The NAB did by basing its decisions around the more optimistic scenario, which meant capital levels were fine, although the doomsday scenario would mean it was short of capital by some $5bn.

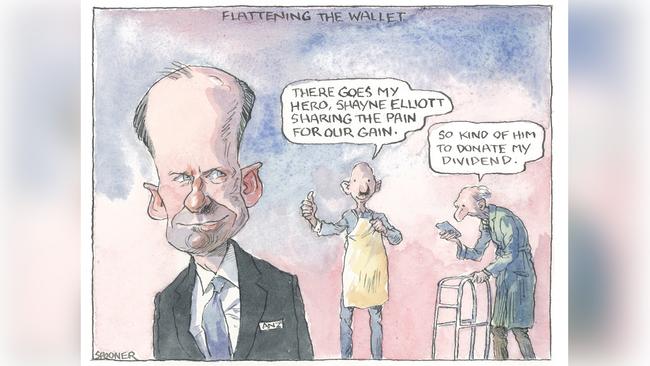

ANZ failed by not providing the different options so the market had no independent read of how risk-weighted assets would perform under different economic scenarios. This means the market can’t assess whether capital ratios its are safe.

ANZ did exactly the right thing on dividends by delaying its decision until its August quarterly statement, which will mean it will have an early read from its customers on the home loan suspension table.

The six months actually expires in October, around the same time as a host of other government plans run out and barring extensions the proverbial may well hit the fan by then with reality on the full extent of the downturn hitting home.

Arguably ANZ should have delayed its dividend decision further to see just how many of its home loan borrowers are really in trouble.

Credit Suisse’s Jarrod Martin led the ANZ attack on Thursday, seeking more details on the risk- weighted sensitivity analysis, which will come, but no doubt not as fulsome as he would like.

The bank regulations are pro-cyclical which means in good times they emphasise how well placed the banks are, but in bad times they do the reverse which explains why the market wants to see all scenarios before the banks.

Westpac has won plaudits for taking a large COVID-19 charge and it remains to see how it scores on the disclosure plans.

Helping hand

The banks went out of their way to show a willingness to help Australia through the crisis led by offering a six-month pause on loan repayments.

ANZ has 105,000 customers taking advantage of this, or 11 per cent of customers and 14 per cent of its loan book.

In around June it and the other banks will go back to the customers to check how they are travelling, with ANZ taking a so-called “opt in” approach meaning customers tell you if they want to participate.

Some customers will fall into the hardship basket which could end up costing the banks money, but for those who simply return to paying their mortgage their loan will be extended and the banks lose nothing.

“Magic” Matt Comyn at CBA is opting for an “opt out” approach to his gesture to free cash by putting some 750,000 standard variable rate customers on his $425bn home loan book at the lowest rate the customer is entitled to.

Some customers may want to keep paying off their home loans faster and if so they need to contact the bank and make their own arrangements.

Apathy suggests this will mean more people on the base rate which is better for CBA because it means the value of the home loan book is inflated.

NAB’s Ross McEwan by contrast went for the opt in strategy, arguing people shouldn’t be in debt longer than they need to or want to.

ANZ’s Shayne Elliott reported a massive increase in refinancing as brokers are using the fall in home sales to transact more business elsewhere, and their share of ANZ’s book has increased from 55 to 70 per cent.

The big end of town is adding more loan facilities to prepare for a prolonged downturn, but demand for loans at the small business level is tepid for the simple reason that no-one wants new debt right now.

Elliott said going forward more caution and risk aversion will be the prevailing theme.

Mining data

ANZ is preparing the way to make more money from your data.

Former Woolworths executive Emma Gray on Thursday was promoted to the top executive ranks, highlighting the focus.

The COVID-19 crisis has highlighted the trend towards a cashless payments system, with many stores refusing to take cash, which in turn gives the bank more information on what you spend your money on.

This allows the bank to target you for, say, a home loan if your spending patterns suggest your are saving up for a deposit, or by knowing you use Energy Australia for your gas and electricity. ANZ can have a chat to, say, Origin and say “do you know the extent of your market share losses in Victoria ... perhaps we can do some joint marketing”.

Open banking comes into force in June which conversely will allow customers more power their business elsewhere.

Safety first

Fortescue Metals has cut the number of people moving to its mines by 40 per cent by changing its shifts from two weeks on and one off to four on and two off.

The move was made in the name of safety to protect staff at the height of the virus — and while cheaper — is unlikely to stay long term because staff prefer short rotations.

The COVID-19 crisis has also driven more emphasis on health which will continue.

Packaged goods

One trend which has gone backwards is sustainable packaging, with the crisis killing the use of keep cups and home bottle supplies to buy drinks.

Woolworths chief executive Brad Banducci sees this as a pause rather than a dead end with packaged goods still looking for a sustainably appropriate solution.

The virus has meant people prefer packaged goods but the environment wants less packaging.

It has also cut the use of cash, fast forwarding the use of cards to pay for your groceries and soon receipts will also be a thing of the past.

Online sales at Woolworths now represent 4.1 per cent of sales up from 3.7 per cent, and the trend is clear and increasing.

Woolworths boss Brad Banducci argues the safety driven move to home delivery and store pick-up facilities will also accelerate. Woolworths has around 200,000 staff on its books which has increased by 20,000 during the crisis, some of whom will stay, but the push is into more flexible hours by casual staff to again save costs.

Banducci also faced a barrage of analyst questions by disclosing costs would increase up to $275m this quarter to make his supermarkets safer. This is a short-term increase and safer staff and customers should drive sales and profits, according to Banducci.

In the last quarter Woolworths posted same store sales growth of 10.3 per cent, well below Coles at 13.1 per cent, making the latter’s first outperformance since the first quarter of 2019.

Worse, Banducci said, sales growth has slowed to 5.1 per cent which while still comparatively strong, doesn’t look good against a big cost increase.

The battle here is over the market’s overly short-term focus.

Bank profits are down sharply as expected but that’s old news, what the market wants to see is how the banks’ capital levels will stand when the economy slumps and both ANZ and National Australia Bank failed the test for different reasons.