Freedom Insurance used every trick to trap customers

Freedom Insurance deployed every trick in the book to hold on to each dollar it siphoned from its unsuspecting victims.

Freedom Insurance deployed every trick in the book to hold on to each dollar it siphoned from its unsuspecting victims, pitting staff against one another in a battle to dissuade the most determined customers from cancelling their policies and deducting the cost of an employee’s “seat”, which they had to earn back before they won bonuses.

While sales of toxic funeral insurance policies, callously named “final expenses policies”, and accidental death insurance cover have soared in recent years for the fledgling company, so too have the busloads of victims calling up in vain to try to cancel policies.

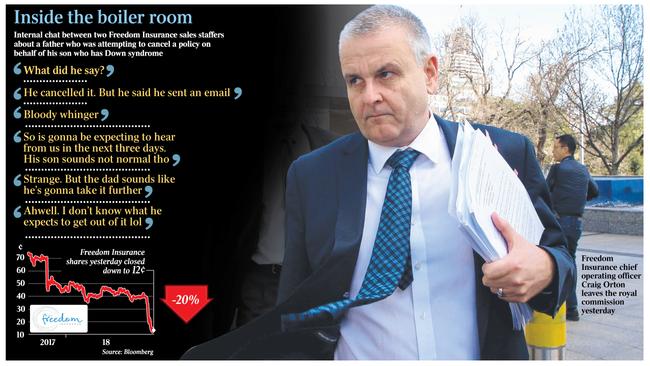

As Freedom chief operating officer Craig Orton was forced to take the stand in Melbourne’s Federal Court yesterday for a second day, counsel assisting the commission Rowena Orr QC ran over the extraordinary efforts the company went to ensure its customers could never dumped their useless insurance.

In the case of one customer, a 26-year-old man with Down syndrome whose father, Grant Stewart, was rebuffed several times in his attempt to get his son’s policy cancelled, a “retention” agent for Freedom called the father a “bloody whinger” and that his audibly disabled son “sounds not normal tho”. In an online chat between retention staff, one remarked that: “I don’t know what he (the father) expects to get out of it lol.”

The company only buckled to the cancellation requests of Mr Stewart, a Baptist minister from Melbourne, after forcing him to make his son verbally ask that Freedom “terminate” the policy after several calls, with the royal commission privy to the son’s pained stuttering of the word over the recorded call.

When one retention agent asked a colleague to look at Mr Stewart’s cancellation request, the colleague simply replied, “no”. The agent responded with 25 sad faces.

Freedom employed a team of 30 staff members — called “retention” agents — whose sole job was to handle calls from angry customers and try to fob them off, and who were paid bonuses to do so.

Of the almost 40,000 cancellation calls — more than 70 a day — that Freedom received over the last financial year, about half complained they could not afford the cover and a further 28 per cent said they were cancelling because they did not want the policy in the first place.

Despite the number of callers wanting to cancel their Freedom policies, only a quarter of these customers managed to do so.

“More than two thirds of the people who called to cancel their policy were persuaded to continue their policy without change,” Ms Orr told the commission.

The Australian can reveal that the conduct at the ASX-listed Freedom Insurance was so awful that it prompted a member of the Australian Securities & Investments Commission to warn staff it needed to “urgently” serve a notice on it, as the conduct was “far worse than” Select AFSL and besieged life insurer ClearView Wealth — although both companies were redacted in the documents provided to the commission.

The royal commission has skewered the work of Freedom, Select AFSL and ClearView, and illuminated how fearful customers should be handling cold calling from sales people representing little-known brands.

The commission earlier revealed how sales staff at Freedom Insurance, which ran a number of high-pressure outbound call centres, pushed tens of thousands of policies on unsuspecting customers, and were driven to sell “frenetically” with extreme bonuses such as luxury trips to Bali, cruises on Sydney Harbour and Vespa scooters in competitions that pitted employees against one another despite a ban on conflicted remuneration.

Ms Orr read out emails between Freedom staff pushing them to sell more policies in exchange for rewards.

“Everyone aiming for seven lives over the first two sessions — 3.5 lives [insured] per session, easy-peasy — and we’ll smash 400 lives to lock in the incentive money for the last part of the day,” the email read.

“Get on the phone and SELL SELL SELL,” an email to staff read. “Show me the money!” read another, tied to a picture of actor Tom Cruise in the film Jerry Maguire.

Mr Orton admitted Freedom staff rebuffed the requests of customers, and acknowledged some had complained they were told they had to phone — not write to — the company to get their policy cancelled.

Customers complained that policies were not cancelled on request, that premiums were still being deducted after they had been told the policy was cancelled, and that they were “just hung up on” when they asked for policies to be cancelled.

“The key problem was not taking no for an answer. That is not acceptable,” Mr Orton said.

He said the company “absolutely” plans to stop the retention strategies.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout