BusinessNow: Live coverage of financial markets and companies, plus analysis and opinion

A growing gulf is separating the big four banks as investors shun the heavyweight and flock to ANZ.

- Qantas CEO nabs record salary

- CBA in brutal correction

- Stocks head for worst week since June

- Housing supply a risk for banks

- Is the housing bubble about to burst?

- Aurizon appoints new CEO

- TPG in Singapore telco race

Welcome to the BusinessNow blog for Friday, September 2. It’s been a rough week for the ASX 200, with oil prices and post-earnings season blues getting the better of investors. A key event for markets will be tonight’s US jobs data.

8.02pm: Putin calls for oil production freeze deal

Russian President Vladimir Putin in an interview published Friday urged compromise to find agreement on an oil production freeze to combat a global supply glut.

“We consider that it is the right decision for world markets, that’s the first thing,” Mr Putin told Bloomberg News.

The globe’s major oil producers have been unable to strike a deal on freezing output due mainly to a dispute between Saudi Arabia and Iran over Tehran’s desire to boost levels after the lifting of sanctions.

“I think that in fact from the point of view of economic expediency and logic it would be correct to find some sort of compromise, I am sure that everyone understands this,” Mr Putin said.

Oil markets rallied last month on hopes that producing countries will limit supply when they meet later this month in Algeria.

But so far nations such as Iran and Iraq show no signs of a willingness to freeze output, raising the prospect of another failure.

Russian energy minister Alexander Novak told Russian news agency Interfax on Friday that Moscow has not yet been officially invited to the Algiers gathering but said it was “likely” that the meeting would discuss the “current situation”. AFP

7.08pm: New tests for local stocks

The Australian market could be in for a testing time this month, writes David Rogers.

A 2.5 per cent fall in the benchmark S&P/ASX 200 over the past week was its worst since the lead-up to the Brexit vote in June. The energy and materials sectors led falls as commodity prices tumbled, but the sell-off was also broadbased as the earnings season showed the that Australian sharemarket is highly dependent on record low interest rates to justify its lofty valuation.

After hitting a near decade-high of 16.8 times expected earnings per share for the year ahead, the market’s PE ratio has fallen to 16.2 times — still well above the decade average of 13.6.

With Australia’s cash rate at a record low of 1.5 per cent and the dividend yield of the sharemarket near 4.5 per cent, the yield advantage of shares versus deposits has never been higher. And the Reserve Bank is widely expected to cut rates again in the year ahead, possibly to as low as 1 per cent, forcing more investors to seek income from the sharemarket. Read more.

6.09pm: Samsung forced to halt Note 7 sales

Many of Samsung’s brand new Note 7 handsets could be recalled globally after reports of batteries exploding in South Korea, writes Chris Griffith.

The Note 7 went on sale on August 19 — just two weeks ago — and has been hailed by many a critic as the best smartphone on the market.

However reports of batteries exploding while charging in Samsung’s home country of South Korea have prompted alarm about the safety of the handset, which has been on sale in 10 countries.

Sales today were paused in South Korea and in Australia pending a decision by Samsung on action it may take. Read more.

5.32pm:Aussie treads water as US jobs awaited

The Australian dollar has edged lower as financial markets wait on crucial US employment numbers that will shape the interest rate outlook in the world’s largest economy.

At 5.30pm (AEST) on Friday, the local unit was trading at US75.44 cents, down from US75.52c on Thursday.

The currency rallied overnight after the greenback dipped on US manufacturing data that showed the sector contracted for the first time in six months in August.

But the Australia dollar barely moved in the local session as traders and investors hold their breath ahead of the release of the US jobs numbers later on Friday, chief market strategist at easyMarkets Anthony Darvall said. Read more.

5.07pm: Invest like the Future Fund

The Future Fund has vastly outperformed the market since its launch a decade ago, although the fund’s size makes it hard for for any individual to imitate directly, says James Kirby.

But here are three of chairman Peter Costello’s strategies you can employ in a search for better yields. Watch the video here.

4.30pm:Stocks end week deep in red

The Australian sharemarket ended the week as meekly as it started it as investors were unwilling to make bets on a rebound ahead of crucial US jobs numbers due out on Friday night (AEST).

At the closing bell, the benchmark S&P/ASX 200 index slumped 42.8 points, or 0.79 per cent, to 5,372.8, while the broader All Ordinaries index stumbled 40.6 points lower, or 0.74 per cent, to 5,470.6.

The weak session pushed the index down 2.5 per cent on the week, its worst showing in more than two months.

The resources sector was the only bright spot through the day, with bargain hunters driving energy higher near the end of trade and gold miners performing strongly through the session.

Daniel Palmer

Read more

4.14pm:Patties clears final hurdle in sale to PEP

Patties Foods has unsurprisingly cleared the final hurdle to its $232 million sale to suitor Pacific Equity Partners.

The group informed investors this afternoon the scheme had received the approval of the Supreme Court of Victoria, ticking the final box for the deal after shareholders recently voted overwhelmingly in favour.

Daniel Palmer

Read more

4.00pm:Fed move hinges on US jobs report

Another blockbuster jobs report in the US tonight could have a particularly big impact on the economy by making it more likely the Federal Reserve will raise short-term interest rates, possibly as soon as this month.

However, analysts aren’t expecting a blowout report.

Tonight’s report will likely show that employers added a solid 180,000 jobs in August, according to economists surveyed by data provider FactSet. That would be below the 255,000 gained in July and June’s 292,000, which was the most in eight months.

The unemployment rate is expected to dip to 4.8 per cent from 4.9 per cent.

Most analysts and investors predict the Fed will stand pat at its meeting later this month and postpone any rate hike until December.

AP

3.20pm:Qantas CEO nabs record salary, bonus

Qantas chief executive Alan Joyce has been well rewarded for the national carrier’s record year, cementing his place among the nation’s highest paid executives.

For the year to June 30, Mr Joyce received $13m in pay, incentives and entitlements, a record for the CEO, including his largest ever short-term cash bonus of $3.3m.

The total pay packet was up 9 per cent on the prior year’s $11.9m and tops the salaries of the chief executives of the nation’s big four banks.

Daniel Palmer

Read more

3.09pm:CBA is caught in a brutal correction

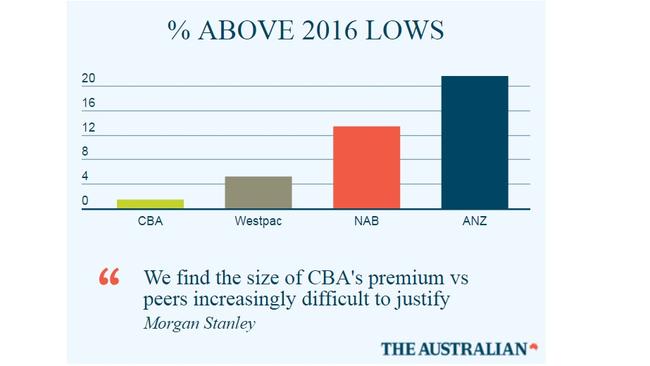

It’s been a swift and savage changing of the guard in terms of bank favourites, with CBA heavily on the nose while ANZ and NAB sit pretty.

Commonwealth Bank shares are less than 1.5 per cent above their lowest point for the year, while ANZ currently sits almost 22 per cent above its low.

Investors are concerned CBA, the biggest of the four by a solid margin, will need to tap the market for cash to raise its tier-one capital ratio from around 9.3 per cent to a likely 10 per cent regulatory requirement.

Morgan Stanley is pushing that opinion this week, saying CBA’s premium valuation is “increasingly difficult to justify”.

Meanwhile, ANZ shares have been on a tear in recent weeks as the market applauds the bank’s new strategy and what Morgan Stanley deems to be a compelling investment case..

“We think the new institutional bank strategy can work, the risk of a capital raising has receded, the dividend outlook is better than that of the other majors and the two-year earnings per share downgrade cycle is ending.”

Commonwealth Bank shares last traded 0.7 per cent lower for the day at $71, broadly in line with a 0.8 per cent drop from the market.

2.50pm:London’s star is fading

London’s dominance in foreign exchange trading is on the wane as Asia and other emerging markets make inroads into the world’s largest financial market, according to an authoritative three-yearly report.

London remains the world’s foreign exchange hub but has lost ground to Tokyo, Hong Kong and Singapore, as well as New York.

In another sign of the City’s fading powers since the financial crisis, London has dropped behind New York in over-the-counter interest rate derivatives trading.

Read more

2.30pm:Alibaba launches Aussie wine store

Australian wines are set to get a big boost in China from e-commerce giant Alibaba Group’s latest venture.

An online “flagship store” featuring Australian wine has been launched on Alibaba’s business-to-consumer platform Tmall.com.

Read more

2.05pm:Macquarie sells Macquarie Atlas stake

UPDATE to the 11.38am blog post:

Macquarie Capital has sold a stake of about 10 per cent in Macquarie Atlas, in a deal worth $282 million.

The 53 million shares were sold by Macquarie Capital at $5.32 each, a 4.1 per cent discount to the last closing price of $5.55 and 7c above the floor price of $5.25.

Shareholders were understood to have offered strong support for Friday’s block trade, which also saw a number of new investors inject capital into to the toll road operator.

In total, almost 16 investors participated, with demand out of Asia said to be strong.

Bridget Carter, Gretchen Friemann

1.55pm:Woolies chairman lifts shareholding

Woolworths chairman Gordon Cairns appears unperturbed by legal action pursued by the retailer’s home improvement joint venture partner this week, sharply lifting his holding in the company the day after court proceedings became known.

In a filing to the market this morning, Woolworths (WOW) revealed Mr Cairns purchased almost $120,000 worth of shares through the custodian of his super fund on Tuesday.

The on-market acquisition of 4,900 shares was made at $24.34 a share and brings his total tally to 13,600 shares.

Daniel Palmer

Read more

1.39pm:CommSec pays $700k in fines

Commonwealth Bank’s high-profile stockbroker CommSec has paid fines totalling $700,000 and refunded $1.1 million in brokerage to customers after the ASIC-controlled Markets Disciplinary Panel (MDP) alleged it contravened market integrity rules.

The action will ensure brokerage refunds to 25,000 of its clients, while 48,205 customers have received corrective disclosure notices.

The issue related to the failure to disclose so-called crossing trades, which refer to deals where a broker acts for both buyer and seller.

Daniel Palmer

1.22pm:Coles, VFF to launch farmers fresh milk

Coles and the Victorian Farmers Federation will next week launch their new farmers fresh milk alternative in a bid to tap the market for branded milk and directly help farmers.

The product due to be launched next Wednesday is modelled on a two-year long program in South Australia, which sells milk under the SADA name for $2.99 per two-litre bottle, with farmers collecting 20c for each packet sold.

John Durie

1.05pm:Dow Jones CEO bullish on subscriber model

Dow Jones chief executive Will Lewis has sounded a bullish note for subscriber-driven newspapers, saying the publisher has unearthed a “model that works” and warning that free digital upstarts like BuzzFeed have reached a tipping point.

Mr Lewis, speaking at a conference for industry trade body NewsMediaWorks in Sydney, said: “Ultimately — engagement will trump the numbers currently causing the pain”.

Noting The Wall Street Journal has attained 948,000 digital-only subscribers out of a total Dow Jones subscriber base of over 2.5 million, Mr Lewis said “people will choose healthy eating over digital junk food”.

Darren Davidson

Read more

12.33pm:Stocks head for worst week since June

Local investors are looking down the barrel of the worst week the ASX 200 has seen since mid-June as weakening commodity prices and general discomfort with a potentially overpriced market weigh heavily on minds.

At just before 12:15pm AEST the S&P/ASX 200 was 0.6 per cent weaker for the day, and 2.5 per cent for the week, at 5367 points.

The index has noticeably underperformed global markets this week and the almost 10 per cent fall in oil prices only explains it up to a point.

Canada, another market with strong commodity exposure, is actually 0.3 per cent higher for the week.

As analysts sift through last month’s flood of earnings releases very few are saying the local market can justify the 16.2x price to earnings multiple it’s sitting on at the moment, which is almost a decade-high.

Deutsche Bank equity strategist Tim Baker summed up the mood this morning with this quote: “Australia has outperformed this year, making relative valuations a little high. [And] while FY17 profits should grow, it’s unlikely to be by much.”

It’s not just resources selling off either, industrials are also down 2.5 per cent for the week and financials are down 1.8 per cent, which adds to the theory that there’s much more at play that commodity price problems.

12.15pm:ACCC crashes Telstra-NBN HFC party

The Australian Competition and Consumer Commission has put a spanner in the works for Telstra and NBN Co to get on with the job of building the hybrid-fibre coaxial (HFC) portion of the National Broadband Network (NBN).

According to the competition watchdog, Telstra stands to gain a “head start” over its rivals under the $1.6 billion agreement it has signed with NBN Co to help roll out and upgrade its HFC network.

Supratim Adhikari

Read more

12.04pm:PE ‘doesn’t care’ about Dick Smith debacle

One of the nation’s leading private equity managers, Archer Capital boss Peter Wiggs, has expressed complete indifference to public opinion over the doomed float of Dick Smith, saying private equity insiders had no interest in reflecting on the bad publicity flowing from the retailer’s demise.

During the Australian Private Equity & Venture Capital Association conference in Melbourne yesterday, Mr Wiggs, when pressed about the possible reputational damage in the wake of Dick Smith’s collapse, retorted: “Who cares?’’ and said none of his backers or partners could care less either.

“The great thing is that no one who is important in private equity cares what the financial press says about it. My LPs (limited partners) don’t care, my advisers don’t care, I certainly don’t care,’’ Mr Wiggs declared.

Eli Greenblat

Read more

11.38am:Macquarie to offload Macquarie Atlas stake

Macquarie Capital is selling a stake of about 10 per cent in Macquarie Atlas Roads, in a deal worth at least $278.25m.

According to a term sheet sent to investors, the 53 million shares are being sold at a $5.25 per share floor price through Macquarie Capital.

Macquarie has been the manager of toll road operator Macquarie Atlas Roads since 2011, receiving performance fees ever year, which have been reinvested through the issue of 59 million shares over the period.

It means Macquarie’s interest in the stock has increased to about 20 per cent.

The floor price to today’s block trade represents a 5.4 per cent discount to Thursday’s $5.55 per share close and a 7.3 per cent discount to its five-day volume weighted average price of $5.66.

Macquarie will be left with a 10 per cent share in the business.

It comes amid speculation that Macquarie Group could soon move to cut ties with the listed satellite on the back of questions about whether its rampant earnings growth would continue and whether it would eventually cash out.

Some investors believe that an internalisation, sale or break-up is on the cards, since the stock climbed to more than $5 after trading at less than $2 five years ago.

One theory is that the group will wind up the fund, selling its two major assets — the Dulles Greenway in the US and APRR in eastern France.

Currently, Macquarie Atlas only owns half of the Dulles Greenway, but chief executive Peter Trent has previously indicated that the group was likely to purchase the remainder with the proceeds from the sale of its Chicago Skyway.

It is also expected to buy the remaining share of the APRR it does not own — an asset likely to be attractive to Middle Eastern and European buyers.

Gretchen Friemann, Bridget Carter

11.20am:Farewell to the credit card era

The great American love affair with credit cards and other debt is beginning to decline. And in Australia, there are similar signs of decline in the use of credit cards, albeit we are experiencing a boom in home lending that is not duplicated in the US.

Credit card debt has driven the US economy for the past 50 years and is still at peak levels. But as the New York Times reports, data from the Federal Reserve indicates the percentage of Americans under 35 who hold credit card debt has fallen to its lowest level since 1989, when data collection started.

Millennials’ declining use of credit cards is a trend that will shape the nation.

Robert Gottliebsen

Read more

10.58am:Debelle named RBA deputy governor

The Reserve Bank’s assistant governor of financial markets, Guy Debelle, has been appointed deputy governor of the RBA.

He will take over from Philip Lowe, who assumes the role of governor from Glenn Stevens on September 18. Absolutely no surprises there.

10.50am:ACCC victory against travel sites

The competition watchdog has claimed a victory against the nation’s largest online travel sites, with giants Expedia and Booking.com agreeing to alter price and availability parity agreements in their contracts with local accommodation providers.

Australian Competition and Consumer Commission chairman Rod Sims said the move would raise price competition within the sector as the removal of the clauses allows for online travel competitors and consumers to eye better deals with the hotel directly.

Daniel Palmer

For more on this read John Durie’s full analysis.

10.25am:Stocks slide at the open

The Australian sharemarket is eyeing a third day in the red despite beaten-down mining stocks regaining favour.

At the 10.15am (AEST) official market open, the benchmark S&P/ASX 200 index slid 22.7 points, or 0.42 per cent, to 5,392.9, while the broader All Ordinaries index gave back 19.6 points, or 0.36 per cent, to 5,491.6.

10.01am:Aurizon CEO forced out

Longstanding Aurizon chief executive Lance Hockridge has been forced out of the role, with former high-profile Rio Tinto executive Andrew Harding tapped as his successor.

The group admitted Mr Hockridge would receive termination benefits, a signal he was tapped to leave after a year of underperfomance by the company.

Aurizon’s share price has slumped 15 per cent over the past three weeks, a period during which it released disappointing full-year earnings.

Daniel Palmer

Read more

9.52am:Housing supply a risk for banks: UBS

A rapid increase in housing supply, particularly of high-rise apartments, poses a significant risk for the banks, UBS warns.

“We were pleased to see the data from APRA confirming management commentary that the major banks’ underwriting standards for high-rise apartments have been tightened,” UBS analyst Jonathan Mott says.

“That said, the environment for the banks remains very challenging given the subdued revenue outlook, reliance on efficiency gains, normalising bad and doubtful debt charges and upcoming higher capital requirements.

“While the banks’ relative valuations do not look stretched, it is hard to build a compelling case to hold an overweight position in the banks.”

He notes that while the major banks have significantly reduced lending for high-rise apartments, and their total exposure to residential commercial property was flat in the June quarter, foreign banks grew their exposures 27 per cent in the June quarter and 67 per cent in the last six months.

Growth in total exposures to Australian commercial property remains strong at 10.8 per cent, the highest since the global financial crisis, with foreign banks’ exposure up 42 per cent over the last year.

9.28am:Housing bubble recession risk: CLSA

The Australian housing market has peaked and new construction will decline in the next two years, according to a new report from CLSA.

The broker’s base case is for the ‘crisis’ to start with cheap apartments and later spread to other units, while its worst-case scenario would see dwelling prices fall sharply in all areas, eventually leading to a recession.

It says the companies that will be most affected are CBA, Lendlease and Mirvac.

“We believe the housing cycle has peaked and that new construction will decline over the next two years,” CLSA analysts say.

“Our forecast is based on a scenario where over the next few years, we will see a number of apartment buildings struggle to achieve reasonable levels of settlement, leading some small, private developers into receivership.

“This will expand into surrounding apartment buildings. While we believe that there will be limited settlement risk on high-quality flats, it will result in a sharp slowdown in new apartment developments.

“Single-family housing will experience a more modest slowdown, in line with previous cycles.”

Held aloft by foreign capital, Australia’s real estate bubble has been extended despite issues of affordability and household debt, but tightening bank credit standards are the likely catalyst for a correction, according to CLSA.

“Our base case has the crisis starting with cheap apartments and later spreading to other flats in close proximity. This is likely to lead to defaults among small developers and a sharp contraction in apartment construction. However, it is unlikely to result in sharp price declines in other regions. Our worst-case scenario would result in dwelling prices falling sharply in all areas, eventually leading to a recession.”

“We believe the correction will start with settlement problems for low-quality apartments. Our proprietary analysis of 35 years of house-sales data indicates expensive flats in those areas will not be immune. However, contagion to dwelling prices in other areas will be limited. “Construction will follow prices, so we expect apartment building to be hardest hit over the next five years.

“Our recession scenario is likely to require price contagion to extend to other regions and include houses, with household debt at 122 per cent of GDP and price-to-income ratios of up to 12x increasing this risk.”

For more on the potential housing ‘crisis’, read Michael Bennet’s report.

9.05am:Alumina, Alcoa call off court action

Aluminium giant Alcoa and Australia’s Alumina have agreed to terminate their litigation over Alcoa’s $16bn demerger and make amendments to their joint venture agreement.

The deal follows earlier concerns from Alumina (AWC) that the demerger was a breach of the AWAC joint venture’s terms, with Alumina having argued that a spin-off would force a new — and financially weaker — partner onto it.

The companies now say they will alter their agreement to promote better information sharing, joint input on significant decisions, faster decision-making and a more streamlined dispute resolution process.

Elizabeth Redman

8.50am:Aurizon appoints new CEO

Freight rail operator Aurizon has said chief executive Lance Hockridge will step down before the end of the year, tapping former high-profile Rio Tinto executive Andrew Harding as his successor.

Mr Hockridge’s departure was first flagged by The Australian two weeks ago, at which time Aurizon denied that he was leaving the company.

Mr Hockridge, who has held the chief executive role at Aurizon since its float in 2010, will officially stand aside in December after Mr Harding begins at the start of that month.

Hockridge has presided over a 73 per cent share price rise since the rail operator listed in 2010 and there will be the usual fear that the new CEO could “clear the decks” by getting any potential bad news out of the way early in his tenure.

However, the market is unlikely to be too concerned as Harding is of good pedigree, having worked for Rio Tinto for more than 24 years, most recently as chief executive iron ore.

David Rogers, Daniel Palmer

8.45am:TPG in Singapore telco race

TPG Telecom has thrown its hat into the ring to become the fourth telco operator in Singapore in a surprise foray into an overseas market.

As Supratim Adhikari reports, ASX-listed TPG has joined local outfits MyRepublic and AirYotta, lodging an application with the InfoComm Development Authority of Singapore (IDA) in a bid to acquire spectrum in the 700, 900, 2,300 and 2,500 MHz bands.

If successful, TPG will become a direct competitor to local rival Optus’ parent Singtel.

Read more

8.40am:Today is ASX200 reshuffle day!

Resolute Mining, Webjet, Galaxy Resources, Infigen Energy and NextDC will be added to the benchmark S&P/ASX 200 share index after the close of trading on September 16, S&P Dow Jones Indicies says.

Austal, Cover-More, Mesoblast, Programmed Maintenance, Select Harvests and Village Roadshow will be removed.

Expect some share price volatility in these companies today as traders position for the index changes.

More on this later

8.35am:It’s been an ugly week on the ASX

Australian stocks look set to notch up their worst five-day run in 11 weeks as commodity prices, ex-dividend dates and post-reporting season blues weigh on the market.

The ASX 200 is heading for a 0.2 per cent fall at the open, which would take the weekly loss to 2 per cent – its worst week since June 17.

Energy stocks look likely to struggle again as the price of oil plunged further overnight. The commodity has now lost almost 10 per cent in four days.

BHP Billiton could find some buyers today after a rough week, the stock’s ADRs are pointing to a 1 per cent gain.

8.30am:Amcor’s latest cash splash

Amcor is buying the North American rigid plastics blow molding operations of Sonoco Products Company for $US280m.

The company says the purchase price represents a multiple of 8 times EBITDA. Including about $US20m of synergy benefits and underlying market growth, it is expected to add about $US50m of profit before interest and tax to its Rigid Plastics segment by FY2020.

Sonoco has six US production sites and one in Canada.

8.26am:Broker rating changes

Independence Group cut to Hold vs Buy - Bell Potter

CYBG cut to Neutral vs Outperform - Macquarie

7.05am:Market tipped for more losses

The Australian market looks set to open lower after Wall Street steadied to close flat following data showing that US manufacturing had declined.

At 6.45am (AEST), the share price index was down 12 points at 5,394.

The Institute for Supply Management said its index of US national factory activity fell to 49.4 in August, below expectations of economists polled by Reuters for a dip to just 52.0.

It was the first contraction in manufacturing since February. But data on the labour market pointed to a pick-up in third-quarter economic growth.

Locally, no major economic or equities news is expected.

In Australia, the market yesterday lost ground as falls across the materials and energy sectors offset gains by some financial companies. The benchmark S & P/ASX200 index was down 17.4 points, or 0.32 per cent, at 5,415.6 points — its lowest close since July 14.

The broader All Ordinaries index was down 18.2 points, or 0.33 per cent, at 5,511.2 points.

AAP

6.55am:Dollar edges higher after US data

The Australian dollar has crept higher against the greenback following a report that showed weakness in the US manufacturing sector.

At 6.35am (AEST), the local unit was trading at US75.51 cents, up from US75.44 cents yesterday.

The greenback pulled back after data cast doubts on the strength of the US economy.

AAP

6.50am: Iron ore dips further below $US60

The iron ore price has edged further below the $US60 a tonne threshold, continuing to slide as China restricts some industrial activity to clear the skies ahead of the G20 meeting.

Iron ore lost 1 per cent to $US58.40 overnight, according to The Steel Index, from $US59 the previous day.

Read more

6.40am: Wall St lifts before payrolls

Energy and financial shares fell overnight (AEST), but major US stock indexes were little changed as investors looked ahead to tonight’s jobs report.

The Dow Jones Industrial Average rose 18 points, or 0.1 per cent, to 18419. The S & P 500 was flat, and the Nasdaq Composite gained 0.3 per cent.

European shares closed mixed, with Deutsche Bank gaining after reports of merger talks, although the main indices in London and Frankfurt declined, with Paris edging higher.

The Australian share market is set for modest falls this morning, with ASX futures 12 points lower at 6.28am (AEST).

6.30am:IMF signals growth downgrade

The failure of policy makers to fix deep-rooted problems in the world’s largest economies has pitched the globe into the worst slow-growth rut in nearly three decades.

And it could be about to get even worse, the International Monetary Fund said Thursday, signalling another downgrade ahead in its global growth outlook.

The IMF warned leaders of the Group of 20 largest economies meeting later this week in China that the global economy is at risk of stalling without urgent action to revive dismal trade and investment levels, and stronger efforts to reverse a rising tide of protectionism.