BusinessNow: Live coverage of financial markets and companies, plus analysis and opinion

TPG Capital will list Inghams Enterprises as a company worth between $1.3 billion and $1.5 billion.

Welcome to the BusinessNow blog for Tuesday, October 11. Among events today are the release of housing finance figures for August and Telstra’s AGM.

5.19pm:TPG to list Inghams at $1.3bn

TPG Capital will list Inghams Enterprises as a company worth between $1.3 billion and $1.5 billion.

The poultry producer will sell up to 70 per cent of its holding in the business but no less than 50 per cent.

A prospectus for the company will be released to the market on Wednesday ahead of a float on the Australian Securities Exchange in November.

The pricing range equates to between 13.5 times and 15.5 times the company’s forecasted earnings.

Net profit for Inghams is expected to grow 19 per cent for the 2017 financial year, with volume growth of 7.7 per cent over the same period.

The fruit and vegetable company Costa listed last year at a value that equated to 18 times its forecasted earnings, and the latest pricing range for Inghams places it on a similar footing to its smaller rival across the Tasman, Tegel Foods.

The pricing is also below the average for listed Australian top 200 companies at 16 times their forecated earnings, which average annual earnings of about 7.7 per cent.

Tegel, which listed earlier this year, and Costa, have both been used as comparables for the Inghams float.

However, some argue that Tegel is not a relevant comparable, given that it is one quarter of the size of Inghams and growth in the New Zealand market is far less.

5.07pm:TPG to sell down 50-70 per cent of Inghams

TPG Capital to sell down between 50 per cent and 70 per cent of Inghams Enterprises.

The group will list as one with a price equating to between 13.5 times and 15.5 times its forecasted earnings.

4.38pm:More broker rating changes

BHP Billiton cut to Neutral vs Buy - UBS

South32 cut to Neutral vs Buy - UBS

Qube Holdings initiated at Overweight - JPM

4.24pm:Stocks squeeze out another rise

The Australian sharemarket has eked out a second straight gain as a year-long high in crude prices drove enough interest in resources companies to offset a lacklustre session from the big banks and defensive sectors, Daniel Palmer writes.

At the end of trade, the benchmark S&P/ASX 200 index ticked up 4.4 points, or 0.08 per cent, to 5,479.8.

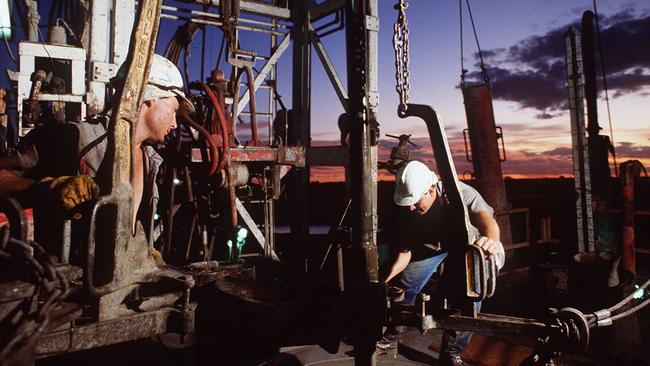

News of Russia potentially joining OPEC in curbing supply ensured a sea of green in the energy sector.

Santos surged 4 per cent to $3.94, Origin Energy bounded 4.1 per cent to $5.79, while Woodside added 0.7 per cent to $30.05.

Elsewhere, Oil Search rallied 3.4 per cent to $7.65 and Beach Energy climbed 2.8 per cent to 74.5c.

A rebound in oil prices extended to strength across the commodities space, with base metals surging offshore.

In materials, BHP Billiton leapt 1.7 per cent to an 11-month peak of $23.80, Rio Tinto advanced 2.1 per cent to an 11-month closing high of $53.20 and Fortescue jumped 3 per cent to $5.18.

Action in the finance sector was more subdued, with Westpac and ANZ off 0.4 per cent and 0.3 per cent, respectively, while Commonwealth Bank and NAB ended broadly steady.

Among other blue chips, Telstra slid 0.4 per cent to $5.05, while Qantas weakened 1.3 per cent to $3.14 on surging oil prices.

Elsewhere, UGL shares won 0.3 per cent amid hopes a rival bid could emerge to challenge a $524m play for control by CIMIC, while CSL lost 1.1 per cent as defensive stocks fell out of favour.

Meanwhile, the Australian dollar ended the local session at US75.5c, slumping half a cent on weak local housing data and strength in the US unit.

3.03pm:Aussie dollar dives to three-week low

The Australian dollar has given up a half a US cent in value today as the greenback regains strength.

At 3pm AEST the Aussie was buying US75.50 cents, down from US76.07 at 7am. It is now trading at a fresh three-week low.

The ASX 200 has followed a similar path today, dropping from a six-week high earlier today to struggle to maintain positive ground with an hour remaining.

2.41pm:Safety stocks are becoming dangerous

From earlier today

UBS says investors should stay cautious on “defensive yield” stocks in the property, utilities, infrastructure and telco sectors because they remain highly correlated with bond yields which have been rising from extremely low levels since July.

These sectors remain the largest underweight position in the firm’s model portfolio given the size of the rally over the past four and a half years, the still tight observed correlation to bonds and the still very low yields prevailing in the bond market.

While UBS strategists expect both the Fed and the ECB to be gradualist in their withdrawal of stimulus while the growth backdrop still appears tepid, so that any further bond yield back up should be moderate rather than severe, they caution that the ‘taper tantrum’ of 2013 showed that ‘weight of money’ can move bond yields significantly even if the global policy shift is gradual and the macro backdrop remains relatively benign.

Read the full post from 9.44am here

2.35pm:Stocks drift away from today’s six-week high

A strong sessions from BHP Billiton, Rio Tinto and the energy sector isn’t enough to see the ASX 200 hold its gains today, with the index sliding towards neutral ground in afternoon trade.

At 2.21pm AEST the S&P/ASX 200 was just 0.1 per cent higher for the day at 5480.7 points after hitting an almost six-week high of 5498 points earlier in the session.

Another jump in the price of oil following further talk of production cuts from OPEC, and now Russia, lit a fire under the energy sector, while a healthy jump in the price of iron ore has seen BHP and Rio Tinto get in on the action.

The energy sector has gained 2.3 per cent, while BHP is up 1.5 per cent to a fresh 11-month high of $23.75, while Rio Tinto struck a new six-month high after gaining 2 per cent.

Origin Energy is 4 per cent higher, Santos has lifted 3.7 per cent and Oil Search is up 3.5 per cent.

The big four banks has slipped into negative territory, with Westpac and ANZ both weighing on the market with a 0.5 per cent fall.

CSL isn’t helping — it’s down 0.8 per cent, while Transurban gives up 0.7 per cent, Brambles falls 0.9 per cent and Macquarie Group loses 0.5 per cent.

1.41pm:Businesses shrugged off the last rate cut

The August interest rate cut appears to have had little impact on business confidence in

September, with sentiment remaining steady, Daniel Palmer writes.

NAB’s latest monthly business survey showed a continuation of recent trends as dominant service sectors such as home construction outperform, the resources sector wavers at the end of the mining boom and the retail industry shows signs of weakness.

1.25pm:Telstra’s Mullen passes the AGM test

More from our tech editor Supratim Adhikari, who is covering the Telstra AGM

Telstra’s new chairman John Mullen has put in a solid performance in his first annual general meeting, announcing a brand new way the telco intends to measure customer satisfaction and sending a very clear message to Vodafone Australia and the ACCC.

Until now, strategic Net Promoter Score (NPS) has been the only metric that Telstra has relied on to measure customer satisfaction. The metric has also been directly tied to executive remuneration. However, Mr Mullen said that Telstra will now use an additional metric — Service Experinece Index (SEI) which will measure the experience a Telstra customer has when using a service.

“We already measure these experiences as part of our NPS program … and the overall quantum of the customer will remain unchanged.

“So we are going to measure what Telstra customers think of Telstra as a whole and how they rate their individual experience and action with the company,” Mr Mullen said.

On regulated mobile roaming, Telstra’s management said its shareholders should make their concerns known to the ACCC, once the regulator releases the issues paper on the move.

Judging from the sentiment on display at the AGM, shareholders aren’t likely to mince their words on what they think of Vodafone’s instigations and what the ACCC should do with its inquiry.

1.00pm:Housing investors outpace owner-occupiers yet again

The value of home loans issued in Australia weakened 1 per cent in August, with a 1.6 per cent skid in owner-occupied housing finance offsetting a 0.1 per cent rise in investment housing loans, according to official ABS numbers, writes Daniel Palmer.

Investment finance has now outshone owner-occupied finance for four straight months, belying talk of a tightening of loan condition to investors by the banks.

Read more

12.04pm:Here’s what’s happening on the ASX right now

Despite weak trading volumes on the back of US and Chinese holidays, the Aussie market is pushing higher thanks to investors diving back into riskier options.

“Investors are chasing growth related stocks, while former favourites such as Healthcare and Property languish. Holidays overnight in North America and in China today are dampening trading volumes,” CMC Markets chief market strategist Michael McCarthy said.

“Iron ore stocks are in demand following further gains for the red metal. However, South 32 is leading the majors with an almost 4 per cent gain. Energy stocks are the top performers, and the sector is top of the table with a 2 per cent jump. Banks are also in positive territory. These three groups account for most of the gains, leaving the rest of the market chequered.”

“The gains come despite, or possibly inspired by, an Australian dollar slip below US76 cents. This weakness is hard to explain in light of commodity strength and support for the Canadian dollar and the Norwegian Krone,” Mr McCarthy said.

“If the gains in mining stocks stick, the AUD may have to play catch up.”

11.56am:Telstra could throw big money at customer service

More from our tech editor Supratim Adhikari, who is covering the Telstra AGM

Telstra has flagged a potential increase in how much money it will pour into improving its customer service, with Chairman John Mullen acknowledging that the telco needs to lift its game.

Customer service the perennial bugbear of Telstra customers predictably raised shareholder ire at the telco’s AGM, with questions raised about the proficiency of telco’s field force and complain resolution process.

“We have spent billions in improving our networks but now we have to make a similar sort of investment in customer service,” Mr Mullen said.

“We understand there is a problem with customer interactions, we measure all of the complaints we get and 40 per cent of executive remuneration is based on this.”

“As you can see in the annual report we went backward by 4 points (in fiscal 2016) and nobody got any bonuses on that,” he added.

Read more

11.46am:oOh! to raise $64.5m for takeover

Outdoor advertising group oOh!Media will pursue a $64.5 million capital raising to fund the acquisition of smaller rival Executive Channel International (ECN), Daniel Palmer writes.

The purchase of ECN, a digital out of home media group, for $68.5m will come through oOh!Media (OML) subsidiary Inlink Group.

Read more

11.31am:Telstra grilled on mobile roaming plan

Regulated mobile roaming is making some Telstra shareholders very jittery, with the issue dominating the telco’s annual general meeting, writes The Australian’s Technology Editor Supratim Adhikari.

One vocal shareholder has urged the telco to fight the ACCC to the hilt, while another has asked fellow shareholders to put pressure on politicians to get involved.

Telstra chairman John Mullen said that the telco’s board will leave no stone unturned in ensuring that shareholders are not short-changed.

But it wasn’t all bouquets for Telstra’s management with one shareholder, a small business owner, railing against Telstra’s processes when it comes to fixing faults and a few questions on whether the telco can ride out the impact of the National Broadband Network (NBN).

Mr Mullen said he was confident that Telstra can ride out the pain as its fixed line monopoly is put to rest and a more competitive mobile market.

“If you look at the track record of Telstra it has an amazingly strong performance of offsetting similar trends in the past.” he said.

At 11:30am AEST Telstra shares had lost 0.2 per cent to trade at $5.06.

Read more

11.18am:Market giants strike multi-month highs

It’s a big day for some of the market’s heaviest stocks, with BHP Billiton, Rio Tinto touching fresh multi-month highs.

At 11:05am BHP stock was 1.2 per cent higher for the day but earlier jumped as much as 2 per cent to an 11-month high of $23.87.

Meanwhile, Rio Tinto’s 1.3 per cent rise has been enough to take it to a six-month high of $52.77.

Over in the banking space ANZ also remains within inches of the 11-month high it hit yesterday. The bank shares are almost flat today but, at $28.35, they’re around the highest they’ve been since late October last year.

At 11:17am AEST the broader S&P/ASX 200 was 0.3 per cent higher at 5492 points.

10.57am:Telstra bosses fire up against ACCC

Telstra head honchos John Mullen and Andrew Penn have ratcheted up their rhetoric against the ACCC’s move to explore the prospect of regulated roaming, with Mullen saying that regulator’s enthusiasm will come at the expense of Telstra shareholders,” The Australian’s Technology Editor Supratim Adhikari writes.

He has also asked shareholders to share their view with the ACCC during the inquiry process.

Meanwhile, Penn has warned that regulated roaming is a threat to the government’s mobile black spot program.

Another point: Telstra’s board is now a tad lighter with the departure of Singapore-based director Chin Hu Lim is leaving the telco, citing family commitments. Mr Lim was a non-executive director at the telco since August 2013 and joined the board in October 2013.

10.35am:Telstra reaffirms guidance, says outages ‘unacceptable’

Telstra has reaffirmed its full-year guidance at its annual general meeting in Sydney while tagging this year’s raft of network outages as an ‘unacceptable’ outcome for customers, writes Daniel Palmer.

The telecommunication giant’s customers endured seven significant outages through the first half of calendar 2016, ultimately leading to a ramp up in capital investment from Telstra and the departure of high-profile executive Kate McKenzie in July.

Telstra chief executive Andy Penn said the complexity of its network meant issues were inevitable, but the extent of disruption this year was excessive.

“Telstra’s network in Australia includes approximately 230,000kms of optical fibre cabling, 170,000 routers and switches, over 8,500 mobile network sites and more than 5,000 exchanges. With this level of complexity, occasionally issues do occur,” he said.

“However, these interruptions had a wider impact than is acceptable and we have apologised for that.”

10.33am:Energy pulls ASX higher

Investors are making the most of the latest jump in the oil price, with local energy stocks leading the ASX higher this morning.

At the 10.15am (AEDT) official market open, the benchmark S&P/ASX 200 index advanced 17.5 points, or 0.32 per cent, to 5,492.9.

IG market analyst Angus Nicholson said the prospect of Russia joining with OPEC in agreeing to supply curbs would prove a positive for Australian resources companies, even if the optimism proves temporary.

“The Brent oil contract jumped to its highest level this year overnight after Russia said it was prepared to join an OPEC supply deal after it is finalised in November,” he said.

“The rally was purely sentiment-driven as the details of how this would actually work are still pretty thin on the ground, but given Russia is the biggest oil producer in the world any deal that gets them to cut back will be seen as a big positive for the oil market.”

The energy sector gained 1.9 per cent, with Santos’ 4.5 per cent gain making it the best performing stock in the ASX 200.

Beach Energy rose 3.1 per cent and Origin gained 3 per cent.

BHP Billiton strongly beat its ADR, with shares in the world’s biggest miner gaining 1.5 per cent to $23.76, while Rio Tinto gained 1.1 per cent after the price of iron ore shot up overnight.

The big four banks, meanwhile, opened only slightly positive.

9.58am:Iron ore launches out of week-long break

Iron ore has burst out of its week-long holiday, with the price of the steelmaking commodity jumping back above $US55 a tonne.

The price of iron ore delivered to the port of Qingdao in China rose 1.4 per cent to $US56.65, while Tianjin iron ore was trading 2.6 per cent higher at $US55.80.

BHP Billiton is heading for a 0.9 per cent rise, according to its ADRs, with the oil price adding to positivity around resources stocks.

In London trade, BHP Billiton jumped 2.8 per cent, while Rio Tinto rose 2.1 per cent. The diversified miners also got a boost from a rise in the oil price after Russia backed global moves to limit output.

9.44am:Be careful with defensive yield. says UBS

UBS says investors should stay cautious on “defensive yield” stocks in the property, utilities, infrastructure and telco sectors because they remain highly correlated with bond yields which have been rising from extremely low levels since July.

These sectors remain the largest underweight position in the firm’s model portfolio given the size of the rally over the past four and a half years, the still tight observed correlation to bonds and the still very low yields prevailing in the bond market.

While UBS strategists expect both the Fed and the ECB to be gradualist in their withdrawal of stimulus while the growth backdrop still appears tepid, so that any further bond yield back up should be moderate rather than severe, they caution that the ‘taper tantrum’ of 2013 showed that ‘weight of money’ can move bond yields significantly even if the global policy shift is gradual and the macro backdrop remains relatively benign.

“Equities have historically shown a tendency to be vulnerable to sharp shifts in bond yields but have been able to rise in the face of moderate and gradual shifts in bond yields, particularly if the growth outlook brightens,” UBS equity strategists David Cassidy and Dean Dusanic say in a report.

They note that defensive yield sectors have fallen quite sharply since the start of August.

Large cap defensive yield stocks that have suffered the biggest falls include APA Group, GPT Group, Transurban, Scentre Group, Vicinity Centres, Spark Infrastructure, DUET, Sydney Airport, Westfield, AusNet, Dexus, Stockland, Goodman, Mirvac and Investa.

9.24am:Fortescue’s costs to fall further, says Macquarie

Fortescue’s cash production costs for the September quarter should fall to $US13/tonne vs $US14.3/tonne in the June quarter, according to Macquarie.

Such an improvement (9%) could be a positive share price catalyst if it beats consensus, even though Macquarie expects shipments to fall marginally.

The broker also sees “material upside risk” to its base case forecasts under a spot price scenario, particularly for FY18, although the spot iron ore remains above the broker’s expectations.

“Fortescue is currently trading on FY17E P/E of 8.2x and EV/Ebitda of 4.3x, and a free cash flow yield of 14%,” the broker says.

“At spot prices, FY17E multiples improve to 7.3x P/E and 4.0x EV/Ebitda, and the free cash flow yield rises to 16%.”

“More significantly at spot prices, FMG’s gearing falls to 28% by end of FY17 and the company would move to net cash by FY20”.

9.17am:Broker rating changes

Sealing Travel raised to Buy vs Hold — Bell Potter

Mayne Pharma raised to Buy vs Neutral — UBS

BHP Billiton (UK listing) raised to Buy vs Neutral — SBG Securities

Western Areas cut to Sell vs Outperform — CLSA

Ansell cut to Neutral vs Buy — UBS

8.44am:ASX full of energy

Local energy stock will be worth keeping an eye on this morning, with gains in the oil price boosting Wall Street and likely to filter through to the Aussie market this morning.

The SPI 200 is pointing to a 0.4 per cent rise, but fair value suggests it could be a slightly better start than that.

US crude prices climbed 3.1 per cent to $US51.35 a barrel, their highest closing value since July 2015 after Russian President Vladimir Putin supported international efforts to limit oil supply.

It’s a live situation, however, and many analysts expect oil-price volatility ahead of a key meeting between world petroleum companies and oil producers in Istanbul this week.

US energy shares rose 1.5 per cent, with Exxon Mobile and Chevron among the best performers.

By pushing higher today Australian energy stocks would be adding to an already strong run, with Origin Energy, Woodside Petroleum and Beach Energy all gaining more than 2.5 per cent in the last five days.

7.05am:Wall St rallies as oil gains

US stocks rose as a fresh climb in oil prices spurred gains in shares of energy companies.

European stocks also got a boost from the gains in oil, while investors cheered the falling pound which could lift the earnings of exporters.

Dow Jones

6.55am:Iron ore leaps back above $US55

The iron ore price has jumped back above budget estimates as traders return to their desks after a week-long public holiday in China, Elizabeth Redman writes.

Iron ore rose 2.6 per cent to $US55.80 a tonne overnight, according to The Steel Index, from $US54.40 in the previous session.

6.45am:Dollar creeps up

The Australian dollar is higher against the greenback, again lifting above US76 cents.

At 6.35 (AEDT), the local unit was trading at US76.03 cents, up from US75.96 cents yesterday.

AAP

6.40am:Putin backs oil output cut

Russian President Vladimir Putin sent oil prices rising overnight by voicing his support for curbs on petroleum output, a prospect that has proved difficult for Moscow to carry out in the past.

Mr Putin said Russia, which pumps more crude oil than any other country, was ready to “join common efforts to limit oil production and urges others to as well.” His comments came a little more than a week after the Organization of the Petroleum Exporting Countries, a 14-nation cartel that doesn’t include Russia, agreed to a modest cut in its collective output of 1 per cent to 2 per cent.

Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout