Billionaires born as shares surge

The reporting season is about to produce Australia’s next two billionaires, as a medical technology firm kicks goals in the US.

The corporate reporting season is about to produce Australia’s next two billionaires, as the market rewards a little-known but strongly-performing Melbourne medical technology firm that is kicking goals in the US.

Pro Medicus co-founders Anthony Hall and Sam Hupert are already members of The List — Australia’s Richest 250, but are close to rocketing into the ranks of the nation’s wealthy elite thanks to the surging share price of the company they started way back in 1983.

The Pro Medicus share price is up more than 177 per cent this year as shareholders back the company’s strategy of pushing sales of their diagnostic imaging systems into the US, where key contracts have been won in the past year.

Pro Medicus now has market capitisation of more than $3.1 billion. The company entered the S&P/ASX 200 on August 7.

Hall and Hupert each have a shareholding of about $900 million, and are two of the biggest winners in wealth terms during this year’s company profit reporting season.

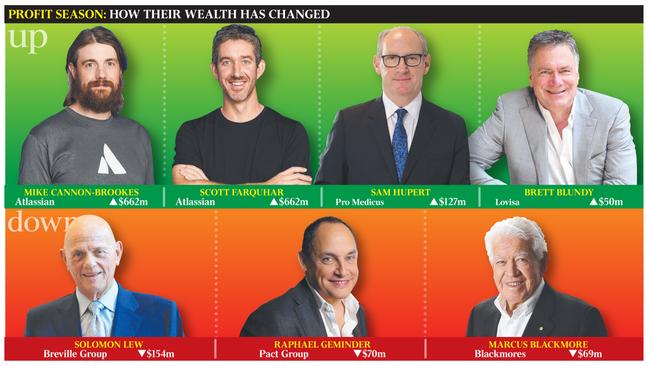

The pair’s share wealth — they each own a stake of about 28 per cent in Pro Medicus — increased by about $127m after their company lodged an impressive 91 per cent increase in profit on Thursday.

Elsewhere, a range of members of The List saw their share wealth surge or dive, depending on the quality of the results they announced to the market.

Atlassian duo Mike Cannon-Brookes and Scott Farquhar have enjoyed a share wealth increase of more than $600m since their software company told the Nasdaq in early August that it had broken the $US1bn revenue barrier for the first time.

Also locally, another software billionaire in WiseTech Global founder Richard White also impressed the market when announcing a 33 per cent increase in net profit to $54.1m during the week. White’s share wealth has risen more than $260m since.

WiseTech’s share price has risen by about 96 per cent since January 1, but White says the company can keep growing around the world.

“The opportunity available to us is vast and while our growth rates to date have been strong our penetration of both customers and addressable markets is still in the early stages,” he said after the profit result.

WiseTech’s share price hit an all-time closing high of $33.25 on Friday and White’s share wealth has now broken through the $4bn mark to make him among the 15 richest people in Australia.

Another billionaire, retailer Brett Blundy, increased his share wealth in jewellery chain Lovisa by $50m after its results, while Netwealth founder Michael Heine’s stake rose $100m this week after his firm announced a $36m net profit and forecast its funds under advice would hit $30bn next year.

By contrast, the share value of Raymond Barro and his family’s stake in cement maker Adelaide Brighton has fallen by more than $300m following a profit downgrade at the end of July.

Shares controlled by retail billionaire Solomon Lew, including those of his listed company Premier Investments and appliance maker Breville, are down about $150m after it flagged most of its products would be hit by US tariffs later this year.

Raphael “Ruffy” Geminder has lost about $70m from the value of his Pact Group shares as a result of the packaging manufacturer cutting its dividend and delivering a downbeat earnings outlook, while Marcus Blackmore’s shares in his Blackmores vitamins group are down $69m this week and about $400m in 12 months.

Blackmores revealed last week that its net profit had fallen 24 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout