Beach Energy investors, including Kerry Stokes’ Seven Group, hit by ‘transparent’ update

Beach Energy boss Matt Kay’s candid quarterly update delivered a massive loss to one major investor, but wider policy “interference and tinkering” may make the situation worse.

MORE than $900m was wiped from Beach Energy’s market value on Friday after the South Australian oil and gas producer downgraded full-year production expectations and predicted longer-term challenges.

Quarterly production to the end of March came in at 5.9m barrels of oil equivalent (MMboe) – a 5 per cent reduction on the previous quarter – while sales revenue increased 14 per cent to $393m.

The update saw its share price plunge 24 per cent to $1.28, carving $913m from its market capitalisation. Major shareholder, Kerry Stokes’ Seven Group, lost $260m from the value of its stake in Beach Energy.

After more than five years of riding through surprisingly positive production results at it its Western Flank oil and gas assets, Beach Energy managing director and chief executive Matt Kay said the group has “now seen a surprise on the downside”.

“Today is a tough day for Beach, but we are being open and transparent with the market,” Mr Kay said.

“We are facing a number of challenges across our Western Flank oil and gas assets as a result of the unique nature of these fields.

“We are now witnessing underperformance from a number of fields.

“This has had a negative impact on our production for the quarter, as well as our FY21 production guidance and Western Flank 2P oil and gas reserves.”

Listing out a “number of negative outcomes” of its review of reserves, the group said there would be a 13.4m barrel net downgrade in its Western Flank 2P oil reserves; 5mmboe net downgrade to 2P gas reserves and a FY21 proforma production guidance downgrade to 25.2-25.7mmboe.

The net reserve writedown equates to about 5 per cent of Beach’s 2P reserves at the end of June last year.

Production is also likely to come in lower than expected in FY22.

“But I would still say it’s not lights out for Western Flank, there is still a lot of exploration to pursue.”

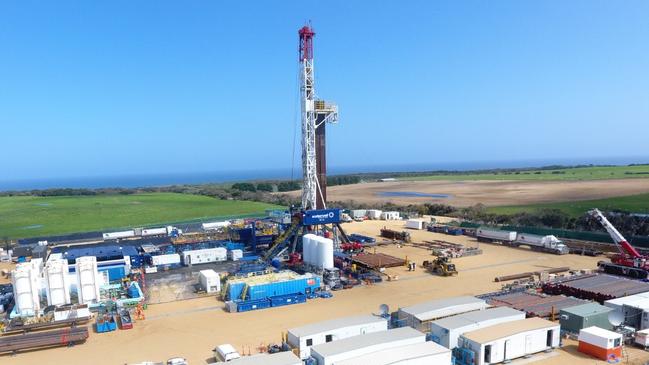

Equipped with a “strong balance sheet” and diversified operations, the focus is on delivering its two growth projects – the Waitsia Gas Project Stage 2 in the Perth Basin and the Victorian Otway development campaign – and other potential developments, including Trefoil in the Bass Basin.

“We are focused on the fact that we could see a significant gas shortage, potentially by 2023.”

Beach landed two key gas discoveries offshore Victoria’s Otway Basin as it seeks to boost supplies to southern states ahead of a looming shortfall in the next few years.

It is looking to tap discoveries – so far, Artisan and Enterprise – from its Otway Basin drilling program to help feed its 205-terajoule-a-day Otway Gas Plant near Port Campbell in southwest Victoria.

The business is among oil and gas producers looking to meet growing demand from the east coast as supplies from ageing fields come under strain and a shortage looms.

Mr Kay said gas is a key part of the transition to a renewables future and government interference was a concern.

“We are not part of the problem, we are part of the solution and we are putting our money where our mouth is and investing in gas for the future.

“For us to keep investing we need certainty, boards need certainty.

“Interference and tinkering with free markets, already facing challenging conditions, is not the best approach.”

Gas pricing particularly is a sticking point, with most producers against any price capping the under the voluntary Gas Code of Conduct, which is intended to even the playing field between gas suppliers and buyers.

“Price sustainability is key in an industry which is challenging enough, we don’t need policy challenges to add to it,” Mr Kay said.

As reported previously, offshore production from the Bass Strait is set to decline from 2023 while output from the Cooper Basin will fall away from 2026, raising concerns for users in Victoria, NSW, South Australia and Tasmania.

Australia is facing the shortfall despite being a major liquefied natural gas supplier, most of it to contracted to overseas customers.

It has prompted a radical shake-up of the power grid amid the challenges facing the coal plants, which currently provide 70 per cent of electricity, but will contribute less than a third of supply by 2040 and are widely expected to be forced out earlier than previously planned as competition from renewables and carbon constraints render plants uneconomic.

RBC Capital Markets analyst Gordon Ramsay said Beach remains its “preferred name in the mid cap space”.

“By FY22, we expect more than 70 per cent of Beach’s East Coast gas sales to be repriced or recontracted to deliver higher gas revenues,” Mr Ramsay said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout