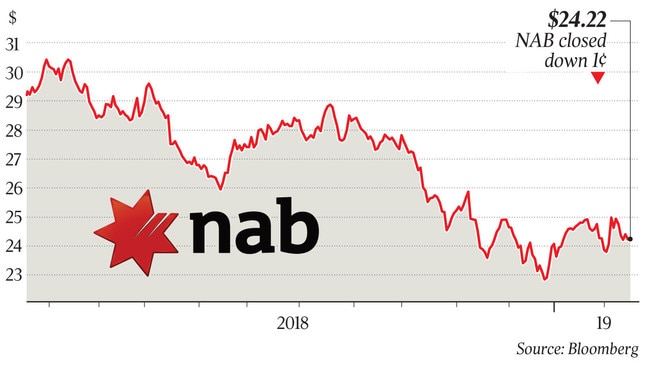

Ratings agencies split over NAB’s prospects

Ratings agencies have taken contrasting views of NAB’s royal commission-inspired leadership woes and the task ahead.

Ratings agencies have taken contrasting views of National Australia Bank’s royal commission-inspired leadership woes and the task ahead to repay customers and fix its culture.

S&P Global Ratings remains confident about the bank and its ability to navigate the departure of chief executive Andrew Thorburn and the future retirement of chairman Ken Henry, while also dealing with a spate of issues including potential criminal action and referrals to the corporate regulator.

Many of those issues were raised during the royal commission, which questioned NAB’s governance given the rorting of its loan introducer program and rampant charging of advice fees where services were not provided.

Still, S&P is taking a long-term view and expressed optimism at an investor and media briefing on Friday.

“In the short-term it will cast a bit of a shadow over the bank’s culture and reputation,” said S&P financial institutions director Nico De Lange, adding he didn’t believe there would a “lasting impact” on NAB’s business.

“We consider that the board and executive management still has sufficient breadth and depth to fill the gap.”

However, peer Fitch Ratings cut NAB’s outlook on its long-term issuer default rating to negative from stable, citing risks around the exit of the CEO and the distraction of repaying customers and improving culture.

“NAB’s focus on remediating issues and changing culture means its ongoing operations may not receive sufficient management time, resulting in a weakening of NAB’s earnings relative to peers,” Fitch said.

“Management changes may make this task more difficult in the short-term. The affirmation of NAB’s ratings reflects Fitch’s expectation that the bank will maintain its strong company profile in the short term, which in turn supports its sound financial profile.”

Mr Thorburn is exiting the bank this month after royal commissioner Kenneth Hayne took aim at him and Dr Henry for not taking accountability for governance and compliance failures. Dr Henry will leave once a new CEO is appointed.

In an ASX statement after the Fitch downgrade, NAB said it had acknowledged the issues raised in the royal commission and the self-assessment it conducted for the banking regulator.

“NAB is determined to be a better bank and is taking action to earn the trust and respect of customers and the community,” it said.

“Fitch confirmed their view that NAB continues to have robust risk and reporting controls around other risks, including credit, market and liquidity risk.”

More broadly, while S&P said improvements were required in governance after the royal commission, it still saw Australia as a “low-risk banking system” by global standards.

While risks around the housing market downturn and personal indebtedness remain elevated, S&P said the probability of a sharp correction in house prices was “relatively low”. “House prices don’t fall steeply in a vacuum,” financial institutions director Sharad Jain said. He pointed to economic growth in Australia printing at 2.5 per cent to 3 per cent this year and unemployment remaining low.

S&P also assessed proposed higher capital requirements in New Zealand, which it believes may leave Australia’s banks with an $8 billion shortfall.

Australian banks account for 88 per cent of the NZ banking system’s assets.

Despite the additional capital S&P said the Australian parent banks’ ratings were unlikely to change if the measures were implemented.

Fitch’s downgrade to NAB’s long-term issuer outlook puts it in line with rival Commonwealth Bank, while Westpac and ANZ Bank remain stable.

On CBA, Fitch said the negative outlook reflected “challenges in remediating shortcomings in operational and compliance risk management” after issues had been uncovered over the past decade. “Management’s focus may be diverted from ongoing operations when rectifying these shortcomings and increased compliance costs might manifest in weaker earnings, particularly in relation to domestic peers,” it said.

Fitch affirmed the ratings of Australia’s major banks on Friday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout