BusinessNow: Live stock market news, TPG Telecom, Telstra shares plus analysis and opinion

Australia’s biggest telco has shed 12 per cent in the last week as investors leave the stock out in the cold.

BusinessNow top stories: TGP telecom, Telstra shares sink; South32 scraps Peabody mine plans; Global tensions, miners weigh on market.

Daniel Palmer 4.44pm: Global tensions, miners weigh on market

Australian stocks have copped their heaviest sell-off in a month as geopolitical worries forced a risk-off approach from traders.

The local market shed over $15 billion as a new five month-low in iron ore weighed on the resources giants.

At the close, the benchmark S&P/ASX 200 slumped 53.2 points, or 0.90 per cent, to 5,836.7, while the broader All Ordinaries lost 57.2 points, or 0.97 per cent, to 5,868.7.

It represented the worst day of trade since March 22, although crucially the benchmark managed to end just above key technical support at 5,830 points.

The negative start to the holiday-shortened week could, however, be quickly forgotten with a number of crucial events of the horizon.

“It promises to be an interesting week, especially with such heightened concerns at a geopolitical level, 17 per cent of the S&P 500’s market capitalisation reporting and the final stages of the French elections upon us,” IG chief market strategist Chris Weston said.

3.42pm: LISTEN: The Money Cafe

Editor-at-large Alan Kohler and wealth editor James Kirby talk housing pressures, the bond market and Trump’s 100 days of power in the latest episode of The Money Cafe.

3.20pm: ASX attempts bank charge

Australia’s S&P/ASX 200 has regained key technical support at 5830 in late trading.

The index is down 0.9 per cent at 5836.9 after falling as much as 1.2 per cent to a three-week low of 5820.4.

The four major banks are down less than 0.9 per cent after falling at least 1.2 per cent earlier.

Resources remain weak with BHP down 2 per cent as iron ore futures fall a much as 3.9 per cent.

Telstra continues to struggle, down 3.5 per cent amid concern about competition from TPG.

2.50pm: Gloomy RBA to hold fast: Westpac

A less confident economic growth outlook from RBA minutes doesn’t change the steady policy outlook, according to Westpac.

“The decision by the Board to specifically highlight labour market and housing market is significant,” says Westpac chief economist Bill Evans.

“However, it does not change our view that rates are set to remain on hold over the course of 2017 and 2018.” Provided employment continues to improve and consumer spending growth remains around trend, “the case to cut rates is not strong”, he says.

And the evidence from the second half of 2015 — when a tightening of regulations contributed to a sharp slowdown in house price inflation — points to the likelihood that any official concerns with rising household debt will be dealt with through the regulatory channels.

2.14pm: Telstra’s $6.4bn week for the worse

Telstra (TLS) has lost over $6.4 billion in market valuation in a week (three trading days).

Investors have punted shares in the country’s biggest telco another 3.6 per cent lower today, which brings the total fall since TPG announced its entry into the mobile space to 12 per cent.

Read Supratim Adhikari for the full rundown of Telstra’s TPG headache

Meanwhile Vocus Communications (VOC) is quietly suffering a 5.5 per cent fall as it drops to its lowest level since November 2013 after losing 30 per cent in 10 days.

And capping off a day to forget for the local telco sector, TPG has dropped 17.4 per cent as it raises capital.

1.54pm: What struck JPMorgan in RBA minutes

Minutes from the RBA’s April board meeting have opened the door to a “possible” rate cut, according to J.P. Morgan senior economist Ben Jarman.

Mr Jarman says the RBA’s comment that “developments in the labour and housing markets warranted careful monitoring over coming months” was an unusually specific remark, in citing particular data ‘triggers’.

“While housing and labour market dynamics have been pushing in different directions recently — housing too hot, unemployment too high, and last week’s employment surge may provide a glimmer of more upbeat news, generally we would regard these remarks as dovish,” Mr Jarman says.

In regard to the RBA comment last week noting the high proportion of households that have no pre-payment buffer for higher rates, Mr Jarman says “it is hard to think of a more fundamental metric demonstrating that interest rates are high enough. At the same time, the inflation target is looking increasingly distant given that unemployment is well above NAIRU (non-accelerating inflation rate of unemployment). If an interest rate move is to be made in the near term, down is much more likely than up, so today’s shift in guidance can only feasibly be read as the RBA opening the door to a possible easing.”

1.36pm: Aurizon clips guidance, falls as trade resumes

Aurizon (AZJ) has cut its FY17 earnings guidance by about 11 per cent.

FY17 EBIT is expected to be $800m-$850m vs. $900m-$950m previously forecast.

It expects a $100m-$115m reduction in FY17 EBIT because of Cyclone Debbie, $70m-$80m of which will be recovered through regulatory processes in coming years.

After coming out of a trading halt, Aurizon shares have fallen as much as 4.5pc to $5.05.

1.05pm: RBA’s eggs in the iron ore basket?

Minutes from the RBA’s April board meeting have focused on the employment and housing markets.

“The board judged that developments in the labour and housing markets warranted careful monitoring over coming months,” the RBA said in its outlook.

“Although forward-looking indicators of labour demand continued to suggest an increase in employment growth over the period ahead, this has been true for some time without leading to an improvement in labour market conditions,” it added.

The RBA reiterated its recent concern about the housing market, saying “growth in housing credit continued to outpace growth in household incomes, suggesting the risks associated with the housing market and household balance sheets has been rising.”

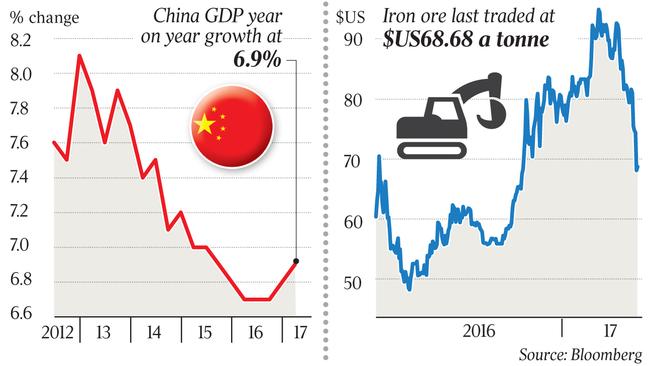

An improvement in global economic conditions had supported higher commodity prices, which are “expected to have provided a significant boost to Australia’s national income in the March quarter”.

However, since the April 4 RBA meeting iron ore has fallen 17 per cent, hitting a 5-month low of $US66.25 overnight.

12.38pm: ASX bids goodbye to recent highs

The ASX 200 is heading for its worst session in a month as heavy-hitter Telstra helps pull the index further away from its recent high above 5900 points.

The local index is heading into lunch down 1 per cent at 5828.7 points, which has it on track to record its worst fall since March 22.

Telstra is leading blue chips lower as investors continue to show their concerns about TPG’s entry into the mobile space, while the big four banks certainly aren’t helping out.

CBA, Westpac, NAB and ANZ are between 1 per cent and 1.3 per cent weaker for the session.

Another sharp fall in iron ore and oil prices, meanwhile, have BHP Billiton, Rio Tinto and Fortescue well into negative territory today.

The market hit a two-year intraday high of 5948.4 points a week ago and looked to be eyeing that elusive 6000 level... but that looks like a distant memory now.

12.04am: Vocus, have you lost weight? 30pc?

Vocus Communications (VOC) has plunged to a three-and-a-half year low this morning as investors hammer the stock amid turbulence in the sector.

Vocus shares are down 5 per cent today and have lost around 30 per cent in 10 sessions, with many market watchers left baffled by the brutal selloff.

Shaw and Partners have downgraded the stock to sell, saying “we would not be invested in VOC until it is clear management are on top of the business and earnings risk is removed”.

“While it may bounce at some point, we would sell into that.”

It’s possible rumours last week that an unnamed Australian telco was set to raise capital (revealed to be TPG, which is down 17 per cent today) could have sent Vocus shares lower and reignited fears in the space.

Today’s Vocus tumble is occurring on trading volume quadruple the 20-day average, according to Bloomberg.

11.20am: ASX phones no friends, hits 6-day low

Australia’s S&P/ASX 200 has hit a 6-day low 5836.2 as resources and telcos lead broadbased falls after the Easter break.

The index is testing key technical support near 5830, which should hold barring a further slide in commodities and global equities.

Telstra is down 3 per cent at a 2.5-year low of $4.03 in a selloff magnified by investors funding TPM’s $400 equity capital raising.

BHP Billiton is down 1.9 per cent at $23.86 after spot iron ore fell 3.5 per cent to a 5-month low of $66.25 overnight.

But it currently remains supported by an important trend line drawn from the February 2016 low.

10.43am: Market caught in Tesltra sinkhole

Bargain hunting investors haven’t immediately jumped on Deutsche Bank’s ‘no guts, no glory’ approach to Telstra following last Wednesday’s $4 billion wipeout.

The stock drops as much as 3 per cent this morning to find a new four-and-a-half-year low of $4.075 on strong volume. This drop from the ASX top 10 company brought the whole index lower, with the ASX 200 falling 0.9 per cent this morning and now heading for a 1.5 per cent loss in two sessions.

TPG’s entry into the mobile space sent Telstra investors into a tailspin, with fears the new entrant would eat a big chunk of the segment that makes up 35 per cent of the blue chip’s earnings.

Deutsche Bank has made the call that last week’s selloff was overdone and the telco giant is now showing a buying opportunity. Today, however, seems not to be the day, according to investors.

10.20am: Should bargain hunters dial into Telstra?

Deutsche Bank has upgraded Telstra to Buy vs. Hold, with a revised target price of $4.51.

“Despite the negative impacts from a new mobile entrant we believe TLS is now an appealing investment,” Deutsche Bank telco analyst Craig Wong-pan says.

He notes that Telstra’s share price now offers a “sustainable” fully-franked dividend yield of 6.6 per cent as well as potential capital return.

While Telstra will be negatively impacted by the entry of TPG as a mobile network operator, Mr Wong-Pan feels this will be “somewhat mitigated” by Telstra’s superior network, its incumbent position and loyal customers, different customer bases — with TPG focusing on the more value conscious customers, potential for Telstra to use a fighter brand to preserve core customer economics, and a lack of TPG stores to drive subscriber growth.

Telstra (TLS) shares have fallen 3 per cent to a 4.5-year low of $4.08 in early trading, while TPG Telecom (TPG) shares have fallen as much as 16 per cent to at $5.60 after initiating its capital raising to purchase a new mobile network.

9.59am: Brekky Wrap: Flying blind or buying fine?

Australian investors are flying into the week blind this morning after a long weekend leaves few ways to measure expectations ahead of the local open.

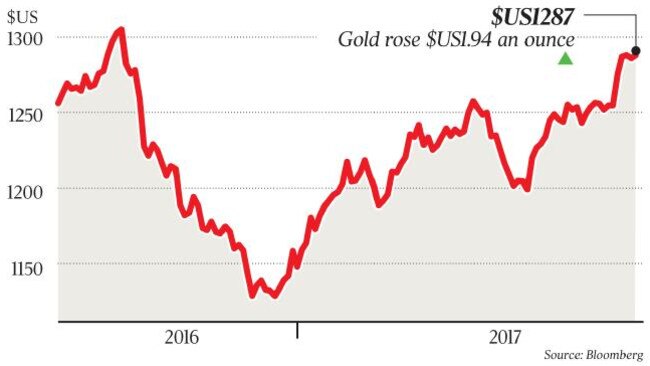

Iron ore hitting a five-month low, oil trudging around 1 per cent lower and safe-haven gold remaining strong amid global political concerns and a weak US dollar, however, are keeping brows furrowed as investors await the latest set of RBA minutes today and inflation numbers next week.

“With SPI futures closed on Friday and Monday, perhaps one way to conceptualise the ASX 200 open is through the fact S&P 500 futures are trading at similar levels as we closed on Thursday — so this seems like the best, most reliable lead,” IG chief strategist Chris Weston said.

“Another aspect of note were some fairly punchy falls in bulk commodity futures, with iron ore and steel futures (traded on the Dalian exchanges in China) falling 2.5 per cent and 1.3 per cent respectively. Spot iron ore has closed down 3.5 per cent.

“BHP’s American Depository Receipt (ADR) closed down 1.7 per cent if we use this as a proxy for all things mining.”

9.56am: Broker ratings changes

Telstra (TLS) raised to Buy vs. Hold — Deutsche Bank

Amaysim (AYS) cut to Sell vs. Hold — Shaw & Partners

Vocus (VOC) cut to Sell vs. Hold — Shaw & Partners

Fortescue (FMG) target price cut to $5.80 vs. $6.70; Neutral rating kept — Citi

Whitehaven Coal (WHC) cut to Underperform vs. Neutral — Macquarie

Ruralco (RHL) raised Buy vs. Hold — Bell Potter

Daniel Palmer 9.33am: Newcrest profit warning on seismic event

Newcrest’s full-year guidance is under pressure after an earthquake on Friday interrupted activity at one of the nation’s largest gold mines.

The news has helped wiped 5 per cent from the group’s (NCM) valuation.

The “large seismic event” in New South Wales hampered the gold miner’s Cadia operation, near Orange, with work underway to assess the damage.

No injuries were sustained by employees as a result of the event, despite damage to the project.

Daniel Palmer 9.20am: Aurizon halts trade on Debbie impact

Rail freight operator Aurizon (AZJ) has entered a trading halt this morning pending an update to guidance.

It is widely expected that the group will need to lower its expectations after its Queensland operations were affected by Tropical Cyclone Debbie at the end of last month.

More to come.

9.12am: South32 scraps Peabody mine plans

David Winning writes:

South32 says competition concerns have scuttled a $US200 million deal to buy a metallurgical coal mine in NSW, together with a stake in a coal port, from Peabody Energy.

South32 (S32), the coal and metals miner spun out of BHP Billiton in 2015, agreed in November to buy Peabody’s Metropolitan Colliery and an associated 17 per cent stake in the Port Kembla Coal Terminal, south of Sydney.

Michael Bennet 9.06am: Asia shrugs off apartment slump fears

Asian banks have almost doubled their share of lending to corporate Australia in the past five years, helping power the commercial property boom that is worrying regulators.

As Citi last week ceased interest-only mortgage lending to some customers, the Reserve Bank warned that the mostly healthy banking system was vulnerable to property development loan losses if “apartment markets in some cities were to turn down and settlement difficulties became widespread”.

The RBA said risks in the $1.6 trillion mortgage market had risen, citing falling apartment prices and higher vacancy rates in oversupplied pockets of Melbourne and Brisbane.

Sarah-Jane Tasker 9.00am: Conroy batts for bookies, ad regulation

Former Labor minister Stephen Conroy is lobbying the Turnbull government for a reduction in wagering advertising.

Mr Conroy argues that corporate bookmakers are not just changing the perception of their practices but the way they operate.

He has dealt himself into the wagering reform debate in his role as executive director of Responsible Wagering Australia, which he took on in November last year as the spotlight on the sector intensified.

Sarah-Jane Tasker 8.58am: Hong Kong fund eyes path Down Under

A Hong Kong-based investment firm, connected to the city’s richest person, Li Ka-shing, has set Australia as its top target over the next year with technology and healthcare assets in its sights.

Alan Kwan, executive director of State Path Capital, said the investment company wanted to dispel some untruths about Asian funds investing in Australia.

“Chinese funds are looking for a solid return and Australia is a safe investment environment. But I think some Australian companies are probably not taking advantage of Chinese funds because they are worried about IP, but that certainly should not be a concern,” Mr Kwan said.

8.45am: Stocks tipped for steady open

The Australian stock market is set to open flat as brewing tension between the US and North Korea weighs on investor sentiment.

At 0700 AEST on Tuesday the share price futures index was unchanged at 5,852. US markets bounced back on Monday after the S&P 500 closed the previous session at a two-month low, in a broad rally led by recently beaten-down bank and technology shares.

The Dow Jones Industrial Average closed 0.9 per cent higher, while the S&P 500 gained 0.86 per cent.

Locally, the market will be focused on the minutes of the latest meeting of the Reserve Bank of Australia, which are due to be released later on Tuesday. In equities news, Papua New Guinea-focused energy producer Oil Search will report quarterly output.

On Thursday, the Australian share market fell as investors fretted over political tensions related to Syria and North Korea and mining stocks were pummelled after a steep drop in the iron ore price.

The benchmark S&P/ASX200 dropped 44.1 points, or 0.74 per cent, to 5,889.9 points, while the broader All Ordinaries index lost 43 points, or 0.72 per cent, to 5,925.9 points.

Meanwhile, the Australian dollar is trading higher against its US counterpart, which has come under some pressure due to the geopolitical tensions over North Korea.

At 0700 AEST on Tuesday, the Australian dollar was at 75.89 US cents, up from 74.81 cents on Thursday.

AAP

8.38am: Gold bugs hatch as havens heat up

The price of gold has struck a five-month high as investors take a risk-off approach amid escalating geopolitical tensions, a weaker US dollar and a Wall Street slide.

And economists predict the metal’s price could continue to be carried higher as the market awaits further Federal Reserve interest rate hikes.

So far this month the precious metal has gained almost 4 per cent to hover just below $US1300 an ounce — its strongest point since Donald Trump’s election sent the commodity higher in early November.

Australian gold miners have been the best performers of the month on the S&P/ASX 200, with Northern Star Resources shooting up 19.7 per cent, St Barbara gaining 18.9 per cent, Evolution Mining jumping 16.7 per cent and Newcrest Mining up 12.8 per cent.

8.30am: Markets batten hatches in global tension

Stronger-than-expected economic data from China has failed to elicit a meaningful recovery in market sentiment.

Investors through the region have been targeting “safe-haven” buying in global financial markets amid rising tensions across North Korea following its efforts to test a missile at the weekend.

Spot gold jumped to a five-month high of $US1295 a tonne, US 10-year bond yields fell as much as four basis points to a corresponding low of 2.197 per cent and the US dollar slipped against the Japanese yen.

China reported a 6.9 per cent rise in GDP for the year to March, surpassing expectations of 6.8 per cent. Growth was powered by industrial production, which rose 7.6 per cent versus 6.3 per cent expected by economists, and retail sales jumped 10.9 per cent versus 9.7 per cent expected, according to official figures.

Fixed-asset investment, or spending on infrastructure projects, rose at a 9.2 per cent year-on-year pace in the first quarter, compared to 8.9 per cent growth in the prior quarter.

The figures have again stoked questions around the reliance of Chinese business on debt to fuel growth through the economy.

7.10am: Oil’s biggest decline since March

Oil prices had their biggest drop since March, as new US government figures stoked worries rising output from shale formations could throw the oil market further out of balance.

Output from US shale fields is set to rise by 124,000 barrels a day in May, according to the Energy Information Administration’s monthly Drilling Productivity Report.

That would be the biggest monthly increase in two years, and with the rig count still rising relentlessly, some traders may be wondering if it is only the beginning.

“Big traders are reading into that, putting the pieces of the puzzle together and wondering, are we going to see an accelerated increase in U.S. production from the shale plays?” said Rob Thummel, portfolio manager at Tortoise Capital Advisors.

US crude futures fell 53 cents, or 1 per cent, to $US52.65 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell 53 cents, or 0.95 per cent, to $US55.36 a barrel on ICE Futures Europe.

For both benchmarks, it was the largest single-day drop since March 21, when oil prices hit a low $US47.34.

Dow Jones

7.00am: Dollar gains against greenback

The Australian dollar is trading higher against its US counterpart, which has come under some pressure due to geopolitical tensions over North Korea.

At 6.36am (AEST), the Australian dollar was at US75.90 cents, up from US75.81 cents on Thursday.

FXStreet analyst Matias Salord said upbeat Chinese GDP data had boosted the Aussie dollar, as well as the weak US dollar.

He expects the focus to be on the minutes of the latest meeting of the Reserve Bank of Australia, which are due to be released later this morning.

The local currency is steady against the Japanese yen but slightly stronger against the euro.

AAP

6.40am: US stocks rally

Wall Street stocks scored solid gains overnight ahead of a heavy week of corporate earnings and after China reported better-than-expected first quarter growth.

The earnings calendar this week includes Goldman Sachs, Netflix and General Electric. Companies in the S & P 500 are expected to report 9.2 per cent growth in first-quarter earnings, according to FactSet.

Chinese economic growth came in at 6.9 per cent in the first quarter, better than the 6.8 per cent expected by analysts and a sign of stabilisation in the world’s second-biggest economy.

Analysts said geopolitical concerns were still important, but investors took heart after there were no major international incidents over the weekend. Stocks sold off late last week ahead of the holiday weekend on anxiety about North Korea and Syria.

The Dow Jones Industrial Average gained 0.9 per cent to close the session at 20,636.86.

The broadbased S & P 500 climbed 0.9 per cent to end the day at 2,349.01, while the tech-rich Nasdaq Composite Index rose 0.9 per cent to finish at 5,856.79.

Technology companies with solid gains of 1.5 per cent or more included Amazon, Facebook and Google parent Alphabet.

Despite Wall Street’s gains, Australian stocks are tipped to open lower. At 6.50am (AEST), the SPI futures index was down 15 points.

Most European markets were closed.

AFP