Boutique fund managers ring the tills with bumper dividends

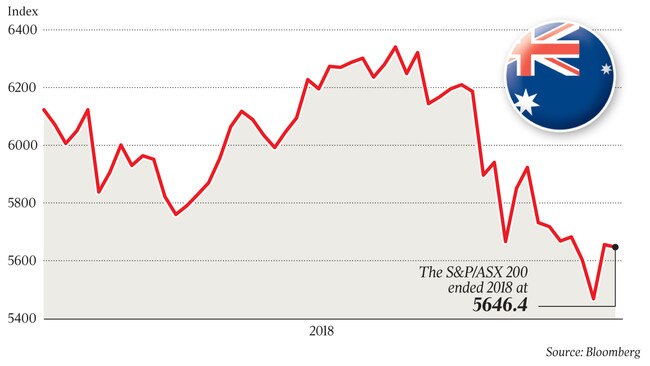

Australia’s most successful fund and asset managers recorded huge profits last year, despite the market volatility.

Australia’s most successful boutique fund and asset managers recorded huge profits last year, despite the volatility, outperforming the market and paying themselves big dividends for managing more than $100 billion for the country’s large superannuation funds and wealth investors.

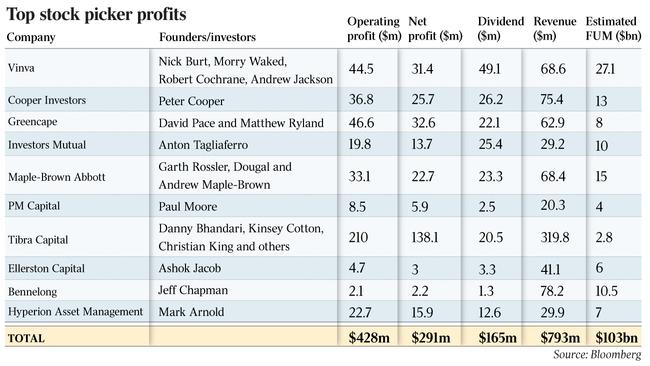

The accounts of the privately owned firms, some of which are controlled by rich-list members and other by little-known portfolio managers, reveal 10 firms made net profits of almost $300 million in 2018 and paid dividends of at least $180m.

The figures mean the fund managers took home some of the biggest payments by executives in the Australian business sector, given usually most of the businesses are majority-owned by their founders or a small group of senior executives.

Firms controlled by prominent fund managers such as Peter Cooper, Anton Tagliaferro and Ashok Jacob were among the big earners, though there were some little-known names that paid themselves huge dividends.

The biggest was Tibra Capital, a firm that splits its headquarters between Sydney and Austinmer, near Wollongong, and trades its own funds on equity, derivatives, options and futures markets around the world.

Established in 2007 by seven young traders, led by Danny Bhandari, Kinsey Cotton and current chief executive Christian King, Tibra made a bumper $138m net profit from $319m revenue in the 2018 financial year. Tibra uses sophisticated analysis and software algorithms to gain a competitive edge and has cash and cash assets of about $391m on its balance sheet and about $200m in net trading assets. The firm’s shareholders shared in about $20m in dividends for the year.

That figure was more than doubled by Sydney-based Vinva Investment Group, which has about $28bn worth of funds under management and paid its group of founders and owners a bumper dividend of $49m. The group, which has shares in companies such as Flight Centre, Whitehaven Coal and Altium, made a net profit of $31.4m from revenue of $75.4m.

The firm’s accounts lodged with the corporate regulator reveal it has about $1.4bn invested in global stocks, with the remainder held in Australian equities. Vinva is a quant-driven fund that keeps a low profile but manages money for some of the country’s biggest funds.

Vinva was established by a team led by managing director and head of equity investments Morry Waked after he left BlackRock in 2010 and was later joined by key personnel such as Nick Burt and Andrew Jackson.

The group oversees a combination of active long-only and long-short strategies.

Vinva’s owners have paid out more than $150m in dividends since the fund was started.

Greencape Capital, founded by David Pace and Matthew Ryland, also had an impressive result. Its revenue of about $63m included $28m in performance fees, while it made a net profit of $32.6m and paid a dividend of $22.1m.

Melbourne fund manager Peter Cooper also received a big dividend from his Cooper Investors, which made a $25m net profit from $75m in revenue. Cooper owns close to 80 per cent of the firm and took home the majority of the $26m divided the firm paid.

That figure was only just above the $25m dividend paid at Anton Tagliaferro’s Investors Mutual. Tagliaferro reportedly sold a 11.9 per cent stake in the business when global asset manager Natixis took a majority stake in Investors Mutual in a late 2017 deal that valued the firm at about $300m.

Brisbane firm Hyperion Asset Management paid a $12.6m dividend from a net profit of $15.9m, while Sydney company Maple Brown-Abbott’s net profit was $22.7m. It paid a $23.3m dividend.

Meanwhile, Jeff Chapman’s Bennelong Funds Management made a net profit of $2.2m and paid the rich lister a $1.3m dividend. The firm’s model sees profits shared with Chapman’s Bennelong Foundation, with the funds management arm taking stakes in and providing services for several boutique funds. The owners of those funds, Ashok Jacob’s Ellerston Capital, backed by James Packer, paid a $12.9m dividend after recording a net profit of $15.9m, while Paul Moore’s PM Capital paid a $2.5m dividend from earnings of $5.9m.