Caltex worth more, says investor

Fuel retailer Caltex should hold out for a higher takeover bid from Canadian suitor Couche-Tard, Pengana Capital says.

Fuel retailer Caltex should hold out for a higher takeover bid from Canadian suitor Couche-Tard, with the current $8.6bn offer not a fair reflection of the value to be realised from a property spin-off and retail revamp, major shareholder Pengana Capital says.

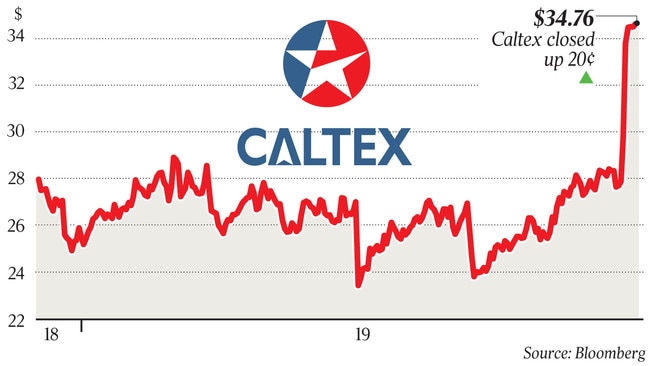

With Caltex chairman Steven Gregg set to deliver the board’s response on Tuesday morning to the Canadian giant’s $34.50 a share offer, the investor said the bid price looked too cheap.

“We have a view that it’s worth more. It’s not hard to get a $40 valuation,” Pengana fund manager Rhett Kessler told The Australian. “It’s a responsible board and they have to weigh up this up. However, the company has only recently started its revised retail strategy and if there’s value there it would be good to see it played out.”

Caltex’s board has been weighing up the merits of an improved $34.50-a-share offer lobbed by Couche-Tard on November 18 after previously rejecting a $32-a-share bid tabled on October 11.

Caltex shares climbed 0.6 per cent to $34.76 on Monday, eclipsing the offer price and signalling investors’ expectations that a deal would be struck.

Couche-Tard has asked for a four-week period of exclusive due diligence, with Caltex due to say whether it will open its books, agitate for a higher price or dismiss the suitor for a second time.

Some of Caltex’s biggest shareholders, including Investors Mutual and Airlie Funds Management, have indicated they want the company to hold out for a higher price, citing the current bid as significantly undervaluing the company.

Pengana said Caltex's planned $1bn property spin-off would act as a useful catalyst for unlocking value amid expectations of further initiatives across its portfolio as part of a review of the business now under way.

“We think there is a lot of value to be unlocked and the company is worth a lot more. The property IPO and the bid interest are both steps along the way to achieve this,” Mr Kessler said.

Caltex last week revealed plans to embark on a $1bn property float of a half-stake in 250 retail sites as it seeks to tap shareholders chasing yield at a time of low global interest rates. Couche-Tard plans to axe the spin-off if its takeover succeeds, raising doubts over momentum for the initial public offering.

Analysts have speculated Couche-Tarde would be likely to bring in a partner to offload some of Caltex’s assets, given the Canadian company’s focus on convenience retail rather than running refineries.

The Pengana fund manager said taking on the entire fuels and infrastructure unit run by Caltex required an experienced operator.

“This is a complex set of assets and in addition to a premium retail footprint the company also has non-trivial infrastructure, consisting of critical terminals and pipelines as well as a strategic refinery.

‘‘You’re managing stuff that goes boom and you need experience to operate that correctly at scale.”

Part of Couche-Tard’s pitch for the Caltex deal is unlocking $830m of franking credits.

It plans to pay a special dividend of up to $8.41 a share to release the credits, with the potential to boost the deal value by up to $3.61 per share.

Caltex will hold its annual investor day on Thursday, when it will outline progress on the business and its strategy.

Chief executive Julian Segal has announced plans to retire, with a search under way to identify his successor.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout