BusinessNow: Live coverage of financial markets and companies, plus analysis and opinion

Local stocks have swung into the red after $34.5bn was wiped off the index yesterday.

- The sell-off’s not over yet

- Is Woolies headed for $40?

- ASX rally splutters

- ‘Women talk too much’

- JB Hi-Fi buys The Good Guys

- Clean-up begins after market rout

- Stocks tipped for strong recovery

Welcome to the BusinessNow blog for Tuesday, September 13. The local sharemarket is eyeing negative territory despite Wall Street rallying overnight, and JB Hi-Fi is buying The Good Guys for $870 million.

7.18pm:Public companies register a $700m cash cow

The federal government slugs users of the “public” companies register more than 100 times what it actually costs to operate and is suppressing that secret cost structure ahead of is plans to sell the register — and associated vast tax streams — to a private company.

Those fees associated with the “public” register mean it is delivering a windfall to the government of more than 10,000 per cent annually. Read more of Anthony Klan’s exclusive report.

6.29pm:IE cuts oil forecast on Asian demand ‘wobble’

The International Energy Agency on Tuesday sharply cut its forecast for global oil demand for this year and the next amid what it called “wobbling” Asian demand.

The fresh data is set to intensify the debate between oil producers later this month in Algiers about whether they should freeze their production.

In its closely watched monthly report, the IEA, which advises oil-consuming countries on their energy policies, downgraded its global oil demand predictions by about 100,000 barrels a day for this year — still growing by 1.3 million barrels a day. It also reduced the forecasts by about 200,000 barrels a day in 2017, with consumption increasing more slowly at 1.2 million barrels a day.

“Recent pillars of demand growth — China and India — are wobbling,” the agency said. “After more than a year with oil hovering around $US50 a barrel, the stimulus from cheaper fuel is fading.” Read more.

5.56pm: European stocks slip in early trade

Europe’s stocks rebounded at the start of trade on Tuesday after a leading Federal Reserve official tempered comments from her colleagues on the need for an early US interest rate hike.

In opening deals, London’s benchmark FTSE 100 index increased by 0.3 per cent to 6,720.25 points compared with the close on Monday.

Frankfurt’s DAX 30 gained 0.4 per cent to 10,483.07 points and the Paris CAC 40 won 0.5 per cent to 4,463.26.

The region’s indices had slumped Monday as investors were spooked by the prospect of a US interest rate hike as early as this month.

“With yesterday’s destructive Fed fears calmed by a reassuringly dovish Lael Brainard last night, the markets have gotten off to a perkier start this Tuesday,” Spreadex analyst Connor Campbell said. AFP

5.32pm:Chase the bosses, Libor trader urges

The former trader convicted of being the “ringmaster” behind the Libor-rigging scandal has claimed that investigators did not seriously pursue anyone else at UBS over the wrongdoing, despite having evidence that it was explicit bank policy.

Tom Hayes, 36, told The Times that Britain’s Serious Fraud Office had not questioned UBS bosses as part of its investigation into manipulation of the benchmark rate that led to his conviction.

The SFO also ignored a UBS document that instructed employees in charge of submitting the bank’s Libor rate to adjust it depending on the bank’s overall risk, Hayes said. Read more.

5.05pm:Dollar loses ground in late trade

The Australian dollar has slipped in late trade, despite positive Chinese economic data and diminished expectations of a US interest rate rise.

At 5pm (AEST) on Tuesday, the local unit was trading at US75.30 cents, down from US75.67c on Monday.

The Australian dollar has slipped in late trade, despite positive Chinese economic data and diminished expectations of a US interest rate rise.

At 5pm (AEST) on Tuesday, the local unit was trading at US75.30 cents, down from US75.67c on Monday.

It followed a volatile session for the local unit, which initially gained ground following dovish comments from US Federal Reserve governor Lael Brainard, before swinging back and forth across the day.

“The Aussie has been down and then up,” National Australia Bank currency strategist Rodrigo Catril said.

“The overnight move was driven by Brainard’s comments being a bit more dovish and the China numbers, which were overall supportive. However, the market remains in a hesitant mood.” AAP

4.35pm:Stocks close in the red

The local sharemarket wilted in afternoon deals, with a strong open evaporating into a lower close as investors warily wait on next week’s update on US monetary policy.

At the closing bell, the benchmark S&P/ASX 200 index edged down 11.8 points, or 0.23 per cent, to 5,207.8, while the broader All Ordinaries index lost 9.1 points, or 0.17 per cent, to 5,310.

The soft close extends on the prior session’s sharp 2.2 per cent fall and has the market on track for a fifth straight week of losses for the first time in two years.

Australian traders initially followed the strong lead from US markets after dovish comments from Fed governor Lael Brainard overnight, but moves were muted by the lack of a reaction on bond markets and US futures turning lower in Asian trade.

A downturn in the price of crude also weighed, with the energy sector failing to kick on from its early gains as a result.

Daniel Palmer

3.55pm:Govt to issue 30-year bond

The Australian government will issue its first ever 30-year bond in a bid to shave off billions of dollars in funding risks, despite offshore demand for local treasuries falling and as traders confront concerns around the sustainability of global quantitative easing programs.

As Michael Roddan reports, the leap into longer-dated funding instruments was unveiled on Tuesday by Australian Office of Financial Management chief executive Rob Nicholl, who detailed the department’s plan to push debt maturities further into the future.

Extending the date of bond maturities saves the country billions in funding risk. The AOFM has already lengthened the average maturity of its debt book to seven years, up from five years, in the process slashing around $12 billion a year from the country’s annual funding risk over the next five years.

Read more

3.25pm:The sell-off’s not over yet

Are Aussie traders more cautious than the rest? Maybe … they’re certainly keeping any risky behaviour to an absolute minimum today as the ASX ignores last night’s Wall Street rally.

“Where there is uncertainty in markets, investors will sit on the sidelines,” Lucinda Chan, Division Director at Macquarie, told BusinessNow.

“Right now there is cash in the market and nobody is really biting to put it in and that’s definitely why you see a little bit of a non-reaction today.”

“I think being defensive makes a lot of sense in the market when there’s so much uncertainty.”

Despite four weekly falls in a row on the local market, and a fifth looming, Ms Chan said 2016 could see more selling as nerves grip investors.

“I think we will see a little bit more profit taking. People are taking their money out and just holding it until they see what pans out in November in the US. I think the year will probably see some more selling, to some extent.”

It’s a dark state of affairs, according to the Macquarie equities division head, and some action (not talk) is needed from the Federal Reserve before calm will return.

“I wouldn’t be jumping in and buying yet because yesterday’s fall was quite steep but today there was no rebound … So people are very cautious.”

The S&P/ASX 200 swung into negative territory shortly after 3pm, and at 3.30pm was down 0.1 per cent at 5214.5 points, a fresh two-month low. It comes after the market rallied as much as 1.1 per cent at the open.

Yesterday saw the index tumble 2.24 per cent in a sell-off worth $34.5 billion.

3.10pm:Is a psychopath lurking in your office?

“Successful psychopaths” are hiding in the upper echelons of the corporate business sector, says an Australian researcher urging companies to begin psychologically screening job seekers.

Forensic psychologist Nathan Brooks said many businesses have their recruitment screening back-to-front by considering skills first and then the candidate’s personality.

Mr Brooks and his research colleagues think they have the answer for concerned businesses after developing a personality screening tool to use during the recruitment process.

Successful psychopaths are insincere, egocentric, charming and lacking in empathy or remorse.

Most damaging for business, they are more prone to engage in unethical and illegal business practices.

AAP

Read more

2.50pm:China data beats expectations

China’s industrial output growth accelerated in August, government statistics showed, exceeding expectations in an encouraging sign for the world’s second-largest economy.

Industrial production rose 6.3 per cent year-on-year, the National Bureau of Statistics (NBS) said, faster than July’s 6.0 per cent and above the median forecast of 6.2 per cent in a Bloomberg News poll of economists.

Retail sales, a key measure of consumer spending, rose 10.6 per cent in August, the NBS said, also ahead of expectations and the July figure.

The figures were a factor in a rise in the Australian dollar, which at noon was trading at US75.56c, up from US75.26c yesterday.

AFP

Read more

2.10pm:Stocks threaten to turn negative

Australian stocks are, remarkably, on the brink of slipping into negative territory for the day as this morning’s bounce continues to evaporate.

Wall Street rallied hard overnight following Friday’s sharp fall, which came on the back of comments from the Fed seen to be more hawkish than expected.

Australian stocks were caught in the global sell-off and lost 2.24 per cent — their fourth-worst day of the year and the nastiest fall since the Brexit shock.

But while Wall Street bounced back 1.5 per cent overnight, the ASX looks like it’ll be lucky to register a positive finish. As 2pm AEST the S&P/ASX 200 was just 0.1 per cent higher for the day at 5225 points.

Financials are weighing on the index, with CBA dropping 0.5 per cent, Westpac giving up 0.7 per cent, ANZ slipping 0.5 per cent and NAB falling 0.8 per cent.

Elsewhere, Telstra has dropped 0.2 per cent and CSL has lost 0.9 per cent.

BHP Billiton and Rio Tinto remain the bright spots of the big players, with the miners gaining 0.7 per cent and 0.5 per cent respectively.

1.29pm:The Star on a winning streak

The Star Entertainment’s winning streak against major rival Crown Resorts continues, with analysts tipping that the casino company offers the most attractive VIP exposure in Australia, writes Sarah-Jane Tasker.

Morgan Stanley has outlined in a global gaming report that The Star occupied a monopoly position in Sydney, which it said remains Australia’s premier VIP market.

The Star’s run rate VIP growth was around 23 per cent, whereas the Australian VIP market, excluding The Star, was around 10 per cent.

More to come

1.07pm:Is Woolies headed for $40 a share?

Long-time Woolworths bull David Errington today declared the retailer has turned the corner and predicts a 78 per cent increase in its stock price to $40 a share based on its turnaround.

John Durie reports that in a note today, the Bank of America Merrill Lynch (BAML) analyst said consensus forecasts for a further $200 million fall in Woolworths’ (WOW) earnings this year after last year’s $1.2 billion fall were too negative, predicting an increase this year.

Separately, JB Hi-Fi boss Richard Murray provided some more insight into David Di Pilla’s $750m deal to buy 81 Masters sites when the venture closes down in December.

Read more

12.38pm:ASX rally splutters as investors pause

The Australian sharemarket has seen its morning rally stumble into lunchtime deals as investors warily await an update on US monetary policy next week, Daniel Palmer writes.

At 12.10pm (AEST), the benchmark S&P/ASX 200 index climbed 21.4 points, or 0.41 per cent, to 5,241.

The modest recovery follows the market’s 2.2 per cent retreat yesterday, and barely takes a bite out of the 6 per cent lost over the past three weeks.

Australian traders initially followed the strong lead from US markets after dovish comments from Fed governor Lael Brainard, but moves were muted by the lack of a reaction on bond markets and US futures turning lower in Asian trade.

The big miners continued to lead the way despite the paring of morning gains, with BHP Billiton rallying 0.8 per cent to $20.10, Rio Tinto adding 0.5 per cent to $47.67 and iron ore miner Fortescue surging 4.1 per cent to $4.895 after announcing a further early debt repayment.

In energy, Santos turned lower, easing 1 per cent to $3.75, while Woodside traded steady at $27.57.

The big banks gave back their early gains, with the big four all around the flatline at noon after jumping as much as 1 per cent earlier.

In retail, Harvey Norman tacked on 0.6 per cent despite key rival The Good Guys falling into the hands of JB Hi-Fi.

Read more

12.26pm:Rio Tinto looks the goods, says Ord Minnett

Rio Tinto is looking attractive under Ord Minnett’s revised iron ore supply and demand forecast, with the analysts upgrading the stock to ‘accumulate’ from ‘hold’.

The ‘higher risk’ upgrade is based on Ord Minnett’s outlook that iron ore markets will only be “modestly oversupplied in the near term”. Analysts say higher Chinese demand will ease the situation, along with lower shipments from Brazil’s Vale.

The price target has been raised to $54 from $51 and the analysts say they maintain their preference for Rio Tinto over BHP Billiton, which retains its ‘hold’ recommendation.

12.02pm:‘Women talk too much’

“Poor blokes. They can no longer get a board seat unless they wear a skirt.”

This was one response given by a chair of an ASX 200 company in a letter to the Australian Institute of Company Directors when asked why the company had no women on its board, Glenda Korporaal reports.

AICD chair Elizabeth Proust retold the story at a lunch hosted by the Australian Israel Chamber of Commerce in Sydney yesterday.

She said the AICD had written to the chairs of ASX 200 companies which had no women or only one woman on their boards — some as many as four times — asking them why they didn’t have more women directors.

Other responses were: “We would rather have someone known to the board already.”

“Women aren’t reliable enough to be long-term board members.”

“Women talk too much and make the board meeting too long.”

“We don’t have to and we don’t want to appoint women to our boards.”

Read more

11.38am:Non-mining recovery slows

The momentum built up in the non-mining economy appears to be slowing despite an uptick in business confidence through August as the Reserve Bank cut rates to a new record low.

NAB’s monthly business survey revealed a modest two-point gain in the confidence index to +6, but current business conditions fell by the same amount to a reading of +7.

The slide in the current environment was driven by falls in both trading conditions and profitability, while the employment component of the index held steady.

Daniel Palmer

Read more

11.15am:A good deal for JB Hi-Fi

From Stephen Bartholomeusz’s column today:

The much touted JB Hi-Fi acquisition has finally happened and it has been struck on terms that both buyer and seller can be satisfied with and defend.

For the Muir family, which founded The Good Guys business 64 years ago, the $870 million purchase price represents a very healthy 11.7 multiple of enterprise value to normalised 2016 earnings before interest and tax.

For JB Hi-Fi, which had made it clear it wasn’t going to over-pay — the deal, it had said, had to make “compelling financial sense’’ for shareholders — that multiple is less than the 13.2 times 2016 EBIT at which it trades. In sharemarket terms, if The Good Guys’ earnings are valued by the market on the same basis as JB’s, it creates value even before any synergies are realised.

The logic of the acquisition for JB goes, however, well beyond the current numbers.

Read more

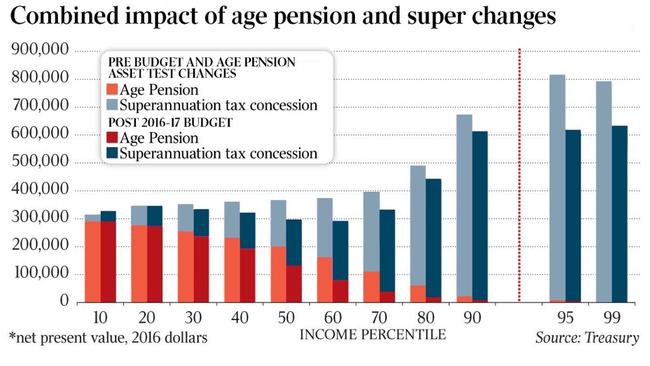

10.54am:Super, pension test changes will hit 70%

Seventy per cent of Australians would be worse off from a combination of tighter pension assets test and superannuation tax changes coming into force next year, a government briefing paper circulated to backbenchers says.

Glenda Korporaal reports that the paper, distributed by Scott Morrison to explain the federal government’s proposed super changes, shows people benefiting the most from the combined changes would be those on the lowest income levels.

The combined impact of the two changes means, however, that everyone earning above the bottom 30 per cent of incomes is worse off. The government’s superannuation proposals include retention of the Low Income Tax offset for people earning $37,000 and below, which was due to end in mid-2017.

10.25am:Stocks jump at the open

The Australian sharemarket has rebounded sharply from a Monday sell-off after comments from US Federal Reserve representatives appeased traders worried a rate hike was imminent.

At the 10.15am (AEST) official market open, the benchmark S&P/ASX 200 index recovered 54.4 points, or 1.04 per cent, to 5,274, while the broader All Ordinaries index rallied 53.7 points, or 1.01 per cent, to 5,372.8.

The reaction drags the local bourse away from a two-month low and has it again trading around levels seen at the start of this year.

Resources stocks turned from laggards to leaders despite mixed outcomes for commodities overnight.

Mining giant BHP Billiton rallied 1.7 per cent to $20.275, Rio Tinto rebounded 1.6 per cent to $47.15 and iron ore miner Fortescue surged 4.1 per cent to $4.895 after announcing a further early debt repayment.

In energy, Santos bounced 1.2 per cent to $3.835, Origin gained 0.6 per cent to $5.21 and Woodside lifted 0.5 per cent to $27.70.

The big banks all rose in early deals, although they lagged the broader market with gains of between 0.4 and 0.9 per cent.

Commonwealth Bank was again the leader, while NAB trailed its peers for a second day.

Daniel Palmer

10.15am:Westpac refunds $9.2m to customers

Westpac Banking Corporation has sent out its second multi-million dollar refund in as many weeks after the bank mistakenly levied young customers with fees which were meant to be waived.

Westpac refunded $9.2m to more than 160,000 customers of its parent bank and St. George subsidiary after the lender found it had failed to waive fees on a number of savings and transaction accounts over the past six years.

The error came as the bank relied on staff to manually apply waivers for customers below the age of 21 for monthly service fees on Westpac Choice transaction accounts and a waiver of the withdrawal fee applied to Reward Saver accounts. Around 130,000 customers were incorrectly levied with the fees.

Michael Roddan

10.00am:Fortescue pays down debt

Iron ore miner Fortescue has continued its push to slash debt during a period of relative stability in iron ore markets.

The Andrew Forrest-chaired group said today it would pay back a further $US700m ($925m) of its 2019 senior secured credit facility.

The partial term loan repayment adds to the $US2.9bn the group paid off last financial year and will result in annual interest savings of around $US26m.

Daniel Palmer

Read more

9.48am:NAB targeted in phishing scam

NAB customers are being warned about a new advanced phishing attack threatening to steal users’ login details, David Swan reports.

Cybersecurity firm Proofpoint said the new attack went beyond a simple faked page or socially engineered attempt to have users provide their credentials, and instead uses legitimate-looking lures combined with JavaScript encoding and decoding to avoid spam filters.

NAB customers have received emails with the subject “Yοur NAB account requires an additional verification”. The content of the email is designed to trick recipients into opening a HTML attachment to verify the login credentials for an account that might be suspended.

NAB has not yet picked up the attack, according to its fraud warnings website.

Read more

9.38am:Murray Goulburn lifts milk price

Battered dairy group Murray Goulburn has announced a step-up in the milk price offered to its farmers, bringing it closer to the industry average after a sharp clawback in recent months.

The news comes amid reports of farmers increasingly shunning the nation’s largest milk processor.

The step-up of 15c brings the price offered to $4.46 per kilogram of milk solids.

It still compares unfavourably to an offer of $4.75 from Fonterra, $4.80 from Warrnambool Cheese and Butter, $5 from Bega Cheese and more than $5 from Lion.

However, Murray Goulburn raised its full-year forecast from $4.45 to $4.88 per kg of milk solids.

Daniel Palmer

Read more

9.29am:Goldman sounds the alarm on bonds

From Robert Gottliebsen’s column today:

Shares are the froth and bubble of the American market, but the engine room is the bond market where institutional traders — using other people’s money — have been gambling hundreds of billions of dollars on a continuation of lower bond yields.

And it was in the bond market where a statement from Goldman Sachs had a big impact overnight.

Goldman Sachs, one of the world’s largest bond traders, put out a special bulletin listing three reasons why the US bond rout was going to get worse.

The Goldman statement followed the lines of my commentary yesterday signalling that the starter’s gun is now cocked to begin a very different set of scenarios for investing in Australia and around the world.

Read more

9.19am:Aitken’s big plans

Angus Aitken says he doesn’t want to be a “noisy’’ broker — ringing clients to try to generate trading activity on the back of corporate news — any more.

Instead, the former Bell Potter head of institutional sales is setting up business as a boutique adviser, aiming to guide no more than a dozen institutional and high-net-worth clients on long-term investing.

Mr Aitken has set up a business with former Bell Potter colleague John Murray, who is leaving as head of advisory boutique Lonsec to partner in Aitken Murray Capital Advisers from next month.

Andrew White

Read more

8.50am:JB Hi-Fi buys The Good Guys

Electronics goods retailer JB Hi-Fi has bought The Good Guys for $870 million after the whitegoods retailer ran a dual-track sales process.

The purchase, which was flagged by The Australian’s Data Room column last week, was announced to the market this morning and will see JB Hi-Fi strengthen its expansion into the whitegoods space.

JB Hi-Fi has already received the green light from the competition watchdog for the acquisition.

Daniel Palmer

Read more

8.44am:Cleanup begins after yesterday’s $34.5bn hit

Local stocks look likely to rally at the open following yesterday’s nasty $34.5 billion sell-off — the fourth-worst session of the year on the ASX 200.

Australian shares were caught in a global panic as Fed officials talked up the chance of an interest rate hike in September — something 85 per cent of Wall Street economists had thought wouldn’t happen.

Some swift repricing of the global market took place and the ASX lost 2.24 per cent in the fray, taking it to its lowest level since July 6 as practically all 2016’s gains were erased.

READ: Rate hike talk quakes global market

Today could be brighter, but we’re unlikely to see all yesterday’s losses return. The SPI 200 is pointing to a 1.5 per cent rise at the open but fair value suggests a 1.2 per cent gain is more likely.

Keep an eye on JB Hi-Fi at the open, with the retailer confirming it will buy rival The Good Guys for $870 million, while elsewhere Santos is said to be cutting around 600 jobs.

A big BHP bounce looks to be on the cards following yesterday’s 4 per cent drop — shares in the world’s biggest miner could gain 2.8 per cent according to its ADRs.

It’ll be interesting to see how the market reacts to multi-year lows hit by heavyweights CBA and Telstra yesterday — are bargain hunters starting to circle?

Late last month Morgan Stanley said CBA’s premium valuation to peers was “difficult to justify” and the market has taken those words to heart, with the country’s biggest stock plunging to a three-year low yesterday.

7.10am: Stocks tipped for strong recovery

The Australian market looks set to open sharply higher after Wall Street regained ground from its previous session’s plunge.

At 6.45am (AEST), the share price index was up 82 points, or 1.58 per cent, at 5,283.

US stocks racked up their strongest gain in two months overnight after Federal Reserve Board Governor Lael Brainard stuck to her dovish stance on interest rates and urged caution about removing monetary stimulus too quickly. Brainard’s speech followed earlier comments by Atlanta Fed President Dennis Lockhart and his Minneapolis counterpart Neel Kashkari in which they suggested there was no urgency to raise benchmark US rates.

Locally, in economic news today, Reserve Bank of Australia Assistant Governor Christopher Kent gives the Bloomberg Address in Sydney. The National Australia Bank’s monthly business survey is due out while the BIS Shrapnel Business Forecasting Conference is on in Brisbane.

No major equities news is expected.

In Australia, the market yesterday slumped to a two-month low as investors dumped stocks from all sectors on fears the US Federal Reserve could raise its key interest rate this month.

The benchmark S & P/ASX200 index lost 119.6 points, or 2.24 per cent, at 5,219.6 points.

The broader All Ordinaries index was down 121.4 points, or 2.23 per cent, at 5,319.1 points.

AAP

7.00am:Oil gains despite rising supply forecast

Oil prices rose overnight, joining the positive movement on equities markets despite a new forecast from producing countries for supplies to grow in 2017.

A barrel of West Texas Intermediate for October delivery rose 41 cents to close at $US46.29 on the New York Mercantile Exchange.

In London, North Sea Brent rose 31 cents to finish at $US48.32 per barrel for November delivery.

In its monthly market report, the Organization of the Petroleum Exporting Countries on Monday revised its 2017 forecast for non-OPEC oil supplies upwards by 350,000 barrels per day, indicating that, rather than contracting, supplies will now in fact grow by 200,000 to an average 56.5 million barrels per day.

“This year’s upward revision is due to US production holding up better than expected, while non-OPEC supply next year is set to get a boost from new production at Kazakhstan’s Kashagan oilfield,” Matt Smith of ClipperData noted in a blog post.

AFP

6.50am:Dollar recovers against greenback

The Australian dollar has regained some of the losses it suffered amid greater expectations of a US interest rate rise and concerns about the longevity of monetary easing in Europe. At 6.35am (AEST), the local unit was trading at US75.66 cents, up from US75.26 cents yesterday.

AAP

6.40am:Wall St rebounds after rout

US stocks climbed overnight, bouncing back in the wake of Friday’s turmoil that ended two months of calm.

The Dow Jones Industrial Average rose 240 points, or 1.3 per cent, to 18325 and the S & P 500 rose 1.5 per cent after their biggest declines since the UK voted to leave the European Union. The Nasdaq Composite gained 1.7 per cent.

The US recovery came after the Dow industrials and the S & P 500 closed at their lowest levels since July 7 on Friday, amid investor concerns that central banks around the world were running out of willingness or ability to prop up markets.

Some of those worries abated overnight.

Dow Jones

6.30am:European markets hammered

European stock markets slumped overnight, spooked by the prospect of a US interest rate hike as early as this month, and mirroring earlier falls in Asia.

Eurozone markets were also worried by signs that the European Central Bank has become less aggressive in its support for the economy, including with its huge quantitative easing program.

London’s FTSE 100 closed down 1.1 per cent, Frankfurt ended 1.3 per cent weaker and Paris slipped 1.2 per cent.

AFP

6.00am:Investors pressure funds on fees

A year of poor returns and fund outflows is having a bracing effect on the hedge fund industry: funds are now changing their business model and making fees negotiable as they try to ride out the market distortions of record low interest rates.

Heading for its first year of net outflows since the end of the global financial crisis in 2009, hedge funds have yielded to pressure from big institutional investors to improve the alignment of their interests, including clawbacks of fees.

Andrew White

Read more

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout