Bigger cracks have been exposed by the stock exchange’s slow-moving technology crash

The shelving of the ASX’s near $300m radical clearing and settlement adventure ranks alongside a generous list of famous Australian corporate misadventures – from Woolworths’ Masters hardware expansion to BHP’s HBI money pit and AMP’s disastrous UK push – if not in costs but ambition of failure.

Indeed, the botched project has the hallmarks of management and board refusing to recognise and act on a project quickly going bad, which in itself raises broader cultural and risk issues going back years inside the ASX.

The endless promises of go-live dates and missed deadlines suggests that bad news is not travelling up. This needs to change.

Thankfully Lofthouse, who notably was an internal candidate promoted to the top job, had the ability to recognise the project was stalled, commission frank outside opinion and make a tough choice to pull the plug rather than trying to trade out of the losses.

Intense pressure was also coming down on the ASX from regulators the Reserve Bank and ASIC, which are both furious about the delay to the replacement of the critical piece of infrastructure.

The RBA and ASIC have demanded ASX to fast track a new plan to deliver safe and reliable clearing and settlement infrastructure. They have also set expectations that ASX must lift its investment in getting a new system ready – something that is likely to come at the cost of future dividend payments.

The bigger concern about the project is that it got off the ground in the first place.

ASX was signing off on an unproven platform to underpin clearing and settlements which are the very heart of its business model. Here it convinced regulators and customers that the cutting-edge, blockchain-based system was the best option for a much-needed ability to speed up transactions, and that they could be confident in its execution.

Time and time again, boards and management fall victim to technology capture. All rational sense is thrown out as they are too willing to believe the promises, not understanding the risks and all too willing to throw good money after bad.

This is not just any company making a poor tech call. The exchange operator has a privileged position with a monopoly licence over the clearing and settlement of share and derivative trades. The ASX plays a critical part in the nation’s financial system and needs to have in place the highest of standards to ensure the integrity of capital markets, as well as supporting their growth.

It was only in February that former ASX chief executive Dominic Stevens was promising a go-live date of mid next year. After five delays before that, what on earth gave him the confidence to declare this when just months later the project hit a grinding stalemate and was ultimately shelved?

The bigger worry for Lofthouse and new chairman Damian Roche is whether the burying bad news culture still exists, particularly as regulators are demanding a hard go-live date for a new settlements system.

When the project was initially signed off in 2016 by a previous chief executive, Elmer Funke Kupper, what level of pre-testing and back-end engineering was put in place? Essentially the ASX was making a massive bet on blockchain, then still a frontier technology, something that no other exchange wanted to make.

For ASX there will be questions around clawback of previous bonus payments for those accountable for the project. It also faces demands of compensation from stockbrokers big and small who have invested millions as they were forced to get their trading systems ready for a technology that doesn’t work.

Now it’s back to the drawing board for the ASX, which no doubt will look to buy an existing clearing and settlement system to replace its ageing CHESS platform, which is now more than two decades old. Chances are the new system will be more Toyota than a next-generation Tesla.

Lofthouse remains open to using parts of the system so far in a near clearing and settlement system, with 60 per cent of the software design complete and tested. But that remains a risk whether the new software will work with existing systems.

The ASX will also have to consider the strategic alignment in the $34m stake in Silicon Valley tech partner Digital Asset, which is building the system.

This investment comes on top of the funds spent and the $255m writedown the ASX will make on the project so far.

The opportunity cost has been immense and the free flow of capital means Australia is years behind developing its financial infrastructure.

For tech purists, the decision by Lofthouse marks a major setback for blockchain technology. It is clearly still too volatile to be used as a backbone when it comes to heavy-duty financial services transactions. It could be years before anyone uses it for such an ambitious project.

Ultimately the sorry story should also serve as a warning for anyone too willing to embrace unproven and complex technology promising a game-changing solution. There is plenty of that around right now and it should remind prospective buyers they need to take a deep breath.

johnstone@theaustralian.com.au

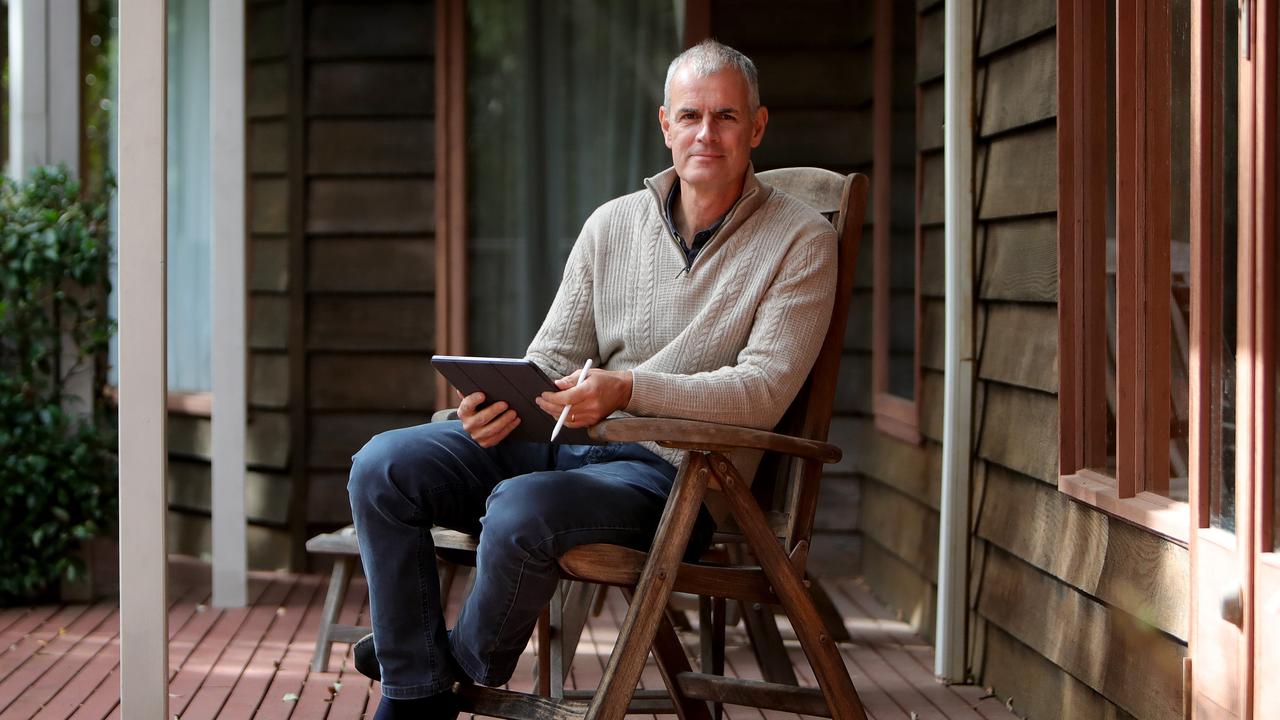

It has taken a little over three months for ASX’s new chief, Helen Lofthouse, to kill a technology disaster six years in the making which has already consumed a string of executives, cost the industry dearly, angered regulators while causing hundreds of millions of dollars in investor funds to evaporate.