Bunnings, Officeworks lead Wesfarmers profit surge as Covid lockdowns boost spending

Wesfarmers chief executive Rob Scott says he is more confident about the nation’s battle against COVID-19.

Wesfarmers chief executive Rob Scott says he is more confident about the nation’s battle against COVID-19 as people learn to live with the virus and prepare for the vaccine rollout, with key economic indicators such as jobs growth and business investment leaving the consumer in a stronger footing.

That confidence should then grow this year as vaccines hopefully halt then reduce health issues related to the pandemic, with the Perth-based conglomerate’s flagship retail businesses such as Bunnings, Officeworks and Kmart well placed to drive attractive shareholder returns.

“I am absolutely more confident than I was in August last year, and I think as a country we have many reasons to be more confident,” Mr Scott said after Wesfarmers posted a 23.3 per cent lift in net profit to $1.39bn.

Once again it was Bunnings that was the key earnings driver for the December half as it was one of the key retailers to benefit from lockdowns and other restrictions that inspired people to turn to renovations and projects, such as home repairs and setting up home offices. Officeworks also benefited from this, especially as home offices sprung up all over the country and children were forced into home schooling, although its earnings growth was slightly behind revenue growth reflecting lower-margin sales and bloated COVID-19 costs.

And reflecting the massive uplift in online retail during the pandemic, Wesfarmers said its group online sales for the December half more than doubled to $2bn, helped by its recent purchase of loss-making online marketplace Catch Group, which posted a $15m loss for the half.

Mr Scott said that in the wake of the 2020 pandemic outbreak, people were now “learning to live with COVID”.

“We have seen the economy rebound; we have seen job growth improve; we have seen savings rate improved; and consumer spending and business spending improve,” he said. “While there are still some people and some businesses that are still doing it tough and we shouldn’t forget them, overall the economy has improved.

“And although I think there are still opportunities to improve our response to COVID-safe practices, we have learnt a lot and are learning to manage it well. So yes, I am a lot more optimistic than I was six months ago, but there are still some risks and uncertainties on the horizon.”

Wesfarmers cautioned that sales growth for its twin retail juggernauts, Bunnings and Officeworks, would probably moderate from March as the two run up against the sales boom experienced at the same time last year, when the pandemic emerged and lockdowns began. The conglomerate will also still book large ongoing costs from keeping its workplaces across the country COVID-safe, which is running at $10m a quarter.

The Perth-based conglomerate issued its first-half profit result on Thursday: a 23.3 per cent lift in net profit to $1.39bn, with profit including discontinued operations up 14.9 per cent. The result was slightly ahead of market expectations, due to better trading from Kmart and Bunnings.

Shareholders will be rewarded for the profit boost, with the interim dividend of 88c up 17.3 per cent from the interim dividend paid in 2020, although the size of the dividend was about 5 per cent below consensus forecasts.

Wesfarmers said group revenue for the December half rose 16.6 per cent to $17.774bn.

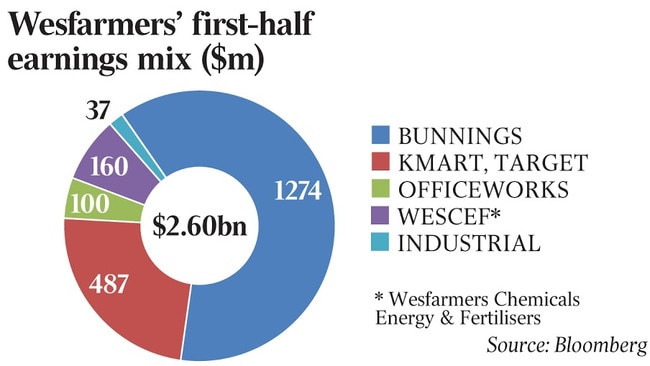

Bunnings did most of the heavy lifting for the conglomerate, with its earnings gaining 35.8 per cent to $1.274bn. Revenue for Bunnings increased 24.4 per cent to $9.054bn for the half, while excluding the net contribution from property, earnings increased 39 per cent.

Officeworks, which has now cemented its place as the leading national chain for office supplies, saw revenue increase 23.7 per cent to $1.523bn for the half. Earnings increased 22 per cent to $100m.

Wesfarmers said there had been good progress to accelerate the growth of Kmart and address the performance in Target during the half and, on a combined basis, Kmart and Target had delivered a record earnings result for the period.

Kmart Group’s revenue increased 9 per cent to $5.441bn for the half. Earnings before significant items and payroll remediation costs increased 38.4 per cent to $487m.

Retail chain Kmart’s earnings growth for the half was driven by higher sales and lower clearance costs as its inventory position improved over the half, with higher stock weights in key product lines supporting trade during the Christmas period. Target, long the problem child for Wesfarmers, ratcheted up profitability significantly in the half, reflecting a higher proportion of full-price sales and lower operating costs, supported by the ongoing simplification of the business.

WesCEF’s revenue decreased 6.6 per cent to $830m. Earnings decreased 7.5 per cent to $160m. Industrial and safety’s revenue increased 4.7 per cent to $898m. Earnings increased to $37m, up from $22mn, excluding payroll remediation costs, in the previous corresponding period.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout