Best year since 2004, but home price growth to slow: CoreLogic

House prices soared 13.5pc in the year to June, but experts say there are signs the growth has begun to run out of steam.

Last financial year delivered the fastest moving housing boom in almost two decades but experts warn there are clear signs emerging that growth has begun to run out of steam.

Australian property prices rose 1.9 per cent over the month of June, according to property researcher CoreLogic’s monthly house price index.

The numbers cap off a fast and unexpected year of turnaround in housing prices following the initial Covid-19 lockdowns.

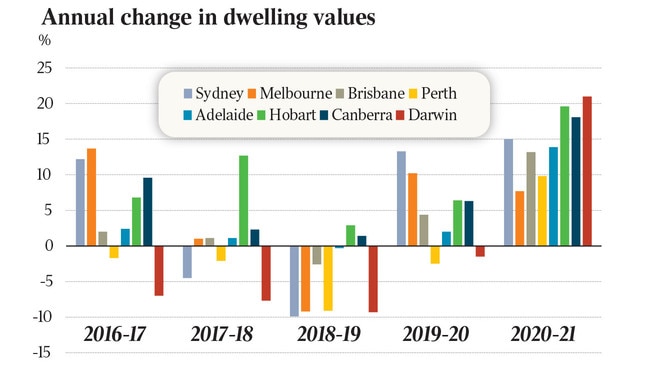

The national property market rose 13.5 per cent in the year to June, the highest rate of growth in residential values since April 2004, at the end of the early 2000s boom.

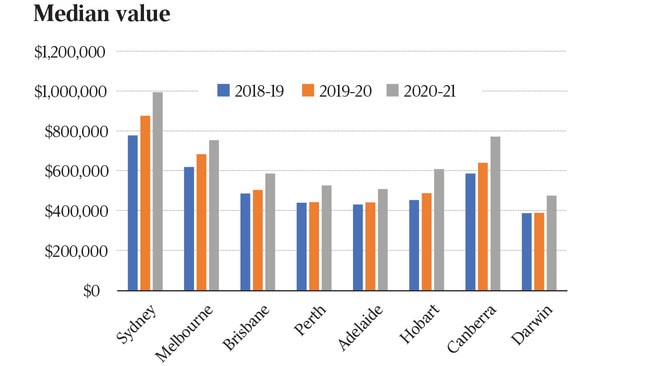

House prices rose 15.6 per cent over the year, while units lifted 6.8 per cent.

However CoreLogic’s executive of research Tim Lawless said barriers to this upward momentum were appearing, with a combination of factors likely to influence this broad slowdown trend.

“Mostly this will be attributable to just simply worsening affordability, due to the fact that housing prices have been rising more in a month than incomes did in a year,” Mr Lawless said.

“We have seen sentiment weaken broadly if you look at any of the mainstream consumer confidence indicators. Also, there is a lot more speculation that interest rates will rise earlier than what the RBA has been persistently indicating.”

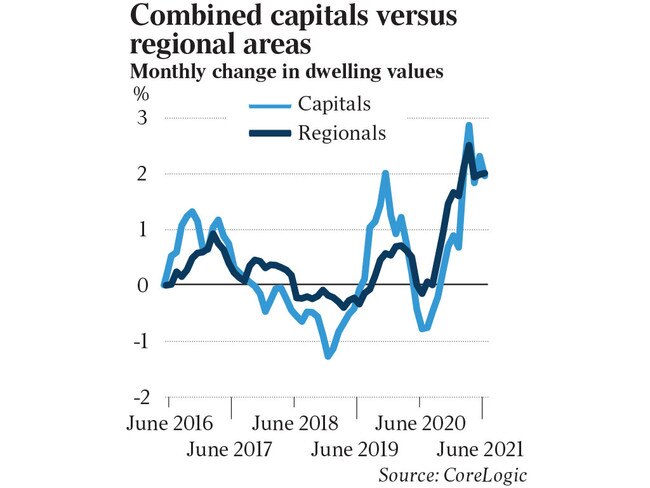

Buyer preference to purchase in leafy or sandy lifestyle locations caused prices to increase in the regions by 17.7 per cent last financial year.

Increases were smaller in the city, at 12.4 per cent.

Demand triggers included a desire for more space and the closure of international borders.

The monthly change in property price of 1.9 per cent sits well above the decade average of 0.4 per cent. However, the month-on-month surge has continually shrunk and is now nine basis points from a recent peak in March 2021.

In June, Sydney property prices rose 2.6 per cent while Melbourne increased 1.5 per cent despite each having their own virus struggles of the month. Hobart recorded the most significant levels of growth in June (up 3 per cent), followed by Canberra (up 2.3 per cent),

Brisbane (up 1.9 per cent), Adelaide (up 1.6 per cent), Darwin (up 0.8 per cent) and Perth (up 0.2 per cent).

Mr Lawless said the outlook for the next calendar year was a continued slowdown in growth.

“We are expecting housing values will continue to rise through the second half of this year and probably well into 2022,” he said. “But I think at a progressively slower rate of growth.”

“Furthermore, the most expensive segment of the marketplace is also clearly slowing down so I think this is a more broadbased phenomenon than just the price sensitive sectors of the marketplace.”

The imbalance between the number of properties available and active buyers in the market is still driving competition. CoreLogic’s latest listings count shows that in the 28 days to June 27, total advertised stock remained 24.4 per cent below the five-year average.

The impact of “short and sharp” lockdowns concurrently underway around the country are expected to have a negligible impact on prices. Previous instances showed a sudden drop in listings but a relatively quick bounce back with minimal impact on prices.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout