BusinessNow: Live coverage of financial markets and companies, plus analysis and opinion

Australian stocks have halved early losses as investors turn away from the presidential debate.

Welcome to the BusinessNow blog for Tuesday, September 27. The Australian sharemarket is in negative territory, but has pared some losses since morning trade.

4.30pm:Woolworths wins stay in Masters stoush

Woolworths has won a stay of the winding-up application filed by one-time partner Lowe’s in the Masters hardware joint venture. The battle between the pair will now be dealt with in confidential arbitration.

Ben Wilmot writes:

The dispute will now be heard behind closed doors by former High Court justice Murray Gleeson. Despite the court win, the timing of Woolworths’ exit from Masters remains uncertain, which could reduce the returns that it receives from the sale of its stake in the venture.

4.25pm:Stocks close in the red

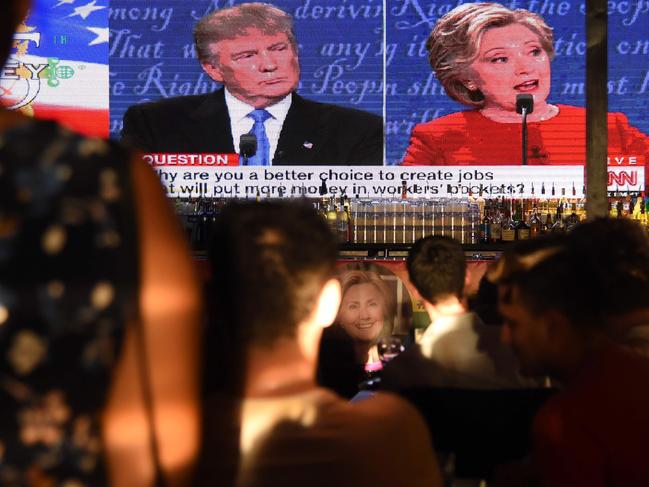

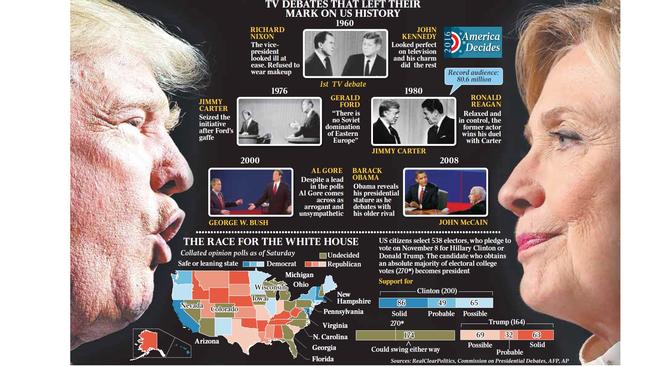

The Australian sharemarket has broken a run of five straight positive sessions despite an afternoon rally predicated on the view that Hillary Clinton won the first US presidential debate, Daniel Palmer writes.

At the close, the benchmark S&P/ASX 200 index dipped 25.5 points, or 0.47 per cent, to 5,405.9, while the broader All Ordinaries index retreated 25.4 points, or 0.46 per cent, to 5,493.7.

The red session followed sharp falls in European trade as questions were again raised on the major banks in the region, with worries about the impact of fines on Deutsche Bank’s capital position at the heart of the worries.

Morgans, in a note to investors, said the activity may present a buying opportunity given the ebbs and flows seen since the financial crisis.

“We think that current market nerves will subside once the Fed’s intentions become clearer (regardless of whether it holds or hikes rates) in the wake of the September 21 FOMC meeting,” Morgans said.

“Current weakness therefore looks like another buying opportunity, as these episodes have proven to be several times since the GFC.”

3.55pm:Country Road CEO resigns

Country Road Group chief executive Matt Keogh has suddenly resigned after only two years in the role, with South Africa’s Woolworths Holdings, which controls the fashion retailer as well as department store David Jones, appointing Scott Fyfe as the new boss of the retail business.

In somewhat of a merry-go-round of bosses, Mr Fyfe will be Country Road’s third boss since 2014.

It comes at a time when Country Road’s recent performance has disappointed investors and Woolworths Holdings, with the chain not trading as profitably as David Jones following a number of poorly executed fashion strategies that saw its range fall flat with shoppers.

Eli Greenblat

More to come

3.42pm:What’s driving Wesfarmers’ price rise?

With less than an hour remaining in the day’s trade Wesfarmers remains one of the strongest major stocks. Could today’s solid performance be due to a mildly positive note from Morgan Stanley?

Analysts raised their 12-month price target to $43 from $42 as they kept their recommendation unchanged at ‘equalweight’, pointing to coal price rises as a driver for near-term improvement.

“While coal prices have the most significant impact on Wesfarmers’ near-term earnings, we believe Coles and Bunnings are the largest drivers of the share price,” analysts Thomas Kierath and Monique Rooney.

“Since July 1 coal prices (in USD) have more than doubled - we refresh our resources forecasts to reflect the recent price movement, which lifts our EPS forecasts by 5-6 per cent.”

At just before 3:40pm AEST Wesfarners shares were 0.8 per cent higher for the day at $44.09, compared with the intraday high of +1.4 per cent.

Meanwhile the ASX 200 was 0.5 per cent weaker.

3.15pm:OceanaGold shares dive on mine closure

Shares in OceanaGold, one of the biggest gold miners on the ASX, have been halted after earlier tumbling more than 8 per cent when the Philippines government ordered the closure of its big Didipio mine in Luzon, Paul Garvey writes.

OceanaGold shares plunged 8.23 per cent in less than half an hour before the trading halt, wiping around $200 million off the company’s value, following a statement from the Philippines that it had suspended another 20 mines across the country.

Environment and Natural Resources Undersecretary Leo Jasareno reportedly told a news briefing in Manila today that OceanaGold was among the companies suspended.

The Philippines subsidiary of Perth-based Medusa Mining, which operates the Co-O gold mine in Mindanao, is among the ten miners that avoided suspension.

Read more

2.46pm:Stocks lift off lows as debate wraps

Australian stocks have picked up in afternoon trade as global investors seemed to gain confidence throughout the US presidential candidate debate.

Wall Street futures now point to a 0.5 per cent rise in the session ahead, which shows no major offense was taken by the market from the debate.

That positivity has helped limit the damage on the local market – at 2:30pm AEST the S&P/ASX 200 was 0.5 per cent in the red at 5405.8 points, compared with the 1.1 per cent it gave up early in the session.

Major stocks remain weak, with the banks and miners seeing losses, while Wesfarmers gains a healthy 1.3 per cent to $44.29.

CBA is down 0.8 per cent and Westpac has dropped 1.1 per cent, while NAB and ANZ slip 0.2 per cent and 0.3 per cent respectively.

BHP Billiton and Rio Tinto are both down 0.5 per cent, while Telstra gives up 0.9 per cent.

Gold miners have been boosted by a positive note from Goldman Sachs, which saw Newcrest upgraded to ‘buy’ from ‘neutral’.

Newcrest gained 2 per cent, St Barbara extended yesterday’s rise with a 3.4 per cent gain, and Galaxy Resources is today’s best performer with a 5 per cent rise.

2.28pm:Aged care selloff overdone - UBS

A sell off in the domestic aged care equities since the government announced its aged care reforms has been overdone, according to UBS analyst Andrew Goodsall.

He notes that consensus estimates have been cut by about 17 per cent since then, yet current stock prices imply a further 18 per cent cut, which he feels is improbable.

Goodsall has trimmed his price targets on Estia Health, Japara and Regis Healthcare, but retains ‘buy’ ratings on all three.

1.53pm:Coalition bows to backpacker tax pressure

The Turnbull government has slashed its proposed 32.5 per cent tax on the wages of working holidaymakers, amid fears the so-called “backpacker tax” would starve regional industries of seasonal workers.

The $500 million tax, which was first announced by Joe Hockey as treasurer, sparked a fervent revolt among regional Coalition MPs who argued the tax made Australia less attractive to backpackers than countries such as Canada and New Zealand.

The government will instead levy a tax of 19 per cent on earnings up to $37,000 from January 1. The passenger movement charge – a $55 fee levied by the government through international airlines – will rise to $60 and the government will impose a 95 per cent tax on backpackers’ superannuation contributions to cover the shortfall.

The age limit for working holiday visa applicants will rise from 30 to 35 and application fee will fall from $440 to $390 from next year.

Jared Owens

Read more

1.10pm:S&P 500 futures rise limits ASX 200 fall

A 0.5 per cent rise in US S&P 500 stock index futures during the first presidential debate has limited the local sharemarket’s decline.

The S&P/ASX 200 is currently down 0.7 per cent, at 5391.50, after earlier falling as much as 1.1 per cent.

Whether or not the rise in US stock index futures, the bounce in the Mexican Peso and a slight fall in the US dollar against the Aussie dollar and British pound means Clinton won the debate is not clear. Other markets have been mixed, with US Treasury bond yields rising a couple of basis points and spot gold falling 0.3 per cent to $US1335 per ounce.

12.55pm:TWE to double US earnings: BAML

BAML expects Treasury Wine Estates (TWE) to more than double US earnings to $289 million in 2019, helping to power the company to a profit of $489 million in the year, up from $218 million last year, writes John Durie.

In a report today, BAML analyst David Errington maintained his bullish outlook for the company, having done a complete backflip on the US outlook.

Two years ago Errington demanded the company sell the US business, claiming it was a drag on earnings.

The business now accounts for 44 per cent of the company’s net sales revenue versus 27 per cent in Australia, and 36 per cent of earnings versus 24 per cent in Australia.

This follows last year’s $660 million Diageo acquisition.

More to come

12.27pm:Westpac should slash dividend: CLSA

Westpac should slice its dividend at its upcoming results and raise equity while the market’s valuation of the bank remained healthy, according to broker CLSA.

As three of the big banks prepare to rule off accounts for the year to September 30, CLSA analyst Brian Johnson told clients Westpac should do the “sensible thing” and cut its final dividend to 80c, down from the interim 94c payout.

“It makes little sense to maintain a higher dividend if that increases the capital shortfall,” he told clients.

Michael Bennet

Read more

12.15pm:Debate shifting Clinton’s way

The US dollar has slipped against the Mexican peso as the US presidential debate rolls on.

At 12:15pm AEST the currency lost 1.4 per cent to 19.59 Mexican pesos, from MXN19.87 an hour earlier, indicating traders believe the debate is shifting Hillary Clinton’s way.

The peso is rising off a record low against the US dollar earlier today, recovering ground lost in recent months amid fears of a Trump presidential victory.

Massive tax cuts, which would potentially pull manufacturing back to the US from Mexico, are a central theme for Trump, as is his plan to force Mexico to pay for a border wall between the two countries.

Mexico peso rebounds from record low during first U.S. #Debates2016 pic.twitter.com/dp267piN7o

— Yvonne Man (@YvonneManTV) September 27, 2016

There's a clear winner in the #PresidentialDebate if the #Mexico peso is any guide. This is USD v MXN. pic.twitter.com/h5U79j0Y8D

— Emma OBrien (@ek_obrien) September 27, 2016

MXN gained 0.4%... Clinton finding some form, or at least shorts covering v modestly

— Chris Weston (@ChrisWeston_IG) September 27, 2016

S&P/DOW futures up 0.4%, USD/MXN down 1.5% since debate started..USD/CAD off too..Market telling you who has upper hand

— Chris Weston (@ChrisWeston_IG) September 27, 2016

USDMXN backing off a little at the moment - I'm with the #forex traders #Trump is losing.

— Greg McKenna (@gregorymckenna) September 27, 2016

Far too aggressive - this is rope a dope

11.55am:AUD could slide if Trump wins: CBA

The Australian dollar could fall up to 10 per cent if US Republican candidate Donald Trump wins the US presidency in November, according to Commonwealth Bank’s currency strategists.

Mr Trump’s main economic policies, including major income and company tax cuts, government spending and tariffs, are “very inflationary”, CBA currency strategists Richard Grace, Elias Haddad, Joseph Capurso and Wei Li say in a research note.

“We believe US bond yields and the US equity market will lift on the company tax cut, and the US dollar will surge higher,” they said.

A 10 per cent jump in the US dollar will be driven by investors chasing higher returns on their investments, which in turn could see the Aussie fall by 10 per cent to around US68.71 cents.

AAP

11.35am:Markets look through US debate

Financial markets appear to be looking through the first US presidential debate, with no significant movements in stocks, bonds, commodities or currencies since it kicked off at 11:00 AEST.

It’s been blow for blow with no clear winner emerging as yet, although Trump appears to be flummoxing Clinton a little and that could work to his advantage.

11.20am:Michelmore to exit MMG

Mining industry veteran Andrew Michelmore has announced he will retire from his job running Melbourne-based copper and zinc miner MMG, and from executive life, from around the middle of next year, Matt Chambers writes.

Before becoming managing director of MMG, Michelmore was chief executive of Oz Minerals (after Oxiana Resources and Zinifex merged), Russia’s Rusal and was at the helm of WMC Resources when it was taken over by BHP Billiton in 2005.

Read more

11.15am:Intueri shares slump 78%

Shares in dual-listed education group Intueri are now nearly worthless after the company sounded the alarm on its ability to operate as a going concern given two of its subsidiaries were ruled non-compliant with current Australian standards.

The development has seen more than three-quarters of its valuation wiped by traders this morning.

Recent audits from the Australian Skills Quality Authority (ASQA) found issues with admissions procedures, assessment practices and learner support resources, with a response from Intueri required by October 21.

The flow-on effect could, at worst, see the Intueri-owned Online Courses Australia and Conwal & Associates have their registrations cancelled, a result that would cripple the group’s Australian operations.

Investors were brutal in response, slashing 78 per cent of its value in early trade on the ASX.

Daniel Palmer

11.10am:QBE looks cheap vs. peers — Macquarie

QBE is about 10 per cent cheaper than its global peers, according to Macquarie.

“While QBE has traded at as much as a 20 per cent discount to our Absolute QBE index, historically the stock price has rebounded from such levels and the current 10 per cent discount been a consistent relative value indicator,” the broker says.

In addition to the PE discount, US bond yields’ performance since late June should support QBE’s share price performance as its price has historically been positively correlated to periods of rising US bond yields, Macquarie adds.

It keeps an Outperform rating and $11.30 target on the stock.

QBE shares were last down 1.7 per cent at $9.39.

11.02am:Goldman Sachs positive on Newcrest

Gold miner Newcrest has been boosted to a ‘buy’ rating at Goldman Sachs as analysts say this year’s rally has “masked much of the strong improved operational performance that management has driven within the company”.

Newcrest shares have gained 27 per cent in the last six months, compared with a 6 per cent rise from the ASX 200, largely driven by a surge in the gold price as risk events, such as Brexit, saw appetite for safe-haven assets rise.

“As the restock driven commodity price rally of 1H16 peters out and the tailwinds of falling currency and consumable prices slow the cost out story, we believe companies that can offer more than just macro plays will deliver outperformance.”

Goldman’s view stands at odds with other major brokers — Credit Suisse, UBS, Morgan Stanley and JP Morgan all rate Newcrest as ‘sell’ (or other wording to that effect — underweight, reduce etc).

Bloomberg data show five ‘buy’ ratings on Newcrest, three ‘holds’ and eight ‘sells’, with a consensus price target of $22.24.

Goldman Sachs’ new price target now sits at $24 and implies a return potential of 7 per cent.

10.55am:Broker rating changes

Charter Hall retail REIT raised to ‘neutral’ vs. ‘sell’ — Citi

SCA Property raised to ‘neutral’ vs. ‘sell’ — Citi

GPT raised to ‘neutral’ vs. ‘sell’ — Citi

10.47am:Stocks slump in early trade

The Australian sharemarket has slumped at the open, with a run of five straight positive sessions almost certain to be broken, writes Daniel Palmer.

At the 10.15am (AEST) official market open, the benchmark S&P/ASX 200 index skidded 50.4 points, or 0.93 per cent, to 5,381, while the broader All Ordinaries index retreated 47.8 points, or 0.87 per cent, to 5,471.3.

Read more

10.40am:Coking coal outlook positive: Macquarie

After a 123 per cent rise in the spot price of metallurgical coal — or coking coal — to $US210/tonne since July 1, the outlook for the steelmaking commodity looks “extremely positive” according to Macquarie.

Its proprietary survey of coal traders found they could see little in the way of restarts coming from the US in the short term, and little additional volume that could come from Australian producers to soften prices. There’s also a widespread belief that China would do little to stop metallurgical coal pricing due to the lack of supply-side reforms enacted by steelmakers, the broker says.

And despite share price gains in coal producers, there remains “material upside risk” to base case forecasts for the bulk commodity producers using spot prices, Macquarie adds.

Spot price valuations would be 20 per cent higher for BHP and nearly 50 per cent higher for South32, it says.

For New Hope Coal, the spot valuation is 33 per cent higher than Macquarie’s base case, while for Whitehaven Coal the upside to its spot valuation is over three times its current base case.

But thermal coal prices look unsustainable since the Chinese government clarified that they would allow some extra thermal production to shift prices back to about S$60/tonne, the broker says.

10.25am:The pros and cons of Fortescue

Fortescue Metals has been cut to underweight from equal-weight by Morgan Stanley analysts, who have simultaneously bumped up their price target on the miner by over 11 per cent to $4.50.

The analysts remain upbeat on the stock, despite Fortescue shares rocketing 162.3 per cent in the year to date, making it the third best performing company on the ASX 200 over the period.

“We found ourselves tossing up between the robust [free cash flow] with ongoing debt reduction and the potential for iron ore to drag the equity lower in the near term,” Morgan Stanley analysts Brendan Fitzpatrick and Rahul Anand said.

“We went with the latter and move to [Underweight], but look for the opportunity to turn positive.”

“Metrics don’t look stretched, yet we struggle to identify nearterm catalysts. That said, the company is hosting its annual site visit in late October and these often generate positive sentiment. However, the potential for iron ore prices to continue to slide through the rest of 2016 could drag the equity lower, presenting an opportunity to turn positive.”

Fortescue shares slipped 1 per cent at the open to $4.90.

10.05am:AUD/USD perky before presidential debate

AUD/USD looks perky ahead of the US presidential debate, due to kick off at 11 AEST.

With polls recently showing increasing support for Trump, the US dollar has been a bit weaker due to the potential for uncertainty about a Trump presidency to delay US rate hikes.

That has seen AUD/USD butt up against a weekly downtrend line from March 2013.

A strong showing from Trump today could see AUD/USD push above this line, currently located near 0.7665.

A decisive move above the line could see AUD/USD test the August peak at 0.7756 or the April peak at 0.7835.

On the other hand, if Clinton wins the debate, further consolidation between 0.7440 and 0.7665 seems likely. AUD/USD last 0.7637.

10.00am:Cover-More to raise $73m for Travelex buy

Macquarie has launched a $73.3 million raise for Cover-More as the listed travel reinsurance seller attempts to fund its acquisition of Travelex Insurance Services.

A term sheet sent to investors states the price and number of shares issued under the entitlement offer will be determined once the institutional component is completed.

However sources told DataRoom the deal looks set to be priced at $1.20 per share.

Investors claimed Macquarie was initially seeking $1.26 per share for the raise.

Gretchen Friemann

9.52am:Retail brokers appointed to Alinta IPO

Bell Potter, Morgans and Evans & Partners have been appointed as retail brokers for the $3.3 billion-plus Alinta IPO.

Another Perth-based retail broker will also join the team of investment banks in the coming weeks ahead of the November listing.

As previously reported in The Australian’s Data Room column the float of Alinta will likely raise between $1bn and $2bn, delivering a valuation of between $3.3bn and $5.2bn.

Alinta, which counts TPG Capital as a shareholder with between 20 and 30 per cent of the business, promises to be the biggest float of the year.

Bridget Carter, Daniel Palmer

More to come

9.46am:US debate: the ‘least worst’ outcome

Today’s first official US presidential debate between Hillary Clinton and Donald Trump leaves the market with few positive outcomes, according to CMC Markets chief strategist Michael McCarthy.

“The first of three US presidential candidate debates during today’s Asia Pacific trading session will likely dominate action as markets search for the winner and their eventual economic policy stance,” Mr McCarthy said.

“Markets are searching for the least worst option between the two US candidates.

“One is a known market bad, the other an unknown bad. Any ramping up of populist rhetoric would likely rattle investors. Any perception that the outsider candidate won the debate could bring a market rout.”

The debate kicks off at 11am AEST and a weak session on Wall Street, along with renewed concerns about the health of global banks, could see the ASX 200 stumble before a word is spoken in the debate.

A spike in oil prices, however, could see strength among energy names.

Follow the full live coverage of the debate on The Australian.

9.26am:Intueri shares take a beating

Shares in dual-listed education group Intueri are now nearly worthless after the company sounded the alarm on its ability to operate as a going concern given two of its subsidiaries were ruled non-compliant with current Australian standards, writes Daniel Palmer.

Recent audits from the Australian Skills Quality Authority (ASQA) found issues with admissions procedures, assessment practices and learner support resources, with a response from Intueri required by October 21.

The flow-on effect could, at worst, see the Intueri-owned Online Courses Australia and Conwal & Associates have their registrations cancelled, a result that would cripple the group’s Australian operations.

Intueri warned its ability to operate as a going concern would be in grave doubt if Conwal was stripped of its licence to operate, with a default event likely in such a circumstance.

Investors were brutal in response, slashing 70 per cent of its value in early trade on the New Zealand Stock Exchange.

More to come

9.10am:Broker rating changes

Medibank Private cut to ‘underperform’ vs. ‘buy’; target $2.40 vs. $3.30 — CLSA

Newcrest raised to ‘buy’ vs. ‘neutral’ — Goldman Sachs

Fortescue Metals cut to ‘underweight’ vs. ‘equalweight’ — Morgan Stanley

McPherson’s initiated at ‘buy’ — Moelis

9.00am:Flight Centre in European acquisition

Flight Centre has announced another acquisition as it looks to shore up a strong position in the European market, particularly in the growing corporate travel space, writes Daniel Palmer.

The agreement to purchase online travel agency eDreams ODIGEO expands its presence to Sweden, Denmark, Norway, Finland and Germany.

The acquirer opted against detailing the price, only saying the deal was all cash and would be completed by year’s end.

Read more

8.40am:BHP, CBA set to slide at the open

The Australian market looks set to slide at the open, following yesterday’s flat finish, with all eyes expected to be planted on the US dollar and S&P futures as the US presidential candidates take the stage in Hempstead, New York, at 11am AEST.

The SPI 200 is pointing to a 0.8 per cent fall, but fair value suggests a 0.7 per cent slip is more likely.

Major stocks look likely to come under pressure, with BHP Billiton and CBA heading for a 0.9 per cent and 1 per cent fall respectively, according to their ADRs.

IG chief strategist Christ Weston says market watchers should turn their attention to Japanese equities today, which could see “good selling”.

8.14am:The Clinton vs. Trump effect

Investors will today get their first glimpse at how the market will react to a head to head debate between US presidential candidates Hillary Clinton and Donald Trump, with the two slated to square off at 11am AEST.

Follow the live coverage of the debate on The Australian.

“What we should learn today is how markets genuinely trade each candidate,” IG chief strategist Chris Weston said.

“If Donald Trump emerges as the victor and the US dollar rallies and S&P futures sell-off, it will provide confirmation of a trade many have already pre-positioned for.

“So the reaction in markets should be very telling today as we head into the November 8 election.”

And for a very black and white assessment, Bell Potter lays out what to expect:

“Hillary Clinton is still the favoured candidate and if she is considered the winner of the first debate, markets will return to calm. However if Trump wins the first debate, market unrest will occur.”

7.05am:Sharemarket tipped to open lower

The Australian market looks set to open lower, following the negative lead of international markets.

At 6.45am (AEST), the share price index was down 41 points at 5,376.

In the US, shares of banks slid overnight, dragging down major indexes worldwide. Investors sold bank shares in the US, Europe and Japan amid concerns about the capital position of Deutsche Bank ahead of an anticipated legal settlement with the US Justice Department.

Locally, no major economic or equities news is expected today.

In Australia, the market yesterday closed flat ahead of the US presidential debate and following weak cues from Wall Street and a sharp fall in oil prices. The benchmark S & P/ASX200 index rose just 0.1 points to 5,431.4 points. The broader All Ordinaries gained 0.5 points, or 0.01 per cent, to 5,519.1 points.

AAP

7.00am:Dollar climbs

The Australian dollar has climbed against its US counterpart ahead of the first US presidential debate between Hillary Clinton and Donald Trump. At 6.35am (AEST), the local unit was trading at US76.37 cents, up from US76.18 cents yesterday.

AAP

6.55am:Iron ore ends winning streak

The iron ore price has snapped a three-day winning streak, edging lower but holding clear of the key $US55 a tonne level.

Iron ore lost 0.2 per cent to $US56.40 overnight, according to The Steel Index, from $US56.50 in the previous session.

6.50am:Iran downplays talk of OPEC deal

Iranian officials played down expectations for an oil-production deal, calling an OPEC gathering here this week “consultative,” and renewed their vow to pump output higher.

Iran Oil Minister Bijan Zanganeh’s comments to Iranian state media came as energy ministers from across the world arrived in Algiers for a three-day conference that is set to culminate Wednesday in an informal gathering of the Organization of the Petroleum Exporting Countries. The 14-nation cartel is considering output limits, known as a production freeze, that some members hope would lift oil prices out of a two-year funk.

Dow Jones

6.45am:Rio Tinto to cut $US3bn debt

Miner Rio Tinto has launched a new debt reduction program for up to $US3 billion as part of the company’s ongoing capital management.

Under the plan, Rio Tinto has issued a redemption notice for $US1.5 billion of its 2017 and 2018 US dollar-denominated notes and commenced cash tender offers to purchase up to $US1.5 billion of its 2019, 2020, 2021 and 2022 US dollar-denominated notes.

Dow Jones

6.40am:Wall St slides as banks drop

Shares of banks slid overnight, dragging down major indexes worldwide. After stocks rallied following central-bank meetings last week, major US indexes notched two consecutive sessions of losses.

The Dow Jones Industrial Average fell 167 points, or 0.9 per cent, to 18095. The S & P 500 fell 0.9 per cent, and the Nasdaq Composite dropped 0.9 per cent.

In Europe, traders took profits after the central bank-fuelled rallies, with investors also selling off Deutsche Bank over worries about its capital position.

Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout