Brookfield to ‘scale up’ Healthscope

The Canadian asset manager says its $5.7 billion move on Healthscope creates a platform for investments in the region.

Canadian asset manager Brookfield says its $5.7 billion move on Healthscope creates a strong platform for future investments in the region as it commits to “pour a lot of capital” into the private hospital group to “scale up” the asset.

Brookfield won the battle for the hospital target by outbidding the Ben Gray-led BGH Capital, which formed a consortium with Healthscope’s largest shareholder, AustralianSuper, to make its move.

The Healthscope board, led by Paula Dwyer, last year declined to engage with either Brookfield or BGH after they both launched their original bids. But both persisted and Brookfield eventually won access to the dataroom and an agreed deal was announced just over a week ago.

Len Chersky, managing partner in Brookfield’s private equity group, said Healthscope was a platform that the Canadian company would now “pour a lot of capital into”.

“There is embedded growth and growth we would like to further create by investing more capital,” Mr Chersky said.

Brookfield might have an agreed bid but the market is not discounting BGH returning with another attempt, despite its latest plea to gain access to the dataroom being knocked back by Healthscope.

The risk of the rival bidder re-emerging is not something Mr Chersky, who is responsible for Brookfield’s investments in the Asia-Pacific, is focused on.

“From our perspective we are laser-focused on closing our transaction,” he said. “We can’t do anything about their potential response. The beautiful thing about Australian M&A: the highest price always wins.”

He said the response from the market to Brookfield’s final offer was positive, adding that other than “self-interested parties on the other side”, it appeared investors liked the transaction.

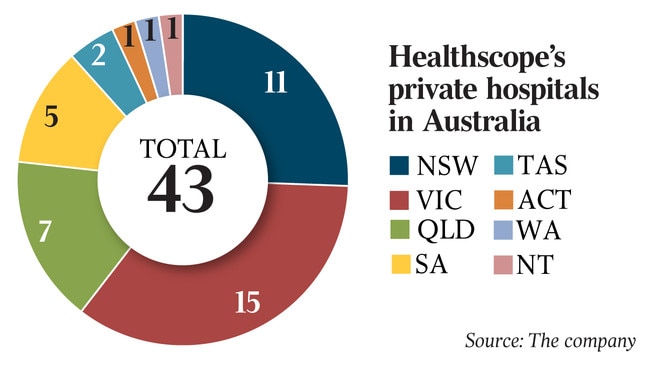

A potential rival bid derailing the Brookfield deal — which sees it own its first hospital portfolio — is not the only short-term risk on the horizon, with a federal election and the recent opening of Healthscope’s Northern Beaches hospital adding noise to the takeover.

Mr Chersky said the company made the Healthscope investment with the expectation that Labor would win the federal election in May. If Labor wins, as the polls suggest, a cap on private health insurance premium increases would be introduced, which would affect private hospitals. “This is probably a short to medium-term event-driven policy,” Mr Chersky said.

“Over the generations there has been bipartisan support for private hospitals. That will continue over the long term and we’ll stay out of the fray on this issue and see how it pans out.”

On the Northern Beaches hospital, Brookfield was finalising its due diligence on Healthscope when the flagship asset was hit with issues when it opened in October. Stewart Upson, Brookfield’s chief executive of Asia-Pacific, said it was good the Northern Beaches issue played out during the due diligence period.

“We had time to look at it and be comfortable that the management had things under control and that things are working well now,” Mr Upson said.

The Healthscope takeover adds to Brookfield’s already strong presence in Australia. It has $22bn of assets under management in the country and $30bn in the Asia-Pacific.

Mr Upson said Australia had been an investment destination for Brookfield for more than a decade, adding it was continually growing its presence in the country and he expected that to continue in the future.

“Brookfield sees the greatest growth in our business in the Asia-Pacific region over the next 10 years,” Mr Upson said.

“Under 10 per cent of our total assets under management are in the region and over time we would like that to grow to a quarter, both in Australia and as we grow further into north Asia.”

Mr Chersky added that health was a theme the company started to focus on a couple of years ago, highlighting that the Australian landscape for private hospitals was superior to other jurisdictions where Brookfield operated.

He said Brookfield started looking at Healthscope at the end of 2017 and were six months into internal due diligence when BGH launched its surprise move at the end of April last year. The board of Healthscope decided at that point to reject both offers and do its own business review to look at spinning out its property assets.

“BGH came back in October with basically the same proposal (that was rejected) and at that point the company decided that it wanted to engage with us as we had the highest number on the table,” Mr Chersky said.

The complicated bid lodged by Brookfield effectively included four deals: a scheme of arrangement at $2.50 a share to acquire 100 per cent of the target; $2.40 a share to lodge a takeover with a minimum 50.1 per cent acceptance; plus two separate property deals.

The offer was structured to overcome the 20 per cent blocking stake held by the BGH-led consortium.

“We have very deliberately structured the scheme to allow all existing shareholders, including Australian Super, to partake in the transaction and we hope they take that up. Ultimately they need to figure out what they want to do,” Mr Chersky said.

He said Brookfield did not view itself as classic private equity with a three-year horizon.