Building indemnity scheme failure blamed for losses

The government is considering a review into SA’s building indemnity scheme following complaints from homeowners left hundreds of thousands of dollars out of pocket.

Homeowners left hundreds of thousands of dollars out of pocket from the collapse of a major building firm say they’ve been failed by a loophole in the state’s building indemnity insurance scheme, and are calling for major changes.

Investigations into the 2019 collapse of Coast to Coast Homes found three customers were exposed by the company’s failure to take out insurance on their behalf.

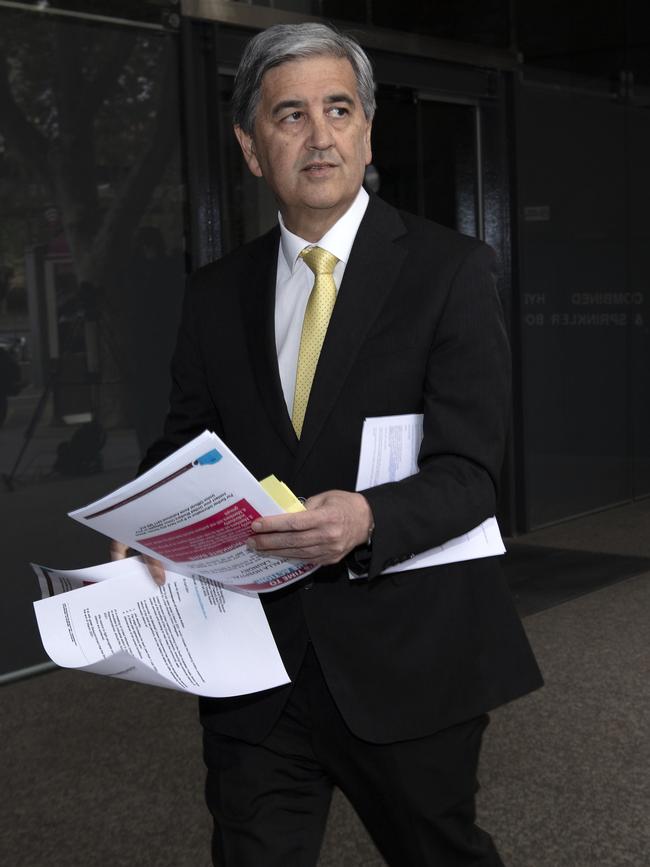

In the most serious case, Tony Taormina says he’s been left close to $450,000 out of pocket after being forced to engage another builder to complete work on two townhouses in Wallaroo.

Mr Taormina said the project had been financially crippling, and completion was still weeks away, more than two years after Coast to Coast started work at the site.

The houses were intended for his retirement and family, but Mr Taormina said he was now forced to sell the properties to repay the banks.

“We thought the system would protect our interests – it never occurred to me that if something were to go wrong that I would be financially damaged,” he said.

“We relied on government forms and contracts, which put the onus on the builder to act on behalf of the homeowner.

“I assumed insurance would be taken out and that there’d be a safety net if there was an issue with the builder - and that hasn’t been the case.

“I’ve tried to pick up the pieces, make good with what we’ve got and try to complete it - I’ve got to sell them now.

“Whether a builder, through neglect or pure accident, forgets to take insurance out, there’s an issue there and if things aren’t changed there’ll be many others in my situation.”

Builders are currently required to take out building indemnity insurance on all projects that require development approval and have a value of $12,000 or more, enabling homeowners to claim up to $150,000 if a builder becomes insolvent.

But councils can miss insurance checks when homeowners use private certifiers to obtain approval, rather than going through council via their chosen builder.

Treasurer Rob Lucas said he was considering a review of the current insurance scheme.

“There’s been ongoing issues in relation to building indemnity insurance for a period of time, in particular in relation to consumer protection issues – there’s been fraud, fake insurance certificates, failure of builders to take out cover,” he said.

“We’ve not resolved a position yet because we do have to have some consultation with officers in CBS (Consumer and Business Services) and the Attorney-General - it is an option … for us to have a look at the whole area.”

Mr Taormina has had several requests for ex-gratia relief rejected by the state government, and last year engaged Brendon Roberts QC to develop recommendations for the government to consider to “close the gap” in the legislation.

They include requiring builders to provide an insurance certificate before demanding payment for work, and introducing a safety net similar to nominal defendant claims in road accident cases.

“It’s about putting the onus back on the builder and not pretending for it to be on the builder which is what the current scheme does - it’s a minor tweak in the legislation,” Mr Taormina said.

“If you have a terrible accident and kill someone in an unregistered car with no third party insurance there’s a safety net, the government will cover that, but there’s no such safety net with builders warranty insurance.”

Mr Lucas said that change would require a “fundamental rewrite” of the current scheme, and was not something currently being considered.

“On the surface of it that would be a very big step and one that I’d need a lot of convincing to head down that path - someone in the end would have to pick up the bill.”

Master Builders Association SA chief executive Will Frogley said there were already checks in place in the current system, and there was no need for change.

“Additional paperwork … will not stop the builders who do the wrong thing – they will only penalise those who follow the rules,” he said.

“Because of the actions of some builders, who are not Master Builders SA members, the tough restrictions and high premiums in place are making it hard for reputable operators to grow their businesses.”

Housing Industry Association SA executive director Stephen Knight said he was open to changes that “remove confusion and increase certainty for all parties in the approval process”.

“HIA would be concerned if any changes resulted in extra cost and time for builders, and ultimately their customers, through additional red tape – the system has the right steps, they just need to be followed and appropriately monitored.”

The collapse of Coast to Coast in May 2019 left creditors up to $9.5m out of pocket and 98 customers with incomplete homes.

An investigation by Consumer and Business Services found there were no grounds for prosecution.

A letter from the consumer watchdog to Mr Taormina last year explained there was no evidence of an “intentional or systematic” failure by the company to take out insurance for its customers given there were only three cases out of hundreds of building contracts.

Jason Baker was another uninsured customer of Coast to Coast, but unlike Mr Taormina, had his West Beach house completed prior to the company’s collapse.

However several defects, including chipped cabinets and doors, and water damaged ceilings, remain unrepaired.

“In two and half years we still haven’t had it done but long term I’m more concerned if something major, structurally, goes wrong and I’m not covered - that’s what keeps me awake at night,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout