BusinessNow: Business news, plus analysis and opinion

Rallying 78pc since August last year, Morgan Stanley says the company’s shares are in for a reality check.

Welcome to the BusinessNow blog for Friday, May 19.

4.30pm: ASX shakes under global tension

The Australian index has seen its worst week since early November as US political fears send shockwaves through what had been a relatively placid market.

The S&P/ASX 200 rallied from a steep early fall on Friday to close just 0.2 per cent in the red, but still chalked up a 1.9 per cent loss over the week, to finish at 5727.4 points.

Major financial stocks did much of the damage as several banks traded ex-dividend through the week, while commodities stocks outperformed.

ANZ was the hardest hit of the big four on Friday, losing 1.9 per cent to $28.50, while CBA gave up 0.7 per cent to $80.23, Westpac dropped 1 per cent to $30.85 and NAB fell 0.6 per cent to $30.38.

BHP Billiton rose 1.4 per cent to $24.28, Rio Tinto gained 2.2 per cent and Fortescue shot up 5.6 to $5.24 amid rising commodity prices.

Wesfarmers and Woolworths dragged, down 0.9 per cent and 1.1 per cent, respectively, while Telstra lifted 0.5 per cent to $4.43.

Key wages and employment data failed to make much of a splash this week as investors’ attention remained glued to the White House and concerns over the stability of Donald Trump’s presidency.

“Markets have clearly decided that the US political situation has the potential to knock stock valuations off their relatively high perch.” CMC Markets chief analyst Ric Spooner said.

3.50pm: Why CLSA says banks are ‘overbought’:

CLSA has upgraded NAB and Macquarie (MQG) to ‘buy’ verusus ‘outperform’ following recent share price falls.

However, it remains remaining underweight the banking sector, which is “over-earning”,”undercapitalised”, “over-distributing” and “over-bought”.

CLSA analyst Brian Johnson notes banks are experiencing sub-cycle loan loss charges, supercharged financial markets trading contributions and forward NIM pressures.

He also points to APRA’s “unquestionably strong” settings are due in “coming months”, their dividend payout ratios above 70 per cent, and have been overbought by “structurally underweight index seeking international institutions”.

Mr Johnson notes that Australian bank share registers are skewed to “sticky” domestic retail investors who are disinclined to sell, leaving institutional investors structurally underweight.

But in his view their earnings aren’t positively leveraged to rising bond rates, and face the prospect of slowing system credit growth, and hence revenue growth, should house prices stop rising.

“Regulatory reforms, particularly the liquidity coverage ratio, net stable funding ratio and declining access to the cheaply priced Committed Liquidity Facility will pressure net interest margins, all the more so given the bank levy from July 2017,” he adds.

“Writebacks on previously provisioned impaired loans see loss charges at cyclical lows, the non-recurrence of which will see losses rise at some point.”

He notes that APRA will disclose what its “unquestionably strong” settings will entail in coming months, and his view banks are A$17bn short of CET1 plus an additive capital shortage should housing risk weightings rise.

First half earnings were rescued by “turbocharged markets trading contributions from bonds, electricity and positive debt value adjustments, which aren’t likely to be sustainable.

“Fears of a collapse in the Australian housing bubble are resurfacing,” Mr Johnson adds. “We are concerned regarding WA housing and apartment settlement risk in Melbourne and Brisbane.”

“Australian banks’ 70 per cent plus dividend payout ratios are vulnerable to normalising earnings from loan losses, financial markets trading, declining NIM and higher capital intensity.”

“This could see dividend cuts greater than earnings per share cuts. Given that EPS/DPS growth is set to slow Australian banks are still not cheap.”

2.45pm: Computershare in utopia: Morgan Stanley

Computershare is due for a fall, according to Morgan Stanley analyst Daniel Toohey, but few other analysts seem to agree.

A total of 14 analysts cover Computershare (CPU), according to Bloomberg research, and Mr Toohey is the only one with a sell rating. Credit Suisse and Morgan Stanley are among those with a buy rating.

He sees a 70-80 per cent chance the share price will fall relative to the country index over the next 60 days.

“This is because the stock has traded up recently, making short term valuation much less compelling,” Mr Toohey said.

“Computershare is trading slightly below our $15 bull case value. This assumes eight US fed rate hikes, 20 per cent fed tax rate, better than expected execution on costs captured in the earnings, and AUD/USD of $0.65c. With the stock priced for perfection, we flag downside risk.”

Today has seen Computershare gain 0.9 per cent to $14.50 at just after 2pm AEST.

The stock rallied as much as 78 per cent between the August 2016 low and May 10, but has since slipped almost 6 per cent.

2.25pm: LISTEN: The Money Cafe

Listen in as Kirby and Kohler discuss the spectacular ATO scandal, the power play behind the sudden bidding war for Fairfax, whether or not Amazon is a good buy and just what exactly it would take for Trump to really rock markets.

Find all episodes of The Money Cafe and subscription links here.

1.30pm: $1bn suit launched at Energy Australia

Queensland Investment Corp has launched an almost $1 billion claim against Energy Australia over the sale of Lochard Energy after it failed to disclose capacity problems at the Iona underground gas storage facility, Andrew White writes today.

QIC has alleged that despite suffering capacity problems at the time of the sale in October 2015, Energy Australia, failed to make the information available to bidders in the 2015 sale.

Proceedings lodged in the Supreme Court of Victoria this morning allege that despite being aware of the information EnergyAustralia made “express contrary representations” during the sale process.

12.32pm: ASX 200: Worst week since October?

Australian stocks are on track for their worst weekly fall since October last year as the S&P/ASX 200 unwinds a further 0.5 per cent at lunch.

With an afternoon of trade remaining, the local market has dropped 2.15 per cent this week to 5711.3 points. The sell-off has so far stopped short of yesterday’s two-month low underneath 5700 points.

Strong gains from BHP Billiton and Rio Tinto are not enough to offset further falls in major banks and retailers. BHP has today gained 1 per cent, Rio Tinto has shot up 2.1 per cent, while CSL and Telstra have edged 0.3 per cent and 0.1 per cent respectively.

ANZ is the hardest hit of the big banks today, down 1.9 per cent for the day, while CBA drops 0.8 per cent, Westpac loses 1.2 per cent and NAB slides 0.8 per cent.

Woolworths is down 1 per cent and Wesfarmers has given up 0.9 per cent.

Here’s how the biggest stocks on the index have gone so far this week:

11.45am: Credit Suisse calls for ‘multiple’ RBA cuts

Damien Boey is sticking to his non-consensus view that the RBA needs to cut rates “multiple” times this year.

“For what it is worth, our cash rate model currently points to one further cut,” the Credit Suisse strategist says.

“However, because of our belief that fulltime employment gains have been significantly overstated, we think that our output gap proxy understates the amount of slack in the economy.”

“Indeed, very soft private sector wage outcomes are consistent with the wider view.”

Overnight index swaps price the chance of a 25 basis cut by year end at 10.3 per cent.

The chance of a hike is close to zero according to Bloomberg data.

9.45am: Brekky Wrap: Worst week in 6 months?

Australian stocks are heading for another disappointing session this morning and are on track to record their worst week in over six months.

The SPI 200 is pointing to a 0.1 per cent drop, while fair value suggests a 0.3 per cent decline is more likely.

In the week to yesterday’s close the S&P/ASX 200 has lost 1.7 per cent, which puts it on track for its worst weekly fall since early November.

“Our opening call then for the ASX 200 sits 5722 points, so a somewhat softer open and it seems a tall order to close above 5836 points and stop what is looking like the first back-to-back loss in the Aussie equity index since January,” IG chief strategist Chris Weston said.

“It’s all eyes on banks again and after an 8 per cent pullback (in the financial sector) one questions if we do start seeing some brave soul starting to wade back in. The shorts will certainly be watching price action and any signs of buying will likely cause a few to cover,” Mr Weston said.

So far this week Sirtex Medical has seen the biggest fall, down 31.8 per cent after its latest liver and colon cancer drug tests fell flat, while Fairfax has seen its shares jump almost 16 per cent as a bidding war emerges for the media company.

Miners, particularly in the gold space, have been benefiting from heightening political tension in the US and a market shift to safety.

9.30am: APN, oOh!media merger plans dropped

Outdoor advertising group oOh!media Ltd. (OML) on Friday dropped plans to combine with APN Outdoor Group Ltd. (APO) to create a $1.6 billion Australian dollar company that would have dominated one of the fastest-growing sectors of the Australian media industry.

The Sydney-based companies said initial concerns voiced by the Australian Competition & Consumer Commission made the deal too risky. Making material concessions to secure the regulator’s support would have undermined the deal’s benefits, they added.

Dow Jones Newswires

9.08am: Origin sale lifts divestment to $1bn

Origin Energy has announced this morning it is currently in agreement to sell its Darling Downs Pipeline Network for $392 million to Jemena Gas Pipelines.

Origin (ORG) had originally announced an asset divestment program in September 2015 targeting a total of $800 million, however this latest sale lifts the total value of the program to well above $1 billion, according to a release the company submitted to the ASX this morning.

9.00am: Broker ratings changes

NAB (WBC) raised to Buy vs. Outperform- CLSA

Macquarie (MQG) raised to Buy vs. Outperform — CLSA

Sirtex (SRX) raised to Buy vs. Sell — CLSA

Sirtex (SRX) raised to Add vs. Hold — Morgans Financial

GUD Holdings (GUD) cut to Sell vs. Neutral — UBS

OZ Minerals (OZM) raised to Buy vs. Neutral — Goldman Sachs

Western Areas (WSA) raised to Neutral vs. Sell — Goldman Sachs

Independence Group (IGO) raised to Neutral vs. Sell — Goldman Sachs

Northern Star (NST) cut to Sell vs. Neutral — Goldman Sachs

Qube (QUB) cut to Underperform vs. Neutral — Credit Suisse

NIB Holdings (NHF) cut to Sell vs. Hold — Shaw & Partners

Huon Aquaculture (HUO) raised to Buy vs. Accumulate — Ord Minnett

Darren Davidson 8.47am: Fairfax suitors to slug it out

TPG Capital will today vow to protect editorial independence at Fairfax Media (FXJ) after its takeover proposal was trumped by Hellman & Friedman’s $2.87 billion bid, setting off a takeover battle that will pit two of the world’s largest private equity players against each other.

Hellman & Friedman’s bid is in the range of $1.225-$1.25 a share, which values Fairfax at between $2.82bn and $2.87bn, versus the TPG consortium proposal of $2.76bn. Fairfax will now open its books to enable both parties to carry out due diligence.

Michael Roddan 8.40am: Bank levy’s negative gearing leak

The government’s new bank levy will raise far less than the forecast $6.2 billion if lenders pass on the costs through higher interest rates to property investors, thanks to negative gearing rules that allow interest charges to be claimed back through the tax system.

The major banks affected by the 0.06 per cent levy — Commonwealth Bank, Westpac, ANZ, National Australia Bank and Macquarie — were yesterday rushing to finalise their submissions to parliament on the draft legislation for the levy.

7.41am: Stocks tipped to edge lower at open

The Australian share market is set to open flat, with investors likely uncertain about the direction despite a strong lead from Wall Street.

At 7.00am (AEST) on Friday, the local share price futures index was down 3 points, or 0.05 per cent, at 5,727.

Major US stocks indices rebounded from their biggest sell-off in more than eight months, with investors relieved by the appointment of former FBI chief Robert Mueller to investigate alleged Russian interference in the election and possible collusion between Donald Trump’s campaign and Moscow.

The Dow Jones Industrial Average rose 56.09 points, or 0.27 per cent, to 20,663.02, the S&P 500 gained 8.69 points, or 0.37 per cent, to 2365.72 and the Nasdaq Composite added 43.89 points, or 0.73 per cent, to 6055.13. The market gains were accompanied by a rebound in the US dollar, leading to the Aussie dollar paring back Thursday’s gains.

At 7.40am (AEST), the local unit was trading at 74.20 US cents, down from 74.47 US cents on Thursday.

No major economic news is expected in the local market.

In equities, Papua New Guinea-focused oil and gas producer Oil Search will hold its annual general meeting on Friday.

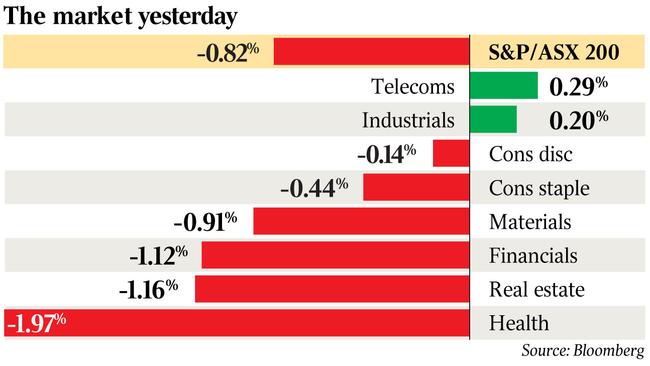

On Thursday, the Australian share market fell for a second straight day as political uncertainty around US President Donald Trump soured risk appetite. The benchmark S&P/ASX200 dropped 47.7 points, or 0.82 per cent, to 5,738.3 points, while the broader All Ordinaries index dropped 45.7 points, or 0.79 per cent, to 5,775.5 points.

AAP

6.57am: Aussie dollar dips as US dollar picks up

The Australian dollar has slipped back against the US dollar, which rebounded along with the major US share markets following appointment of a special counsel to head a key federal investigation in the US.

At 6.56am (AEST) on Friday, the local unit was worth US74.18 cents, down from US74.47c on Thursday. The Aussie dollar was also lower against the yen and the euro.

AAP

6.45am: US stocks rebound after steep sell-off

US stocks rose broadly Thursday, bouncing back from their worst session of the year.

Some of the sectors that were hit the hardest a day earlier were among the biggest gainers, including shares of financial and technology companies.

The Dow Jones Industrial Average added more than 150 points intraday before paring gains heading into the close, finishing up 56.09 points, or 0.3 per cent, to 20663.02. The S&P 500 added 8.69 points, or 0.4 per cent, to 2365.72 and the Nasdaq Composite rose 43.89 points, or 0.7 per cent, to 6055.13.

Some traders said buyers were likely stepping in to take advantage of Wednesday’s sell-off, which sent the Dow industrials to their steepest one-day decline since September.

Dow Jones Newswires