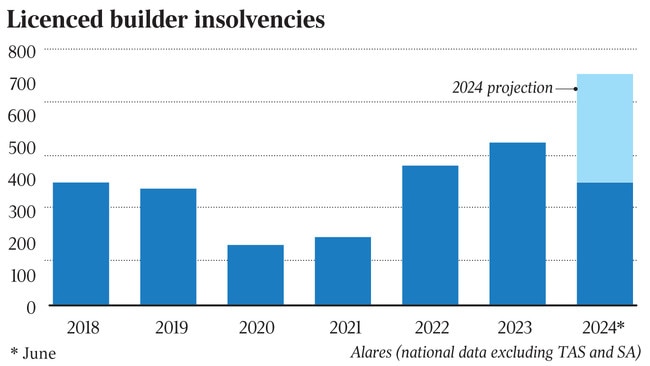

Building company insolvencies at the end of June were already on par with 2018-19 full-year totals

Insolvencies in the building and construction sector were already on par with pre-Covid levels for the calendar year and are set to exceed historical highs.

Insolvencies in the building and construction sector are already level with pre-Covid-19 calendar year totals, and numbers are set to exceed historical highs.

Alares director Patrick Schweizer said the building and construction industry had been particularly hard hit this year.

“The full-year projection for 2024 is expected to well exceed historical highs. There’s clearly a catch-up taking place from the Covid years,” Mr Schweizer said.

The latest Alares Credit Insights report found insolvencies among licensed building companies to the six months to June 30 were on par with full-year totals of about 400 in 2018 and also 2019.

Mr Schweizer said that, according to ASIC sources figures, from 2020 to 2022 there was 8000 fewer insolvencies across the board over the three years when compared to pre-Covid figures.

“This suggests the current increase in insolvencies will continue through the remainder of 2024 and potentially into next year,” he said.

“The key question remains: what will happen once the catch-up is complete?”

The building company figures leave out unlicensed businesses, which make up most of the building and construction sector.

“We use licenced building companies in our data because they can easily be identified, and they provide a good proxy for the building industry as a whole in terms of which way the trends are heading,” Mr Schweizer said.

Malcolm Howell, a partner at business recovery and personal insolvency specialist Jirsch Sutherland, said the stats correlated to what it was seeing in the construction sector.

“Between January and July this year, Jirsch Sutherland has handled 60 matters so far in the building and construction sector, compared with 44 for the same period in 2023 and 78 matters in total over the 12-month period,” Mr Howell said.

“There’s a real domino effect happening, and we have also seen an increase in smaller subcontractors being affected by the financial woes of head contractors.”

According to the Alares report, the number of businesses currently listed with reportable tax debts (more than $100,000 in tax overdue by more than 90 days without meaningful engagement with the tax office) sits at more than 27,000.

Mr Howell said “putting your head in the sand” was not an option.

“Director penalty notices, warning notices and garnishee notices are reaching record levels and that’s pushing more and more businesses into insolvency or having to seek refinancing or restructuring,” he said.

“In June, one in five insolvency appointments were small business restructurings, which reinforces its value as a way to get a business back on track while addressing legacy debt.

“And it’s not just the ATO that’s putting the clamps on; credit providers are getting even tougher with recoveries and the big four banks are increasingly taking to the courts to seek winding-up orders. Insolvency inquiries will continue to rise as the ATO doubles down, economic environment puts pressure on sales, and landlords and businesses start collecting debts.

“And according to the RBA, housing loan arrears have increased steadily from low levels since late 2022, alongside rising household budget pressures from higher inflation and interest rates. It truly is a perfect storm.”

Mr Howell said it was not only current directors in the ATO firing line. “As has been reported recently, even former directors of now-liquidated companies are receiving DPNs because they are liable for unpaid taxes or superannuation contributions,” he said.

“We have seen a significant number of older matters rear their heads many years later, with directors getting a major ‘DPN shock’.

“That makes the need to act swiftly even more imperative: with a non-lockdown DPN there’s a 21-day window to comply, while with a lockdown DPN, directors are instantly liable.

“That’s why it is so important to engage with an insolvency specialist immediately.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout