BusinessNow: Live coverage of financial markets and companies, plus analysis and opinion

Westpac assesses the impact of a Trump election win on markets as investors head for safe havens.

- Trump win ‘bigger than Brexit’

- Fortescue shares slump

- ASX slumps to 7-week low

- Domino’s Pizza chart screams ‘buy’

- ASX200 PE ratio hits 7-month low

- Macquarie behind MMG rights issue

- ASX chart paints dark picture

- Vitaco under ASIC microscope

- CSR H1 profit surges

- Virgin swings to loss in Q1

- October a ‘tough month’ for stocks

- Gold stocks in a purple patch

Welcome to the BusinessNow blog for Wednesday, November 2. The ASX 200 has cracked the 200-day moving average amid US political jitters, gold stocks are on the rise, and Inghams has repriced its IPO.

8.58pm:Nonbanks snatch US mortgage market

Banks no longer reign over the US mortgage market.

They accounted for less than half of the mortgage dollars extended to borrowers during the third quarter — the first quarter banks, credit unions and other depository institutions have fallen below that threshold in more than 30 years, according to industry analyst Inside Mortgage Finance. Taking their place are nonbank lenders more willing to make riskier loans banks now shun.

The shift reflects banks’ aversion to risk, especially in the mortgage market, in the wake of the housing meltdown and financial crisis. Banks also remain fearful of legal and regulatory threats that have cost them tens of billions of dollars in mortgage-related fines and settlements in recent years.

The change, though, gives rise to potential new dangers in the mortgage market. Chief among them is whether nonbanks have enough funds to weather a significant economic downturn in which missed payments on mortgages spike. Many of the loans these lenders are originating are effectively guaranteed by the US government, meaning that in the worst-case scenario taxpayers could be on the hook. Read more.

7.36pm:European markets recoil

Europe’s main stock dropped at the start of trading on Wednesday, with London’s benchmark FTSE 100 index down 0.5 per cent at 6,881.03 points.

In the eurozone, Frankfurt’s DAX 30 lost 0.8 per cent to 10,444.60 points and the Paris CAC 40 index shed 0.7 per cent to 4,437.99 compared with Tuesday’s close. AFP

7.02pm:UK plans fiscal headroom for Brexit

Britain’s finance minister Philip Hammond plans to adopt a flexible fiscal framework that would allow the budget deficit to rise should Britain’s exit from the European Union hit economic growth, the Financial Times newspaper reports. Citing an official close to cabinet discussions that took place on Tuesday, the FT reported that Hammond was planning only a modest fiscal stimulus in his Autumn Statement of policy later this month, but with room to do more if necessary.

“The goal is to create some headroom so it can be deployed if necessary,” the unnamed official was quoted as saying.

“The chancellor made it clear we face an unprecedented level of uncertainty.”

Reuters

6.41pm:Fed tipped to hold on rates

With voters set to choose a new president and Congress in six days, the Federal Reserve will likely keep a low profile when it ends a meeting Wednesday to try to ensure it doesn’t become part of the debate at the close of a tumultuous political campaign.

The Fed is expected to end the meeting with a policy statement that leaves interest rates unchanged. It’s possible that the statement will include a signal that a rate hike is likely at the Fed’s next meeting in mid-December as many expect. On the other hand, the Fed might decide to offer no hints Wednesday of a forthcoming rate hike in order to remain entirely neutral at a sensitive political moment.

“In the midst of an election, the last thing the Fed wants to do is add fuel to all the political controversy from the candidates,” said Sung Won Sohn, an economics professor at California State University, Channel Islands. Ms Sohn and other economists say they still think December is when the Fed will resume the rate increases it began late last year after having left its benchmark rate at a record low near zero for seven years. Next month’s meeting will include a news conference by Chair Janet Yellen, which would provide a platform for her to explain the Fed’s action and perhaps provide guidance on how many further rate increases the Fed foresees in 2017.

The economy has been showing some improvement lately. As measured by the gross domestic product, the economy grew at a 2.9 per cent annual rate in the July- September quarter, the government estimated last week, more than twice the rate in the April-June quarter.

The unemployment rate is 5 per cent, typical of a healthy economy, down from 10 per cent in 2009, and the housing market, whose meltdown triggered the 2008 financial crisis and the recession, has largely recovered.

Yet the Fed has sent no signal that a rate hike might occur this week. That is telling, analysts say, because the Fed under Yellen has carefully avoided catching investors off guard. AP

6.10pm:Global dairy prices hit 27-month high

Lucy Craymer

Global dairy prices have risen 11 per cent over the past two weeks to their highest since July 2014 as expectations grow that the recent dairy glut is coming to an end.

After hovering at historically low levels for much of 2016, prices have finally started to rally as farmers have culled herds to save money and bad weather in New Zealand and Australia has reduced the available milk.

The Global Dairy Trade Price Index, a benchmark of global dairy prices, rose 11 per cent from the previous auction on Oct. 18 to $US3,327 a metric ton. The GDT Price Index covers a variety of products and contract periods in the Global Dairy Trade auction, an international trading platform established by New Zealand’s Fonterra Co-Operative Group (FCG.NZ).

Whole milk powder rose an average of 20 per cent, while butter prices were up 4 per cent.

“Even the most jaded cynic has to be impressed by [the whole milk powder] rise,” said Commonwealth Bank of Australia in a note. Dow Jones.

5.46pm:Tokyo stocks slide

Tokyo shares closed lower on Wednesday, extending a global selloff sparked by an opinion poll that put Donald Trump slightly ahead of his market-favoured Democratic rival Hillary Clinton in the US presidential race.

The benchmark Nikkei 225 index lost 1.76 per cent, or 307.72 points, to end at 17,134.68, while the Topix index of all first-section issues fell 1.78 per cent, or 24.75 points, to 1,368.44. AFP

5.15pm:Aussie dollar dips amid US focus

The Australian dollar is lower against the US dollar as a narrowing in the polls on next week’s US presidential elections send jitters through global markets.

At 5pm (AEDT) on Wednesday, the local unit was trading at US76.31 cents, down from US76.54c on Tuesday.

Westpac senior currency specialist Sean Callow says markets have reacted negatively to polls suggesting Republican Party candidate Donald Trump still has a chance of beating Democrat Hillary Clinton in the November 8 election.

The Australian dollar had rallied after the Reserve Bank of Australia left the cash rate on hold on Tuesday, but then “rolled over”, he said. “While commodity prices for the most part are still supportive of the Aussie, for now the market’s attention is very firmly on the tightening race for the White House and what that might mean for regional trade, equity market sentiment, etcetera,” Mr Callow said.

“And when markets are nervous and equities are falling globally, then the Aussie tends to perform poorly - it is a very risk sensitive currency.”

Aside from the US presidential race, markets are waiting on the conclusion of a US Federal Reserve two-day meeting. The Fed is expected to keep US interest rates unchanged, but markets expect the Fed is likely to set the stage for a December rise. AAP

4.20pm:Stocks tumble on US election concerns

The Australian sharemarket has tumbled to a seven-week low, hampered by concerns around a potential Donald Trump election victory that are forcing global market volatility sharply higher, writes Daniel Palmer.

At the close, the benchmark S&P/ASX 200 index skidded 61.5 points, or 1.16 per cent, to 5,229, while the broader All Ordinaries index backtracked 64.2 points, or 1.19 per cent, to 5,311.

While markets have been focused on the US Fed and subdued global inflation and growth, it is major political events that threaten to cause the most disruption, with the uncertain US election coming on the heels of June’s shock Brexit vote.

3.36pm:Trump win bigger than Brexit: Westpac

With one week remaining before the year’s most anticipated political event – the US presidential election – Westpac says the outcome will be a bigger deal than Brexit, which rocked global markets in June.

“We believe a Trump win has larger long-term global ramifications than Brexit,” say Westpac economists and strategists David Goodman, Richard Franulovich and Sean Callow.

“A Trump presidency would bring about the biggest changes in many decades in existing US arrangements on everything from taxation policy, to trade policy, social spending, immigration and geopolitics.”

“Longer term, our baseline view is that a Clinton win would be more supportive for both immediate and long-run US growth prospects and thus also equity markets,” Westpac said.

“This also implies higher US yields, including the Fed funds rate. The US dollar is likely to be higher in 2017 under a Clinton administration but should slip back near term against the likes of AUD, NZD and CAD in response to a relief rally in risk assets. An aggressively protectionist trade policy is a key factor in our expectation that a Trump win would produce greater volatility and a weaker US dollar.”

3.30pm:Fortescue slumps as investors take profits

Fortescue Metals is seeing a rare and nasty down day as investors become skittish following a year of huge gains.

At 3:20pm AEDT the pure-play iron ore miner was 4.8 per cent in the red at $5.21 and is on track for its worst day since September 12.

Dalian iron ore futures point to a 1 per cent fall in the commodity ahead, which would wipe out most of yesterday’s 1.5 per cent rise.

Also weighing on investor minds is the move from major shareholder Hunan Valin to sell $354.8 million of exchangeable bonds.

Profit-taking could be seen as an understandable move given the stock has ripped more-than 200 per cent higher this year and is the second-best performing stock on the ASX 200, behind Whitehaven Coal.

3.19pm:Stocks sink on prospect of Trump victory

Australia’s S&P/ASX 200 has dived as much as 1.6 per cent to 5207.7 as investors contemplate a potential Trump victory in next week’s US presidential election.

A 1.6 per cent loss at the close would mark the biggest one-day fall in 7 weeks.

The losses in Australian shares are broad-based - and the local market isn’t the only one in the red.

In offshore markets, the MSCI Asia Pacific index is down 1.2 per cent, while US S&P 500 futures are down about 0.3 per cent.

Safe havens are up, with spot gold up about 0.2 per cent higher, while the Japanese yen is up about 1 per cent against the Mexican peso.

3.03pm:Picking stocks in Trump’s world

From Tim Boreham’s column today:

Forget the nags for another year.

On Wednesday afternoon, the results will trickle in on a race with a little more gravitas: the US presidential election.

While commentary understandably has centred on the broad economic implications of a Trump victory, it’s possible to pick some likely ASX winners and losers — albeit with generous imagination and extrapolation.

We’ll start with the prickliest topics...

2.30pm:ASX tightens listing requirements

The operator of the local bourse has finalised plans to tighten standards for admission to the ASX official list, writes Daniel Palmer.

In a statement outlining the changes, ASX Ltd said the new rules would help maintain investor confidence in the IPO market.

Among the changes is a stronger profit test that will see companies required to show consolidated profits of $500,000 for the 12 months prior to admission, up from $400,000 previously.

1.45pm:ASX 200 dives to 7-week low

Australia’s S&P/ASX 200 is down 1.5 per cent at a fresh 7-week low of 5213.2 amid increasing risk aversion globally.

US political jitters are growing after the ABC News/Washington Post poll showed Trump moved 1 per cent above Clinton after Friday’s announcement by the FBI that it reopened its investigation into Clinton’s use of an unauthorised email server.

The Mexican peso versus the Japanese yen — perhaps the best gauge of concern about a potential Trump winy — has fallen 1 per cent in Asia after falling 2.4 per cent overnight.

Meanwhile, gold stocks are among the best performers of the day amid the political uncertainty.

Regis, Resolute and Evolution are all up more than 4 per cent, while Newcrest has risen 1.23 per cent.

As we blogged earlier, IG is of the view that gold stocks are entering a purple patch.

The S&P/ASX 200 is fast approaching important technical support from the September trough at 5192.2.

1.10pm:Surfstitch in play as takevoer target

Troubled sportswear retailer Surfstitch has been put in play as a takeover target amid the receipt of a number of buyout proposals, with its shares surging 9 per cent on the news, writes Daniel Palmer.

The group said it had hired 333 Capital to advise on its strategic options as it considered unsolicited offers from several parties, including a group that has been building a stake in Surfstitch while commencing legal proceedings against it.

“The company has recently received a number of unsolicited, non-binding and indicative expressions of interest and these are being assessed as part of stage two of the strategic review,” Surfstitch said in a statement.

12.34pm:Domino’s Pizza chart screams ‘buy’

Domino’s Pizza now looks a ‘buy’ based on the charts.

After plunging 8.8 per cent to a seven-month low of $58.00, it’s now down 3.2 per cent at $61.59 on 14.65 million shares — 2.5 times normal volume.

The intraday low hit a weekly uptrend line drawn from the November 2014 trough at $21.30.

It also bounced off a channel line drawn parallel to the downtrend line from the record high of $80.69 in August.

The stock could remain under pressure this week while it stays below the July trough at $63.88.

But a close near the current price today will generate a major “hammer” pattern, which is bullish.

A break above the daily downtrend line near $69.00 would tend to suggest the short-term downtrend is ending.

Most analysts have a ‘hold’ rating with a consensus price target of $71.90.

That’s 15 per cent above the current level, so expect the recent share price fall to generate more ‘buy’ ratings.

12.10pm:Pension and super changes: Live Q&A

Australian investors face a double challenge over the coming months as two completely different sets of retirement rules get introduced. On January 1 the new rules for pension access will be applied, and those reforms will be followed on July 1 by the new rules which govern the taxation of both contributions and retirement income ... it’s the biggest change we have seen in more than a decade.

It is estimated more than 300,000 Australians will have their superannuation benefits reduced with the changes due on January 1. The plan is to increase the penalties in the super system for those with significant personal assets.

Nevertheless, with only weeks to go before this complex overhaul of the system gets underway there is widespread confusion among both professionals and investors — that’s why The Australian will be hosting a live Q+A for subscribers at 12.15pm today to cover all your questions on super.

Submit your questions to Wealth Editor James Kirby and tune in from 12.15pm for his responses.

12.00pm:Harvey Norman sales growth slows

Harvey Norman has largely retained the momentum from a record full-year result through the first quarter of fiscal 2017, although sales growth slowed from last year’s showing, writes Daniel Palmer.

For the three months to September 30, the retailer (HVN) logged a 6.6 per cent rise in sales to $1.69 billion, as its international operations were aided by strength in the New Zealand dollar but weighed down by a weak euro and faltering pound.

11.37am:Building approvals slump 8.7pc

Building approvals for September fell 8.7 per cent month-on-month, undershooting a 3 per cent fall expected by economists.

On a year-on-year basis, building approvals fell 6.4 per cent versus a 2.1 per cent fall expected.

This is a volatile series but approvals have been trending down since early 2014.

Here’s what the economists had to say about the data:

Residential building approvals fall by 8.7 per cent in September; recent activity has been very choppy #ausbiz #property pic.twitter.com/g4YiTyNGz2

— Callam Pickering (@CallamPickering) November 2, 2016

Building approvals remain strong - looks like the 2017 and 2018 glut of dwellings will be pretty substantial

— Stephen Koukoulas (@TheKouk) November 2, 2016

11.22am:Bega Cheese is stinking up the ASX

Bega Cheese is stinking up the ASX again today, with the company seeing another 5 per cent wiped off the stock as it finds its way to the bottom of the day’s equity pile.

At 11:10am AEDT, Bega was trading at $4.56, which takes its seven-day meltdown to 30 per cent.

Chairman Barry Irvin last week fronted investors with grim news about the health of the cheesemaker, warning of “headwinds”, “oversupply” and describing a “very challenging business environment”.

The shares swiftly collapsed, leading the company to have its worst week since it listed on the ASX in 2011. Today they slumped to a fresh 13-month low.

Not all investors are running for the exit, however, with Saxo Capital global macro strategist Kay Van-Petersen saying the sell-off is overdone and arguing it’s a good time to go long on Bega as one of the “few pure plays on the Asia protein trade”.

The ASX last traded 1.1 per cent weaker for the day at 5232 points.

11.10am:ASX 200 PE ratio hits 7-month low

The Australian sharemarket hasn’t been this cheap versus expected earnings since early April.

A 1 per cent fall in the S&P/ASX 200 index this morning has seen its one-year forward PE ratio fall to 15.37 times.

That’s below the June and September troughs of 15.43 and 15.5 respectively.

The projected one-year forward dividend yield has hit a 7-week high of 4.5 per cent.

That’s near the June and September peaks of around 4.59 per cent.

But the recent jump in bond yields has reduced some of the relative yield advantage of shares.

11.06am:Macquarie behind MMG’s rights issue

Macquarie Capital was behind the launch of a $US512 million rights issue for MMG on the market today.

The raising will see shares sold at $HK1.50 each, representing a 26.8 per cent discount to the last closing share price.

Major shareholder China Minmetals Corporation has provided an undertaking to take up its rights in relation to its 73.7 per cent interest in MMG.

Chief executive Andrew Michelmore said the fully underwritten rights issue would enable the company to strengthen its balance sheet, with the proceeds to be used to reduce existing debt and to fund project development.

It comes after the company embarked on its Las Bambas acquisition and development of the Dugald River zinc project.

Bridget Carter

10.48am:AMP directors buy stock

AMP directors Catherine Brenner and Holly Kramer bought AMP shares on Monday.

The pair bought 87,822 shares between them.

Their entry levels were $4.61 and $4.565 respectively.

It’s a vote of confidence after AMP shares hit a two-and-a-half-year low of $4.46.

AMP shares were last down 0.4 per cent at $4.50.

10.42am:ASX chart paints a dark picture

The ASX 200 has fallen 1 per cent to a new seven-week low, cracking the 200-day moving average amid US political jitters.

After bouncing off the much-watched moving average in June and September, the index has tentatively broken back below the 5262-point level. Technically, this suggests it could now test the September low at 5192.2 points.

But the index overall will continue to look range bound while 5192 holds.

June saw a false break of the 200-day moving average, in which it punctured the line by about 80 points over three days.

10.40am:Vitaco under the ASIC microscope

Vitaco has admitted the corporate watchdog is probing suspicious trading activity in the lead-up to the group’s announcement of a $314 million takeover by Shanghai Pharma and Primavera Capital, Daniel Palmer writes.

The Australian Securities and Investments Commission recently instigated an investigation into suspected insider trading ahead of the August agreement, focusing on parties close to suitor Shanghai Pharma.

“The alleged insider trading does not involve any of Vitaco’s officers or employees,” the Australian group confirmed.

Vitaco shares gained 0.5 per cent at the open to trade at $2.19. In the year to date the stock has fallen 17.4 per cent, but ripped 28 per cent higher over August 2-4.

10.16am:Collins Foods shares slide

Collins Foods reversed yesterday’s solid rise this morning despite analysts giving the fast food company’s expansion into Germany the tick of approval.

The stock fell 2.4 per cent this morning to $4.87, which cuts into yesterday’s 3.7 per cent rise — its best day since May 20.

Collins Foods acquiring 11 stores in Germany helps silence concerns around the company’s ability to expand its portfolio, according to Deutsche Bank, which maintained its ‘buy’ rating.

“We view CKF’s acquisition of 11 stores in Germany as a minor positive given the EPS accretive nature of the deal and the strategic entry into a new growth market which should create a beachhead for further accretive acquisition opportunities,” Deutsche’s Stuart McLachlan said.

On the other hand, it’ll take investors a lot to take their eyes off the company’s weakening Western Australia performance, according to UBS, which leaves its rating at ‘neutral’.

Analysts remain largely upbeat on the stock, with Bloomberg data showing four buy ratings, three holds and no sells.

10.11am:CSR shares jump 9pc on results, guidance

CSR shares rose as much as 9 per cent in early trade to a three-month high of $3.925 after strong interim results and full-year guidance.

Royal Bank of Canada analyst Andrew Scott says the interim result was 14 per cent better than he expected.

“This was a strong result that demonstrates that CSR is continuing to benefit from the housing market strength,” he says.

“Outlook implies upside to our above-consensus forecasts. We expect that the stock will trade higher on the back of this strong result.”

Strong results again demonstrate that CSR is continuing to ‘make hay as the sun shines on the Australian housing cycle’, he adds.

CSR shares were last up 8.3 per cent at $3.90.

10.00am:Mad Dog 2 approval ‘imminent’: BP

BP says approval of the big Mad Dog 2 oil project in the US Gulf of Mexico it owns with BHP Billiton is imminent and that costs have come down significantly from the previous $US10 billion estimate, writes Matt Chambers.

The US investment comes in the wake of BP’s sudden decision last month to walk away from its $1bn-plus plans to drill Australia’s most anticipated oil exploration wells in more than a decade, in the Great Australian Bight.

9.55am:CSR sees profit at top of estimates

CSR sees FY17 earnings before significant items at the top end of the $154m-$184m range of analyst forecasts.

That’s underpinned by its expectation of stronger building products earnings as the east coast housing boom continues.

Interim profit before significant items was $103.1m, up 12 per cent year on year, with building products EBIT up 29 per cent to $114.5m.

This guidance should see CSR share outperform in a down market today.

CSR last traded at $3.60.

9.49am:CSR H1 profit surges

Building products group CSR has reported a 12 per cent rise in underlying first-half profit aided by strength in the east-coast housing market, writes Daniel Palmer.

The positive six-month showing has enabled the group to deliver full-year guidance at the top end of analyst expectations.

For the six months to September 30, CSR booked a 48 per cent rise in net profit to $114.5 million, with last year’s number hampered by transaction costs to complete its bricks joint venture with Boral.

9.31am:Virgin swings to loss in Q1

Virgin Australia has swung to a loss in the first quarter, weighed by lacklustre conditions in the domestic market, writes Daniel Palmer.

For the three months to September 30, the second-largest domestic carrier booked an underlying pre-tax loss of $3.6 million. This compares with a profit of $8.5m in the corresponding period last year.

Restructuring charges exacerbated the net loss, which reached $34.6m for the quarter.

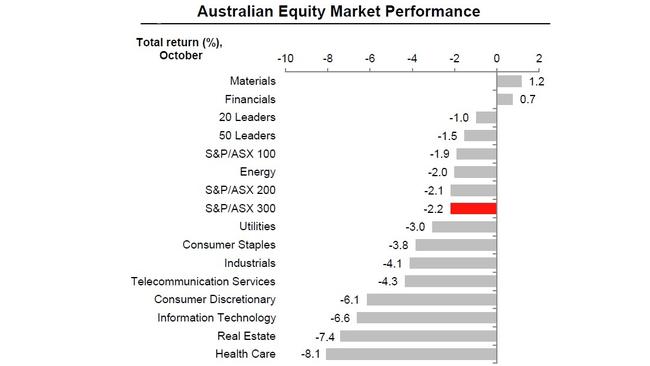

9.28am:October a ‘tough month’ for stocks

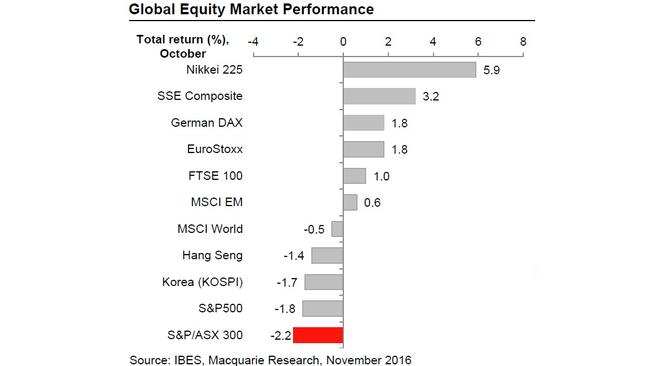

October was a “tough month” for Australian stocks, according to Macquarie, with an “indifferent” AGM season combining with a rise in bond yields to hurt investor confidence in stocks.

“The market had a tough month, falling 2.2 per cent with broadbased sector weakness and some heavy stock specific losses (AMP, CWN, HSO, TPM, WES),” Macquarie said.

“The equity market had to absorb an indifferent AGM season where, despite some positive guidance, corporates generally erred on the side of caution and a further rise in bond yields that proved unrelenting for the interest rate sensitive sectors despite having already suffered two months of declines.”

Even more concerning for investors is that, over the last five years, October has been the best performing month for the ASX 200 with an average 4.6 per cent gain. The market may have been hoping for a healthy month to boost a lean year — no such luck.

The Australian market skews towards yield stocks over growth, which is why when bond yields recover, local large defensive yield stocks like Transurban, Sydney Airport, Westfield, Scentre and Telstra tend to struggle.

Materials stocks emerged as the best performers in October as investors switched from yield to growth, despite Bloomberg’s commodity index losing 0.7 per cent in the month.

Fortescue continued its monster rally, gaining 11 per cent in October, which takes its year-to-date gain above 200 per cent.

Aussie equities noticeably underperformed global indices in October, with the Nikkei 225 seeing an impressive 5.9 per cent gain. The ASX 300 sits at the bottom of the pile, below a 1.8 per cent fall from the S&P 500.

9.21am:Buy gold stocks amid US uncertainty — IG

Gold stocks could be the best bet for equity traders while US political uncertainty is rising before the November 8 election.

“Goldman Sachs’ recent call to put Newcrest on its conviction buy list seems quite inspired now as gold stocks are coming into a bit of a purple patch,” says IG chief market strategist Chris Weston.

“That is where I would be hiding if I were trading equities, at least until we can find some answers to many of the questions the market desperately needs answers to.”

Spot gold hit a four-week high of $US1289.37 last night, closing up 0.9 per cent at $1288.2.

9.09am:Speedcast in raising to buy CapRock

Speedcast is raising $295 million to buy its US-based rival CapRock from Harris Corporation.

The deal was announced last night in the United States.

Credit Suisse and UBS are handling the accelerated renounceable rights offer, with shares offered at $3.10, a 21 per cent discount to Tuesday’s closing price.

The deal is valued at $US425m and will put the satellite communications provider Speedcast at the top of the maritime satellite services market.

Bridget Carter

9.05am:ANZ’s Asia exit gets tick from analysts

Despite spending hundreds of millions of dollars to offload its retail and wealth operations across Asia, ANZ won market support for the deal amid hopes of better returns from further asset sales and restructuring, writes Michael Bennet.

Unwinding some of the Asia presence built up by former chief Mike Smith, ANZ this week agreed to sell retail operations in Singapore, Hong Kong, China, Taiwan and Indonesia to Singapore’s DBS Bank and instead focus on the core institutional business in 15 markets across the region.

Andrew Triggs, an analyst at Deutsche Bank, said that with the book value at around $1.06bn, the deal was likely being struck at 0.7 times after including the hit from costs such as redundancies.

8.52am:Inghams reprices IPO

Inghams has repriced its initial public offering to 12 times forecasted annual earnings.

The company has support for a float at 13.5 times its annual earnings but the deal was repriced at $3.15 per share to ensure robust trade in the after market, sources said.

The bookbuild for the TPG Capital-owned business is scheduled for today.

TPG will maintain a 60 per cent holding in the company, taking the raising to $596.4 million, with the company’s enterprise value to be $1.6bn.

Once listed, TPG will hold 47 per cent of the business.

Fund managers had been indicating that Inghams would be repriced earlier this week, as first reported in DataRoom.

Bridget Carter

8.33am:Wall Street woes to weigh on ASX

The Australian index look set to dive back below the much-watched 200-day moving average at the open after Wall Street dropped as volatility whipped up ahead of this month’s US election.

The local SPI 200 is pointing to a 0.7 per cent fall, which would follow yesterday’s 0.5 per cent loss to take the local market below the 200-day moving average of 5260 — a close below that level could trigger serious concerns among investors.

US bonds and gold rallied overnight as investors seek safety amid the fierce presidential campaign — Donald Trump clawed back ground after the FBI reopened its investigation into Hillary Clinton’s email server.

BHP Billiton’s ADRs are pointing to a flat start, with the price of oil dropping over 1 per cent last night and the iron ore price gaining 1.5 per cent — the two moves might cancel each other out today in investors’ eyes.

Elsewhere the Aussie dollar is buying US76.55 cents, up from US76.07 cents this time yesterday.

7.40am:Vote fuels US investor worries

US investors are buying fear.

The CBOE Volatility Index, Wall Street’s fear gauge, is up for a sixth consecutive day to levels not seen since the UK’s surprise vote to leave the European Union.

Dow Jones

7.10am:Australian market tipped for weaker open

The Australian market looks set to open lower following a negative performance on Wall Street.

At 6.45am (AEDT), the share price index was down 31 points at 5,231.

Wall Street sold off sharply overnight, with the S & P 500 touching a nearly four-month low, amid growing concern over the impending US presidential election and prospects for higher US interest rates.

Locally, in economic news today, the Australian Bureau of Statistics releases September building approvals figures.

In equities news, CSR is expected to release half-year results while nib holds its annual general meeting in Sydney.

In Australia, the market yesterday closed lower as cautious investors await the US Federal Reserve’s decision on interest rates later this week and the result of the US presidential election on November 8.

The benchmark S & P/ASX200 index fell 27.2 points, or 0.51 per cent, to 5,290.5 points.

The broader All Ordinaries index also dropped 27.2 points, or 0.50 per cent, to 5,375.2 points.

AAP

7.05am:Oil market ‘in balance soon’

The global oil market should be balanced early next year, the president of Saudi Aramco said on Tuesday, after oversupply drove prices to multi-year lows in 2016.

“The gap between supply and demand is closing,” Amin Nasser, who is also the state-owned oil company’s chief executive, told an international energy forum.

AFP

7.00am:Iron ore price nears $US65

The iron ore price has continued its dizzying rise, notching up a fresh six-month high as some analysts start to become more bullish on Chinese steel demand, writes Elizabeth Redman.

Iron ore added 0.9 per cent to $US64.40 a tonne overnight, according to The Steel Index, from $US63.80 the previous day, while Dalian iron ore futures are still pointing higher. The last time iron ore settled at a higher level was on April 29, when it reached $US65.20.

6.55am:Dollar steady

The Australian dollar has hardly changed against the US dollar but has fallen against the yen and the euro.

At 6.55am (AEDT), the local unit was trading at US76.51 cents, down from 76.54 cents yesterday.

The local currency gained against its US counterpart after a more upbeat outlook from the Reserve Bank and better-than-expected Chinese economic data.

The currency yesterday sprung to an intraday high of US76.57 cents shortly after the RBA kept the cash rate at a record low of 1.50 per cent and released a neutral monetary policy statement.

It was upbeat about the economy and inflation outlook, with expectations inflation will pick up gradually over the next two years.

Chinese manufacturing and non-manufacturing purchasing managers’ indices for October beat expectations during early afternoon trade.

AAP

6.40am:Wall St dips on election worry

US stocks fell, while Treasurys and gold rallied as investors broadly retreated from risk overnight.

In Europe, stocks also fell as investors looked ahead to upcoming central bank meetings and uncertainty over the US election.

Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout