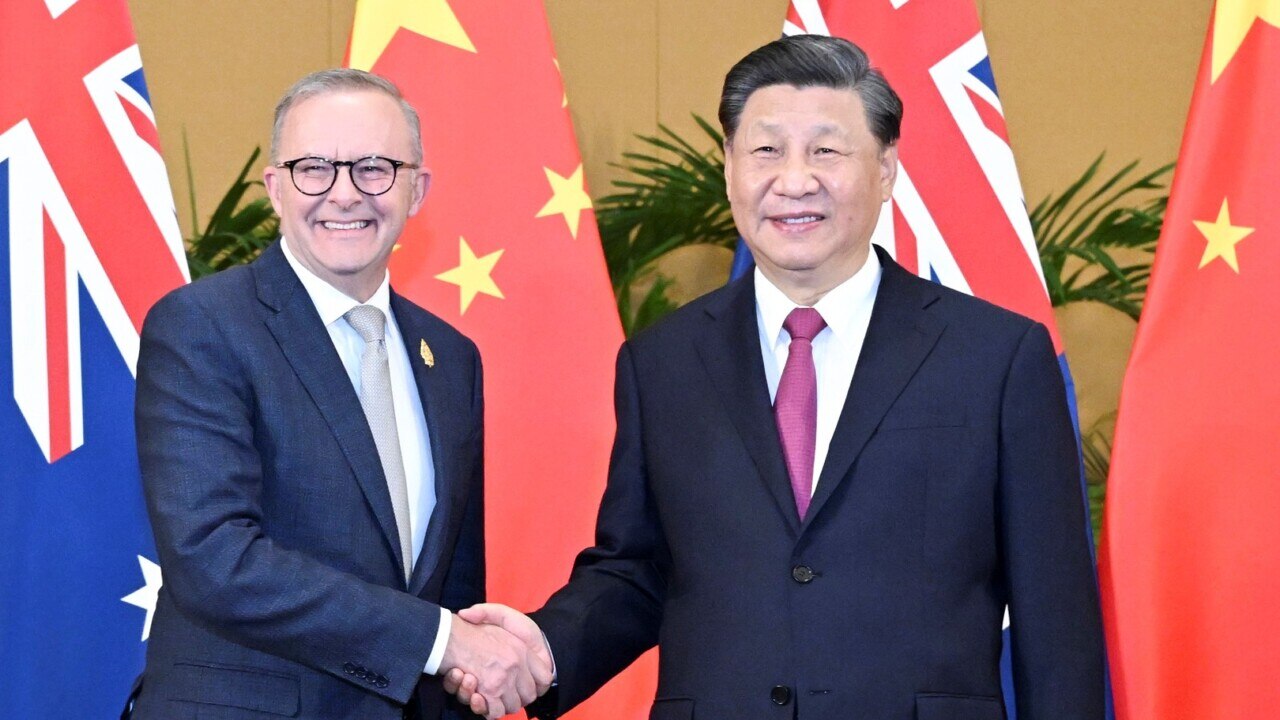

They are what’s happening in and around Russia and its war on Ukraine, and all the things that flow from that with most particularly global oil and gas, but also food; and what’s happening in China.

In China, the big question starts with its zero-Covid policy – which might be starting to fracture, but just as equally might be about to be ramped up and sharply tightened again.

But it goes way beyond zero-Covid. Are we seeing the end of the ‘Great China economic growth story’; a story built on massive and unrelenting export growth and equally massive and unrelenting infrastructure spending at home?

It’s been a combination almost made for ‘our’ – as in 26m Australians – benefit.

China’s voracious demand for our minerals, and especially iron ore, has poured hundreds of billions of dollars into Australia, and been a huge component of federal tax revenues – apart from keeping WA’s budget in the black.

The mind shudders at what our debt and deficits would really be but for China. This music has kept playing all through both Covid and the geo-political and geo-trade chilling of our relations – and despite the overall China economy moving from annual growth rates in the 7-10 per cent range to maybe 1-2 per cent, if you can believe it.

Yes, China put some of our exports into deep freeze – wine, barley, other foodstuffs and most interestingly coal, first energy coal and then coal for steel-making.

The coal bans were mixed up with China also wanting to promote domestic producers – showing yet again the complexities of trying to understand China from the outside. But it kept buying our iron ore and LNG; and not only kept buying but being prepared to pay extraordinarily high prices.

What seems to have happened with the bulk commodities, is buyers and sellers switching around – we’ve been selling more of our energy and met coal to India; India has bought less from Canada; and China has partially switched to buying more coal from Canada.

Something similar has been happening with Russia’s gas and especially its oil; with China the beneficiary, getting it at a discount to the global market. Yet, the bottom line in all this has been very high prices – for good and for bad for Australia and individual Australians – for our minerals and for energy through the turbulence of the Covid years; with a further boost after February from Russia’s attack on Ukraine. Right now, we seem to be in a state of limbo, on both fronts, maybe to last through the northern winter; a state of limbo, stretching from Ukraine to Beijing and Shanghai, waiting to see what unfolds in the spring.

Narrowly China is overwhelming the more important for Australia.

Coming out of the GFC in 2010, China’s huge spending spree almost singlehandedly drove the world economy out of recession, in combination with low global interest rates and central bank money printing (but not, then, in Australia).

We would have had a very different 2010s but for China. Can it do it again? I doubt it. And then there’s Russia and oil and gas and indirectly coal. And of course, a particular finger not far from ’that button’.

Forget about all those domestic points of pain – petrol prices, inflation more generally, interest rates and home loan payments, and so on – as there are two far more important realities bubbling away out there that will really determine your financial and indeed broader wellbeing through 2023 and beyond.